Power Burn Drove Last Week’s Net 6 Bcf Withdrawal, EIA Says

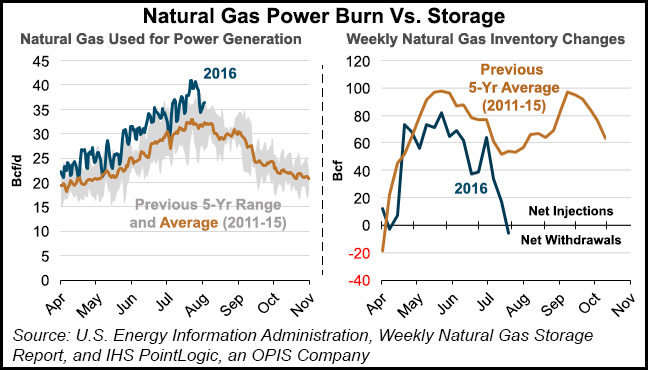

Record-high natural gas power burn was the driving factor behind last week’s unusual 6 Bcf summer storage withdrawal, according to the Energy Information Administration (EIA).

In a note published Monday, EIA wrote that, prior to last week, the most recent net withdrawal on a national basis in July occurred in 2006. Total inventories now stand at 3,288 Bcf, still 16% above the previous five-year average, according to EIA (see Daily GPI, Aug. 4).

Thus far, 2016 power burn has outpaced 2015, which was already a banner year for natural gas consumption for electric generation (see Daily GPI, April 5).

Through the first five months of 2016, U.S. natural gas power burn was up 7.4% from the same period in 2015, according to NGI’s analysis of the latest EIA electric power data. Meanwhile, the Henry Hub bidweek price for the first five months of 2016 averaged $2.034/MMBtu, down 27.8% from $2.818/MMBtu in the year-ago period, according to NGI data.

Marketed U.S. natural gas production experienced its first month/month decline in February and its first year/year decline in April, though average production through the first five months of 2016 was still up 1.6% year/year, according to NGI’s analysis of EIA data.

EIA noted that weekly net injections have consistently fallen below the five-year average this summer, reflecting the power burn demand growth, as well an “unusually high inventory level at the start of the injection season” and “slightly lower” natural gas production.

At first blush, the market’s reaction to the surprising summer withdrawal could be described as counterintuitive. Average Henry Hub futures for the remainder of 2016 and 2017 fell slightly following the news (see NGI’s Forward Look, Aug. 5).

“It’s flow versus level,” Thomas Saal, Senior VP of Energy at INTL FCStone Financial Inc., told NGI Monday. “As long as the bathtub’s still pretty full, it’s not going to create any fear in the market.”

While “definitely unusual,” a summer withdrawal is not unprecedented, he said.

Saal noted the unusually large volumes left in storage following the mild 2015/2016 winter. Following months of low injections, the supply/demand balance has now tightened to the point that “there’s simply not enough production to handle a peak load” driven by increased power demand, he said.

“It looks like the pulse of the market is on the level of inventory, which is quite high, and so even if we have lean injections for the rest of the season, we’re still going to have a very large amount of gas in inventory going into the winter no matter how you rate it,” Saal said. “It may not be the highest, but it will be very high. That will set the stage. We’ll see what happens if we get some cold weather early.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |