NatGas Cash Firms; Technical Bulls, Bears on Edge

It was basically a two-tiered physical natural gas market Wednesday, as surging weather and power-driven gains along the Eastern Seaboard lifted the slumping Southeast, along with the traditional producing basins into the black. Northeast prices jumped by double-digits, but elsewhere, declines of a few pennies to a nickel or more were common. TheNGI National Spot Gas Average added a penny to $2.54.

Futures bulls can’t seem to get out of their own way, and at the close September had shed another 5.4 cents to $2.561, and October had retreated 4.3 cents to $2.616. September crude oil fell $1.06 to $41.71/bbl on an unsupportive inventory report.

The delineation between bullish and bearish is currently in play, but “the key line in the sand that separates the bull case from the bear case is $2.45 and is entirely within reach in Thursday’s trading. It’s $2.45 or bust for the bulls,” Walter Zimmermann of United ICAP told NGI.

“It’s also $2.45 or bust for the bears, because they don’t have a case unless they can break the market below $2.45. Wednesday was a relatively small trading range, but if we have another day like we had Tuesday, we’ll be knocking on the door of $2.45.

“The bullish case is that natural gas holds $2.45, rebounds, and peaks somewhere above $3, and then we get a deeper correction which targets somewhere between $1.95 and $1.92. The bear case is that the move up from $1.611 peaked at $2.998 and that was the seasonal peak.”

Zimmermann said an “average spring to summer decline would be a 36% loss in spot contract value, which would give you $1.92.

“The downside risk for these two cases is very similar. The only difference is that the bullish case breaks above $2.998 first and then the market keels over by the fall. The bear case is that the seasonal decline gets us down to the $1.91 to $1.92 area.”

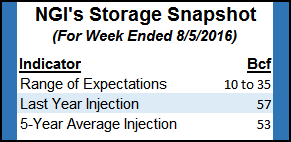

Thursday’s storage report may be the catalyst that tests the $2.45 level. Last week, however, an unusual 6 Bcf was withdrawn, and the market barely moved. For the week ended Aug. 5, expectations are for a build of about 25 Bcf, still well short of historical levels. Last year 57 Bcf was injected and the five-year pace stands at a 53 Bcf build.

Citi Futures Perspective calculated a 17 Bcf increase, and ICAP Energy is looking for an injection of 26 Bcf. A Reuters survey of 19 traders and analysts revealed an average 25 Bcf build with a range from 10 Bcf to 35 Bcf.

“Overall, we continue to expect a very warm pattern the next couple weeks with above normal temperatures, but also with widespread areas of showers and thunderstorms that will hold back the intensity of summer heat,” Natgasweather.com said in a noon update Wednesday. “Specifically, hot high pressure over the central and southern US, including all of Texas, continues to hold strong with daily highs of 90s to 100s persisting.”

The “hot ridge has expanded to gain territory over the Great Lakes and East Coast with highs of upper 80s and 90s pushing into Chicago and major Northeast cities. More importantly, with very high humidities east of the Rockies, the heat index is expected to again reach well over 100-plus in the next few days, focused over eastern Texas, the South and up the Mississippi River Valley.”

The forecaster said it also expected natural gas demand “to gradually wane after Aug. 20-21” because of “notably shorter days, but also with the potential for some cooler Canadian air to spill across the border.

“Overall, we still expect swings in natgas demand over the next two weeks with slightly to modestly stronger than normal demand as the hot upper ridge that’s been dominating much of the country this summer remains intact, although gradually weakening.”

It was that expectation that drove prices lower Tuesday.

“The natural gas market came under heavy selling on Tuesday in anticipation that a seasonal cooling trend will undercut power sector demand to meet air-conditioning loads in the weeks ahead,” said Tim Evans of Citi Futures Perspective.

Evans is looking for a build of 17 Bcf in this week’s storage report, and if his figures are correct, the current year-on-five-year surplus of 464 Bcf will shrink to 299 Bcf by Aug. 26, “with open-ended potential for it to extend the trend beyond the horizon of our specific forecast.”

Tom Saal, vice president at FCStone Latin America LLC in Miami, in his work with Market Profile expects the market to test Tuesday’s value area at $2.678 to $2.614 before moving on and testing $2.751 to $2.719.

Saal placed the week’s initial balance at $2.758 to $2.612 and, according to Market Profile methodology, price movement through the high end of the initial balance should be bought, and conversely a break through the lower end of the initial balance should be sold. Saal places trading objectives higher at $2.831 and lower at $2.539.

In physical trading, eastern prices advanced on the heels of strong power demand. ISO New England forecast peak power loads Wednesday of 22,050 MW would surge to 25,700 MW Thursday before easing somewhat to 24,800 MW Friday. The PJM Interconnection said Wednesday’s peak load of 51,855 MW would increase to 52,693 MW Thursday and 52,776 MW Friday.

Next-day gas at the Algonquin Citygate jumped 71 cents to $3.75, and gas on Iroquois, Waddington rose a stout 37 cents to $3.24. Gas on Tenn Zone 6 200L gained 75 cents to $3.70.

Major market hubs saw prices flounder. Gas at the Chicago Citygate fell 3 cents to $2.69, and deliveries to the Henry Hub lost 2 cents to $2.73. Gas at Opal changed hands 5 cents lower at $2.57, and packages at the PG&E Citygate shed 4 cents to $3.12.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |