NGI Data | Markets | NGI All News Access

Bulls Undeterred by Plump Natural Gas Storage Build

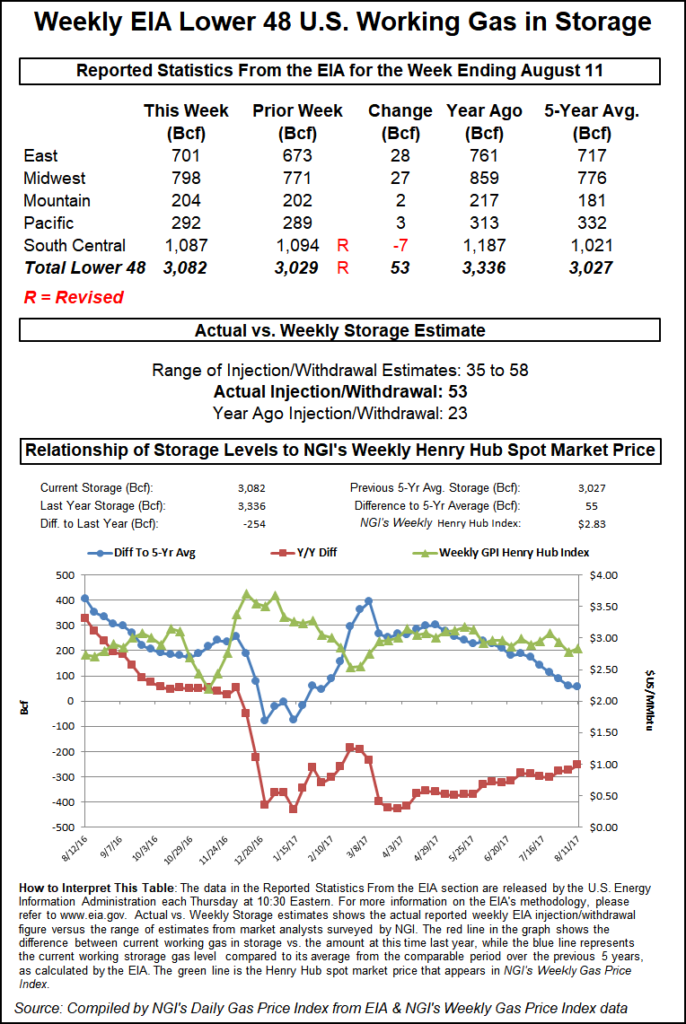

Natural gas futures slumped, then rebounded Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was a bit more than what the market was expecting.

EIA reported a 29 Bcf storage injection in its 10:30 a.m. EDT release, about 4 Bcf greater than what traders and analysts were calculating. September futures reached a low of $2.529 immediately after the figures were released, and by 10:45 a.m. September was trading at $2.577, up 1.6 cents from Wednesday’s settlement.

“The market seems to want to be supported, but there isn’t a great effort to do so,” said a New York floor trader. “The $2.51 to $2.53 area is being supported and that is what we are seeing. Since the market held, traders are comfortable getting long against that base.”

The trader thought that all in all, the market’s performance was that of a buying opportunity. “At least you know where to put your stop,” he said.

“The data for last week showed a larger-than-expected rebound from the prior week’s 6 Bcf net withdrawal as power sector demand likely eased,” said Tim Evans of Citi Futures Perspective. “This may still reflect the same sensitivity to summer temperature extremes as in recent weeks, but in the opposite direction.”

Inventories now stand at 3,317 Bcf and are 361 Bcf greater than last year and 440 Bcf more than the five-year average. In the East Region 17 Bcf was injected, and the Midwest Region saw inventories increase by 20 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was unchanged. The South Central Region, however, fell 10 Bcf.

Salt cavern storage was down 7 Bcf at 313 Bcf, while the non-salt cavern figure was lower by 2 Bcf at 884 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |