NGI The Weekly Gas Market Report | Markets | NGI All News Access

Fitch Sees ‘Modest’ Price Support From Associated Gas Declines

The pullback from oil drilling has dropped associated natural gas production and provided “modest support” to domestic gas prices, Fitch Ratings said Wednesday. But the near-term price outlook is better for oil than natural gas, it said.

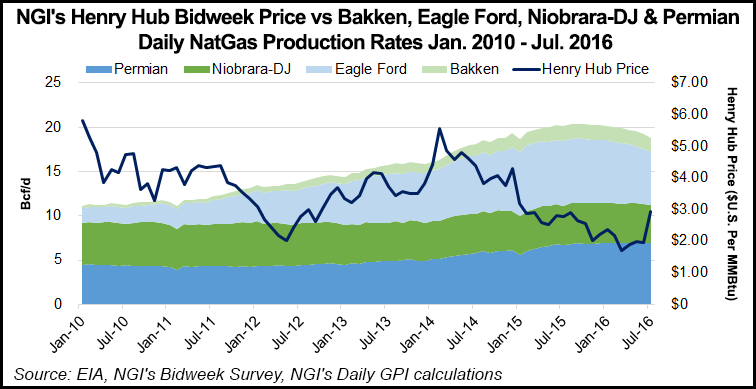

Volumes are down across a number of key liquids-rich shale basins. A review of Energy Information Administration data suggests that associated gas production is down 3.1 Bcf/d relative to peak levels, including in the Eagle Ford Shale (-1.6 Bcf/d), Niobrara formation ( -1.1 Bcf/d), Permian Basin (-218 MMcf/d), and Bakken Shale (-162 MMcf/d).

On an overall basis, U.S. dry gas production has stabilized at about 73 Bcf/d, a year-over-year decline of about 1%, Fitch said. This contrasts with U.S. dry gas production growth in the 5-6% range seen as recently as 2014-2015.

“Less associated gas, lower activity levels in key dry gas basins and improved demand from hot summer weather have helped gas prices recover from rock-bottom levels seen earlier this winter when gas prices briefly dipped below $1.50/Mcf,” the credit ratings agency said.

Unlike the Marcellus or Haynesville shales, where drilling decisions tend to be driven by dry gas economics, drilling in associated gas plays tends to be more driven by oil/natural gas liquids (NGL) pricing.

“As a result, a scenario where natural gas prices remain depressed but oil or NGLs rebound sharply would tend to encourage overproduction of gas and weigh on prices,” Fitch said. “Conversely, a lagged recovery in oil/NGLs pricing would tend to keep activity in the shales depressed, further reducing associated gas production and supporting gas prices, all else equal.”

Price recovery in natural gas could take longer than that for oil, according to Fitch, as the natural gas market depends more upon improvement in demand fundamentals.

“Continued drilling efficiency gains and limited export opportunities are likely to cap gas price gains in the near to medium term,” Fitch said. “Our current base case price deck for Henry Hub natural gas is $2.35/Mcf in 2016, $2.75/Mcf in 2017, $3.00/Mcf in 2018, and $3.25/Mcf in the long term.”

In addition to supportive weather, current demand drivers include additional coal-to-gas switching among power generators; a further increase in industrial demand for gas, including the large slate of greenfield chemicals capacity on the U.S. Gulf Coast and elsewhere; export demand to Mexico; and modest liquefied gas export demand.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |