Shale Daily | Bakken Shale | E&P | NGI All News Access

Production Still Flat, But Oasis Eyeing DUCs For Future Growth

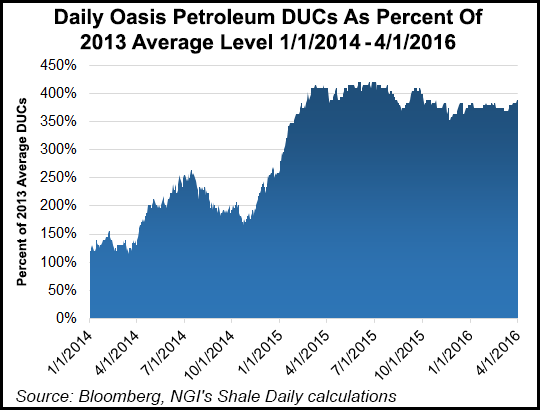

Although production remained essentially flat for the seventh consecutive quarter, Oasis Petroleum Inc. said that if commodity prices recover it could dip into its inventory of drilled but uncompleted wells (DUC) to create double-digit oil production growth over the next two years.

The Houston-based company, a pure-play operator in the Bakken Shale, also bumped up its full-year production guidance for 2016 — from 46,000-49,000 boe/d to 48,500-49,500 boe/d.

Oasis reported 49,507 boe/d of production in 2Q2016, a 1.5% decline from 2Q2015 (50,261 boe/d). Crude oil production fell 6.5% between the two quarters (from 44,043 b/d in 2Q2015 to 41,176 b/d in 2Q2016) but natural gas production soared 34% (from 37,306 to 49,983 MMcf/d). Eighty-three percent of 2Q2016’s production was oil. Production was 49,911 boe/d in the first half of 2016, a 0.8% decline from 1H2015 (50,353 boe/d).

The company said it placed 13 gross (8.7 net) operated wells into production in 2Q2016, and had 83 gross DUC operated wells at the end of the quarter.

During an earnings call Thursday to discuss 2Q2016, CEO Tommy Nusz said Oasis had transitioned its completion activities from Indian Hills in its West Williston project area to the Wild Basin, which is located in its Bakken core area in McKenzie County, ND. He added that the company would stay within its original guidance of $200 million for drilling and completion costs, and would operate two rigs and one frac spread to complete a total of 53 gross (34.3 net) wells by the end of the year.

“For 2017 and 2018, in a $50-60 oil price environment, we are now in a position to significantly grow our production base within cash flow,” CFO Michael Lou said. “If we see strength, we can accelerate through our DUC backlog and add rigs as we progress, allowing us to achieve double-digit oil production growth within cash flow over the next two years.”

During a Q&A session with analysts, Lou said Oasis “had more infrastructure capital to spend, but that is primarily focused around our capital spend in 2016. [We] actually have more that frees up in 2017. In addition to that, with our capital efficiency improving, we actually had the ability to increase our program from a two-rig and one frac spread scenario to something higher.

“Initially, we’ll use the DUC inventory and draw that down. And then if we continue to see that price holds steady in a good environment, then we’ll start to think about adding activity through rigs and frack crews.”

NGI recently completed an in-depth special report about how onshore producers around the country are managing DUC inventories and how the drawdown may impact future production levels.

COO Taylor Reid said Oasis had been testing several different completion designs in 2016. He said the designs fell into two categories — higher proppant loadings and proppant placement efficiency — and that multiple tests had been performed in the Indian Hills and the Wild Basin.

“It’s simply too early to draw definitive conclusions [on which type is better],” Reid said. “However, based on encouraging early time data, we have elected to conduct additional testing on all of the techniques. We believe these designs and techniques have the potential to further enhance both EURs [estimated ultimate recoveries] and returns for Oasis.”

Nusz said Oasis was continuing to look for acquisition opportunities in and around its core blocks in the Williston Basin, where it hold approximately 506,000 net leasehold acres.

“We did some [acquisitions] at the end of last year, albeit small deals and a lot were associated with acreage,” Nusz said. “We’ll continue to look for opportunities…we will look at anything, regardless of size, as long as it’s accretive to our core positions.”

Oasis reported a net loss of $89.9 million (minus 51 cents/share) in 2Q2016, compared to a net loss of $53.2 million (minus 39 cents/share) in 2Q2015. Total revenues were $179 million in 2Q2016, down from $230 million from the previous second quarter. But lease operating expenses fell 15.3%, from $8.26/boe in 2Q2015 to $7.00/boe in 2Q2016.

Stay up to date on 2Q16 earnings and projections for the remainder of the year with NGI’s Earnings Call and Coverage sheet.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |