NGI Data | Markets | NGI All News Access

NatGas Cash, Futures Inch Lower; September Drops A Penny Following Storage Stats

Physical gas traders for Friday delivery mostly laid low Thursday and got their deals done before the release of Energy Information Administration (EIA) storage data. Nearly all points fell a few pennies into the red, with the exception of a few locations on the East Coast, where the combination of heat and humidity sent next-day prices higher by double digits.

All regions from Appalachia to California posted losses of about a nickel, and the NGI National Spot Gas Average fell 4 cents to $2.50. Futures traders have come to accept weekly storage numbers far below historical averages and Thursday was no exception. The EIA reported a build of 29 Bcf, somewhat greater than industry estimates, and prices had only a mild reaction. At the close September had eased 1.0 cents to $2.551 and October was lower by nine-tenths of a cent to $2.607. September crude oil vaulted $1.78 to $43.49/bbl.

Trading wise, natural gas futures seemed to be a redheaded stepchild. “Everyone was trying to pick a top in crude oil. It was go, go, go, but no one wanted to touch the natural gas,” said a New York floor trader.

“I like the natural gas to hold $2.48 to $2.50, but if it gets below $2.42, watch out. $2.42 will get you $2.30.”

September natural gas was held to less than an 8-cent trading range and after the storage data was released September futures reached a low of $2.529 immediately, and by 10:45 a.m. September was trading at $2.577, up 1.6 cents from Wednesday’s settlement.

“The market seems to want to be supported, but there isn’t a great effort to do so,” said a New York floor trader. “The $2.51 to $2.53 area is being supported and that is what we are seeing. Since the market held, traders are comfortable getting long against that base.”

The trader thought that all in all, the market’s performance was that of a buying opportunity. “At least you know where to put your stop,” he said.

“The data for last week showed a larger-than-expected rebound from the prior week’s 6 Bcf net withdrawal as power sector demand likely eased,” said Tim Evans of Citi Futures Perspective. “This may still reflect the same sensitivity to summer temperature extremes as in recent weeks, but in the opposite direction.”

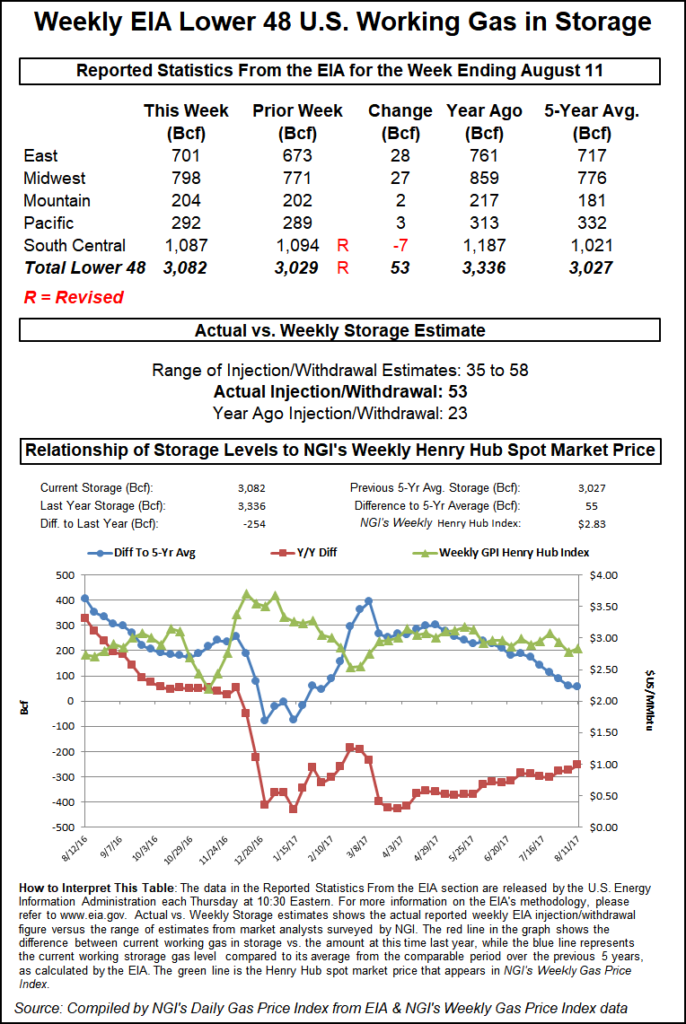

Inventories now stand at 3,317 Bcf and are 361 Bcf greater than last year and 440 Bcf more than the five-year average. In the East Region 17 Bcf was injected, and the Midwest Region saw inventories increase by 20 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was unchanged. The South Central Region, however, fell 10 Bcf.

Natural gas traders might do well to follow crude oil. “In defense of the bearish case we have seen time and time again what typically ends the winter to spring pre-season [natural gas] rally is the seasonal dump in crude oil prices,” said Walter Zimmermann, vice president at United ICAP. “That process is well advanced. Crude oil has definitely been under pressure here, and natural gas has been doing an admirable job of holding its own, but as crude oil continues to implode that takes another reason away to chase natural gas prices higher.”

One market factor that has been curiously out of the mix is any indication of Atlantic hurricane activity. Despite relative calm during the first 10 weeks of the Atlantic hurricane season, forecasters still expect tropical activity this year that could threaten energy interests in the Gulf of Mexico and along the eastern seaboard (see Daily GPI, Aug. 11).

In an updated 2016 Atlantic hurricane season outlook released Thursday, the National Oceanic and Atmospheric Administration (NOAA) said they still expect this to be the most active hurricane season since 2012. NOAA forecasters said they see a 70% chance of 12-17 named storms in the Atlantic, of which five to eight could become hurricanes, including two to four major hurricanes (Category 3 or higher).

Traders may also want to take a closer look at the impact this cooling season’s power burn on supplies and what the implications might be for higher use of gas for power generation beyond summer cooling requirements.

Driven by competitive economics relative to coal and by warmer-than-normal temperatures, the amount of electricity generated using natural gas reached a record high during July, surpassing a record set in July 2015, according to the EIA (seeDaily GPI, Aug. 9).

“Despite the recent rise in natural gas prices, hot weather across the country is leading power plants to pull more natural gas from storage this summer, with the amount of electricity generated by natural gas to meet cooling demand reaching a record high in July,” said EIA Administrator Adam Sieminski. “Natural gas inventories were drawn down in the last week in July for the first time in 10 years during the June-August period, when gas stocks normally increase.”

Record-high natural gas power burn was the driving factor behind last week’s unusual 6 Bcf summer storage withdrawal, EIA said Monday (see Daily GPI, Aug. 8).

Thus far, 2016 power burn has outpaced 2015, which was already a banner year for natural gas consumption for electric generation.

In the physical market major points in and around New York City jumped higher as forecasters called for the region to turn into something resembling a sauna the next couple of days. AccuWeather.com forecast that New York City’s Thursday high of 93 degrees would rise to 94 Friday and hold Saturday. The normal high is 83 this time of year in the Big Apple.

That doesn’t tell the whole story. Adjusted for humidity, the 94 Friday high becomes an oppressive 115. Saturday’s high will feel like 111, AccuWeather.com said.

Philadelphia is expected to be equally uncomfortable. Thursday’s high of 93 is predicted to rise to 95 Friday, 104 adjusted for humidity, and Saturday’s 96 becomes a humidity-corrected 111. The seasonal high in Philadelphia is 86.

Gas bound for New York City on Transco Zone 6 rose 30 cents to $2.74 and deliveries farther south on Transco Zone 6 non NY North added 29 cents to $2.72.

Marcellus points slipped. Deliveries to Dominion South fell 8 cents to $1.24 and gas on Tennessee Zone 4 Marcellus skidded 6 cents to $1.18. Packages on Transco-Leidy Line were off 4 cents to $1.27.

Major market hubs were off as well. Deliveries to the Chicago Citygate were quoted 3 cents lower at $2.66, and gas at the Henry Hub retreated 6 cents to $2.67. Gas on El Paso Permian changed hands 5 cents lower at $2.53, and packages at the PG&E Citygate shed 3 cents to $3.09.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |