Regulatory | E&P | NGI All News Access

Paper: Domestic Gas Drilling Down 11% Without Tax Breaks to Industry

If Congress repealed three tax preferences for oil and natural gas producers, domestic gas drilling could decline by about 11%, depending on gas prices, and domestic gas prices could increase 7-10% by 2030, according to a paper published by the Council on Foreign Relations.

In a 41-page discussion paper — “The Impact of Removing Tax Preferences for U.S. Oil and Gas Production” — Gilbert Metcalf, a professor of economics at Tufts University, said modeling shows domestic oil drilling activity could decline by about 9% if the tax breaks are repealed. The decline in oil and gas drilling would lead to a long-run decline in domestic oil and gas production.

Metcalf said that could lead to a 1% increase in global oil prices and a 5% drop in domestic production by 2030. Also by that year, global consumption could decline by less than 1% while domestic production and consumption of natural gas could decline 3-4%.

At issue are three tax preferences that account for more than 90% of the fiscal cost of tax preferences for the oil and gas industry.

The first, percentage depletion, allows oil and gas companies to deduct a fixed percentage of the revenue from each site as a depletion expense. First enacted in 1926, percentage depletion currently allows a deduction of 15% of revenue covering up to 1,000 bbl of oil or 6 Bcf of natural gas.

Congress enacted the second tax preference, for intangible drilling costs (IDCs), in 1916. The provision allows oil and gas producers to immediately write off the entire value of IDCs as an expense to offset taxable income in the year that the costs are incurred. A third preference, a domestic production manufacturing deduction, was enacted in 2004. It allows oil and gas companies to reduce their taxable income by up to 6%, limited to 50% of what the company pays its employees.

According to figures from the Treasury Department, the percentage depletion tax break costs the federal government $1.7 billion annually, while the IDC provision costs $3.2 billion and the manufacturing deduction costs $1.1 billion.

Metcalf introduces a term, “equivalent price impact” (EPI), which he said is the percentage drop in the price of oil or natural gas that would reduce the profitability of drilling a well as much as tax reform would. He calculated that the EPI from repealing all three tax preferences would range from minus 9% to minus 24%.

Specifically, Metcalf forecast that EPI would decline 14% for independent producers of onshore oil wells, and 24% for offshore oil wells, if all three tax breaks were repealed. For integrated producers, onshore and offshore oil wells would see EPI declines of 9% and 18%, respectively. Meanwhile, for independent producers of onshore natural gas wells eligible for the depletion tax break, EPI would decline 18%; ineligible producers would see EPI fall 14%. Metcalf forecast that integrated producers for onshore natural gas wells would see EPI decline 9%.

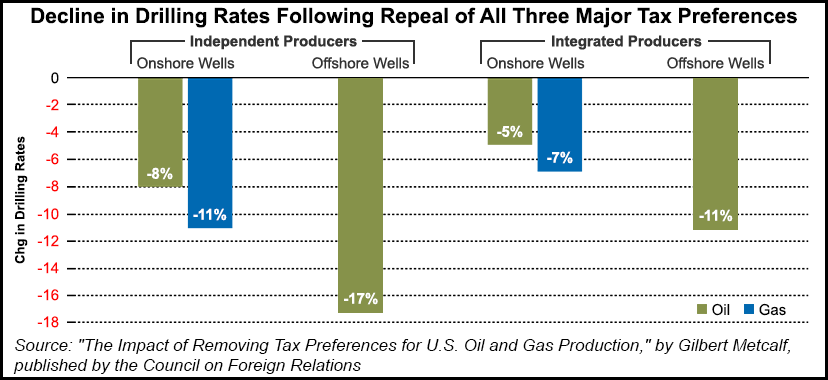

Metcalf projects that if all three tax breaks were repealed, drilling rates would decline 5-17%. For independent producers of onshore wells, there would be an 8% decline in oil drilling and an 11% decline in gas drilling, while offshore oil drilling would fall 17%. Meanwhile, for integrated producers, onshore oil drilling would decline 5%, onshore gas drilling would fall 7%, and offshore oil drilling would decline 11%.

The author said that repealing the tax breaks could help the U.S. meet its climate change goals. It could also encourage other developing nations with their own subsidies to fossil fuel producers to follow suit.

“In light of this, Congress should repeal all three tax preferences,” Metcalf said. “When Congress is ready to take up fundamental tax reform, it will have to grapple with many challenging issues as it attempts to lower overall income tax rates. Having a clear sense of the costs and benefits of proposals to raise revenue from the oil and gas sector will be essential to those discussions.”

The issue of tax breaks for the oil and gas industry has been a hot button issue for years. Republicans and their industry allies argue that repealing the tax breaks would cause layoffs and lead to declines in domestic production. On the other side, Democrats want to see the tax breaks end as part of a bigger strategy to move away from fossil fuels and embrace renewable sources of energy.

Three years ago, the Independent Petroleum Association of America called on House lawmakers to continue the tax breaks for fiscal year 2014, after the Obama administration unveiled a budget that proposed their repeal (see Daily GPI, April 16, 2013; April 11, 2013). More recently, U.S. Sen. Bernie Sanders (D-VT), during his unsuccessful bid for the White House, called for eliminating the tax breaks.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |