NGI Data | Markets | NGI All News Access

Modest Futures Gains Follow Release of EIA Natural Gas Storage Stats

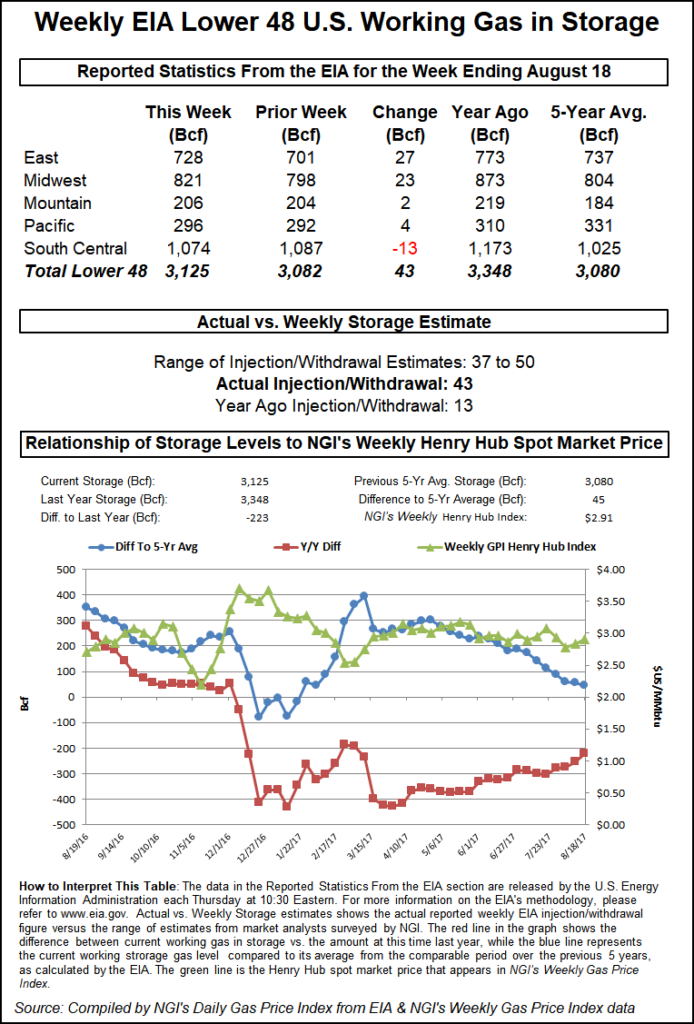

Natural gas futures rose Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was a bit less than what the market was expecting.

EIA reported a 22 Bcf storage injection in its 10:30 a.m. EDT release, about 5 Bcf less than what traders and analysts were expecting. September futures reached a high of $2.675 immediately after the figures were released, and by 10:45 a.m. September was trading at $2.654, up 3.5 cents from Wednesday’s settlement.

“It seems like the market moves, and then we go right back to where we were,” a New York floor trader told NGI.

“Crude oil was less than $40 not too long ago. And think about it, you are up almost $10 in crude. Natgas bulls should be grateful for crude oil, but we are still stuck in that range between $2.50 to $2.75.”

“The data for last week showed a somewhat smaller than expected 22 Bcf net injection into U.S. natural gas storage,” said Tim Evans of Citi Futures Perspective. “While not a major surprise, this suggests some ongoing volatility from prior weeks that had featured both an unexpected 6 Bcf withdrawal and then a larger than expected 29 Bcf build. The market continues to show greater sensitivity to extreme summer heat than anticipated.

“The market does keep making progress in reducing the storage surplus, which remains constructive for the intermediate term, but doesn’t necessarily preclude a further downside price correction, in our view.”

Inventories now stand at 3,339 Bcf and are 327 Bcf greater than last year and 405 Bcf more than the five-year average. In the East Region 17 Bcf was injected, and the Midwest Region saw inventories increase by 16 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was lower by 1 Bcf. The South Central Region shed 12 Bcf.

Salt cavern storage was down 8 Bcf at 305 Bcf, while the non-salt cavern figure was lower by 3 Bcf at 881 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |