Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. E&Ps Set Capex Higher, Expand Portfolios as Optimism Grows

Activity in the U.S. onshore again appears to be heading north, as producers slowly raise rigs and open their wallets for bolt-on acquisitions. West Texas is the No. 1 destination, but even the long neglected natural gas-rich Haynesville and Fayetteville shales may be getting more love in the second half of this year.

During recent second quarter conference calls, exploration and production (E&P) management teams sounded resigned to living with sustained lower commodity prices, but they are controlling what they can, cutting out the fat and laying on the good stuff, like more proppant and longer laterals. Costs were the primary discussion during calls, and fighting with the OFS sector to secure lower prices isn’t over. Halliburton Co. President Jeff Miller summed it up nicely during a conference call last month. “Price negotiations,” he said, “have been a bar room brawl” (see Shale Daily, July 21a).

The E&Ps may be bruised, some even defeated (via bankruptcies), but many are recapitalizing and moving forward.

“The second quarter likely marked the cyclical downturn in North America, but the industry faces a long climb back,” said NGI‘s Patrick Rau, director of strategy and research. He pointed to the quarterly calls to illustrate his points (see Shale Daily, July 29; July 22a).

“Even Plains All-American Pipeline observed that the worst of the gas storage cycle is likely behind us,” Rau said. “However, Schlumberger Ltd. noted the North American recovery will be slow and steady, and Halliburton management believes their North American operating margins won’t break even until 1Q2017. Helmerich & Payne Inc. still only has a mere 19 rigs working in the spot market, and isn’t ready to call the bottom of the market just yet, and Nabors Industries doesn’t expect material day rate increases for land rigs until 2017.”

What is clear is that producers are anxious to get back to work. Since the end of the quarter, a spate of acquisitions has been ongoing, mostly for leaseholds in the Permian and Oklahoma’s stacked reservoirs (see Shale Daily, Aug. 16a; Aug. 16b; Aug. 8; July 13).

Most of the activity is gaining in Oklahoma’s stacked reservoirs and in West Texas, where oil operators are storming into the Permian Basin’s myriad formations (see Shale Daily, Aug. 11; Aug. 10). But some are also looking beyond the oil-rich basins. Everywhere, the focus is to slash capital expenditures (capex) in every way imaginable.

“The key themes emerging…included increases to activity levels, as well as mixed but positive data on costs,” Sanford Bernstein’s Bob Brackett said. Some of the big-time onshore operators are planning to kick up activity in the second half of the year, he noted, among them Apache Corp., Devon Energy Corp., Encana Corp., Southwestern Energy Co. and Cabot Oil & Gas Corp. (see Shale Daily, Aug. 5a; Aug. 3; July 22b; July 21b). Only No. 1 independent ConocoPhillips reduced its spending outlook.

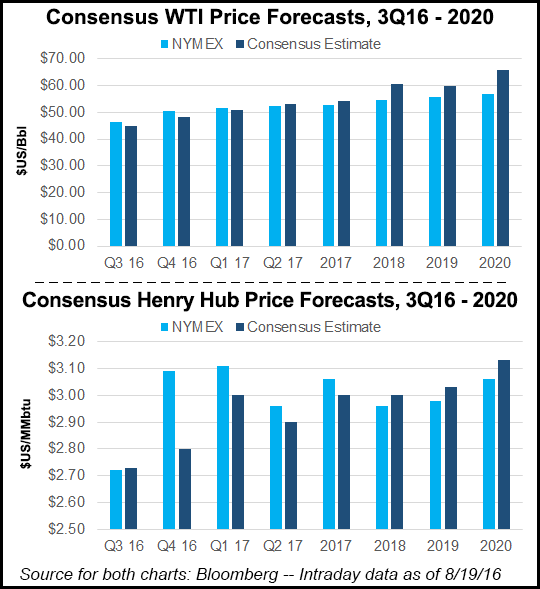

Producers See Higher Oil, NatGas Prices in 2017

What investors want to know is how soon will rigs go back to work, and how many completion teams are being added to the fields? Are drilled but uncompleted (DUC) wells the only order of business?

“The recent pullback in crude oil prices notwithstanding, the majority of E&P companies took up their production guidance slightly for 2016, but expressed optimism that both crude and natural gas prices will increase in 2017,” Rau said. “Although it is still far too early for producers to give formal capex guidance for next year, the trend is certainly higher. On the oil side, it looks like future activity will be driven in $5 increments. Below $40/bbl, no one seems too excited to do much of anything.”

Even at a relatively low oil price, there’s no place like the Permian and Oklahoma’s STACK, the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties.

“At $40, the two hottest plays in the U.S., the Permian and Oklahoma’s STACK, are among the only economic areas in the country,” Rau said. “At $45, operators begin adding rigs to those plays, and drain some of their DUCs. At $50, the Eagle Ford starts kicking in, along with completing even more DUCs. $55 oil seems to get producers more willing to outspend cash flow, and at $60 plus, the Bakken folks start getting more aggressive.”

Anadarko Petroleum Corp. “in particular” is confident of $60 crude prices in 2017 (see Shale Daily, July 27). “Any pullback in North American rig activity in the face of the recent oil prices pullback may contribute to an accelerated rebound in prices next year.”

For the gas side, three Appalachian-centered operators — Consol Energy Inc., Range Resources Corp. and Rice Energy Inc. — said the current combined rig count of 35 or so “is well below the 50-55 rigs required to keep natural gas production in the Marcellus/Utica flat at current levels,” Rau said. “Moreover, Range noted that DUCs in the Appalachia are down 34% since the end of 2015. This, along with takeaway capacity gains in the Marcellus, could lead to improved netback prices in the region next year.”

Operators in the core of the Permian and STACK have boasted about their ability to generate adequate returns at sub-$50/bbl prices, but most U.S. operators appear hesitant to deplete their valuable inventories until West Texas Intermediate approaches $60/bbl, said Evercore ISI’s James West.

Like Anadarko CEO Al Walker who highlighted the $60 price point to generate adequate cash margins and accelerate activity, Hess Corp. CEO John Hess said the company’s Bakken Shale acreage can generate attractive returns at current prices. However, “the company will not increase activity in the basin until WTI approaches $60/bbl,” West noted. “In fact, the company expects to drop two of its three current rigs during August.”

Baker Hughes Inc. “reiterated a similar attitude on its second quarter conference call, stating that as service prices rise to more normalized levels, operators will require oil prices in the upper $50s before we see a sustainable recovery in North American activity,” West said. “Conversely, we have seen a handful of E&P stalwarts increase activity guidance for the second half as cost curves continue to decrease, efficiencies continue to improve and best-in-class rock positions make production growth more achievable.”

For instance, West said, EOG Resources Inc. “plans to add one or two fracture spreads through December to complete an incremental 80 wells” (see Shale Daily, Aug. 8). Cimarex Energy Co. “upped capex to $750 million from a previous midpoint of $675 million as it added a rig in the Meramec play [of Oklahoma] and accelerates well completions in the Permian and Midcon; and Southwestern increased capex by almost $400 million to $505 million from $112.5 million following its July equity offering in order to add four rigs in Appalachia and another in the Fayetteville Shale.”

Adding a rig to the Fayetteville would bring Southwestern’s total “to a grand total of one,” Rau said. “This is further evidence that producing regions downstream of the Appalachia are becoming more economic” because of pipeline reversals.

Haynesville Redux?

Could the mighty Haynesville also be making a comeback? Rau said the evidence points that way.

“I can’t remember the last time Chesapeake Energy Corp. led off a conference call touting the virtues of the Haynesville, but so was the case in the 2Q2016 call” (see Shale Daily, Aug. 5b). As well, Exco Resources Inc.’s management team during its call said the breakeven price is $2.19/Mcf in North Louisiana (see Shale Daily, Aug. 4). “This is no doubt being driven by improved well completions,” which were cited by Chesapeake’s touting a “proppant-geddon” occurring.

“Comstock Resources Inc. mentioned in its conference call that the new standard drilling lateral in the Haynesville is 7,500 feet, up from the previous standard of 4,500 feet, with changed completion designs,” Rau said. “This gets their rate of returns to 49-79%, and they are planning on resuming their Haynesville drilling program in October. Overall well economics in the basin may get a further boost, if Chesapeake is successful in its attempt to drill even longer laterals with mega-sand wells. Current low pressure pumping costs should also benefit refracturing efforts in the Haynesville, especially at a $3/Mcf-plus strip.

There was little mention of significantly higher service costs for 2017.

Schlumberger CEO Paal Kibsgaard, who runs the No. 1 OFS in the world, said the market had bottomed in 2Q2016 (see Shale Daily, July 25). “And he warned that inevitably, service industry pricing has to recover, and as it does, this will consume a large part of the E&P capex increases that are/will be intended for additional activity,” Rau said. “Moreover, Halliburton claims that 900 is the new 2,000, meaning it will only take 900 rigs to absorb all the pressure pumping equipment in North America, now that 4 million hp has been permanently removed from the market.”

Higher prices “are no doubt imminent, but producers don’t seem to be all that worried about them for 2017. For one, producers have noted that anywhere from 50-67% of the cost decreases they have achieved since the peak of the market are through efficiency gains, which they believe are sustainable. Second, It will take a few quarters of sustained activity for drilling and pressure pumping capacity utilization rates to reach levels that warrant significant price increases.

“Finally, many producers will also get a ‘mix benefit’ as more of their higher cost service contracts expire. For example, companies that had signed peak market land day-rates of $26,000-27,000 can get those rigs in the mid-to-upper teens today. Even if prices rise say 10% from current spot rates next year, operators are still able to replace those more expensive contracts at much cheaper rates, meaning they can still spread what they were spending across more wells.”

In reading through the OFS financials, Sanford Bernstein’s Brackett said cost “reflation” had not materialized, but “we did notice a small uptick in operating expenses” for some producers,. On the other hand, general/administrative expenses have begun to reflect the massive employee reductions.

Wells Fargo Securities LLC analysts said U.S. E&P output for the 34 companies they cover wasabout 2% ahead of guidance in 2Q2016, driven by better gas and natural gas liquids (NGL) volumes, offset in part by lower crude production. Nearly 74% (25 of the 34) beat on production and 22 increased full-year guidance.

‘Surprising’ Gas, NGL Volumes in 2Q2016

“While the group that has historically been rewarded for growth and companies are positioning for 2017, the macro implications are that declines that most have been anticipating might be shallower and shorter in duration than previously expected,” Wells Fargo’s David Tameron said. “Time will tell.” It was “somewhat surprising” that 85% of the mid- and large-cap operators beat on NGLs, while 68% beat on gas and only 28% on crude oil.

“We recognize that timing of the activity ramp is very important,” Tameron said. “An activity increase beginning in August 2016 supports much stronger 2017 production growth than a January 2017 activity increase, for example, and thus the need to ramp spending and activity now, in order to stave off declines and position for 2017 growth.

“Though hard guidance on 2017 production figures remains sparse, our view is that operators are positioning for more growth than the street expects, and we believe the announced spending increases in the second half of 2016 validate that view.”

U.S. E&Ps followed by Tudor, Pickering, Holt & Co. (TPH) spent about half of their 2016 budgets in the first six months, versus 60% spent in the first half of 2015. Lower than expected capex in 2Q2016, down 10-15% on average, should allow for acceleration to the end of the year, in turn impacting 2017 growth.

Watch for more natural gas activity in the Northeast, “given improved basis and Henry Hub prices, a number of E&Ps increasing fiscal year budgets (plus-3% on a weighted-average basis), and $50/bbl WTI needed to add more rigs,” said TPH analysts.

The focus in 2Q2016 was on proppant loading, improving type curves, higher gas output and less oil production, but that could change “to the game of chicken that appears to be unfolding on the macro beat.”

Sliding oil prices have undoubtedly deflated sentiment and views on the timing and shape of recovery, according to Evercore’s West.

“While current rig counts suggest the bottom is decidedly in, we warn that the vast majority of rig additions have come from ‘checkbook’ drillers (75% of rig additions have been led by private operators and 33% have been vertical/directional rigs) whose wells generate relatively lower earnings for service companies…We don’t doubt that the bottom is in, but warn that the expected second half increase could be overstated” by companies that reported at the onset of earnings.

West pointed to well spuds and permitting to make his point.

“The correlation between monthly well spuds and preceding month permits is an astounding 0.920 since 2006,” he said. “Going forward, we expect this correlation to slightly weaken as permits understate future drilling activity.”

Drilling permits are valid for six months in Louisiana and Oklahoma, 12 months in North Dakota and 24 months in Texas. “In Texas, 90% of permits drilled were spud within the first eight months after approval (33% of the two-year permit life), but we believe commodity price volatility has reduced this number through the downturn,” West said.

Many operators already may have received approvals for future drilling activity, “and could choose to drill these locations without filing a new permit. So while the four-week permit average has shown a consistent upward trend, the inventory of already approved permits likely understates this trend.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |