Utica Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

NFG Tests Unproven Pennsylvania Utica, Says Could Be ‘Primary Target’

National Fuel Gas Co.’s (NFG) exploration and production subsidiary, Seneca Resources Corp., is opening yet another frontier for Utica Shale development in Northwest Pennsylvania, saying the formation could ultimately be its primary target in a few years after encouraging test results in the region.

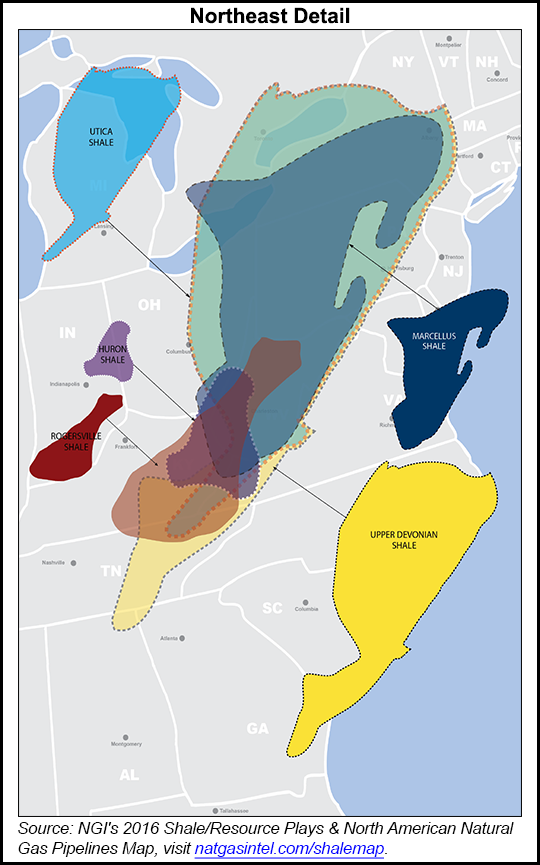

Pennsylvania Utica development has been more common about 100 miles to the west and south of the test well. It was drilled in the company’s Clermont/Rich Valley area, which encompasses Elk, McKean and Cameron counties.

The Utica well was completed with a short lateral of 4,500 feet in Elk County to test productivity on a per foot basis. Its 30-day initial production (IP) rate of 1.4 MMcf/d per 1,000 feet of lateral is about 60-70% better than the company’s Marcellus IPs in the area. The well has produced more than 250 MMcf in its first 45 days of production.

Seneca has already drilled its second Utica well on a nearby pad that it plans to bring online later this year. While it was drilled to the same zone, COO John McGinnis said Seneca would test a different completion design. The company plans to drill six more Utica wells in the Clermont over the next year.

“As we move forward with this appraisal program, we will be testing different landing zones and we will continue to experiment with our completion design for this area,” McGinnis said Friday during a call to discuss NFG’s fiscal 3Q2016 results. “In addition, as we move to the south and southeast across our [Western Development Area], Utica depths, and subsequently pressures, could increase significantly. If the rock quality remains similar, we think there is a good opportunity for even stronger results in the future.”

Depending on the lateral lengths, management believes Seneca can drill Utica wells in Northwest Pennsylvania for $5.5-6.5 million. Initially, the price would stay low because the company plans to drill them off existing Marcellus pads. That would be about 30% more than the company’s Marcellus well costs.

“Based on our preliminary economics, with a 60-70% improvement in well performance and with only a 30% increase in cost, the Utica may end up being our primary target,” McGinnis said. The company plans to test the next six wells between fiscal years 2017 and 2018. If it favors the Utica, McGinnis said, its drilling program could look entirely different by 2019.

Last year, Seneca tested a Utica well in Tioga County, PA, at a 24-hour peak rate of 22.7 MMcf/d (see Shale Daily, March 9, 2015). In 2014 it tested another in nearby McKean County at a rate of 8.5 MMcf/d. Only two Utica wells were drilled in Elk County last year, according to the state Department of Environmental Protection.

Seneca’s announcement on Friday is the latest from operators that have expanded beyond the Utica’s core in eastern Ohio since 2014 to test the formation in West Virginia and Pennsylvania.

Seneca plans to continue running one rig for the remainder of its fiscal year. In June, Dallas-based IOG Capital LP extended its joint venture (JV) with Seneca in Northern Pennsylvania (see Shale Daily, June 13). The company further reduced its capital expenditures budget on Friday to $120-135 million and tightened its production guidance to 160-165 Bcfe. That’s down from a budget of $150-200 million and production guidance of 139-202 Bcfe that Seneca announced when the JV was extended.

The company’s Northeast Access pipeline project remains on track to be completed in 2017. McGinnis said the company would likely end the year with a drilled but uncompleted well inventory of 60-65 wells to fill the project. Northern Access would expand the NFG Supply Corp. and Empire Pipeline systems to transport more than 490,000 Dth/d from Seneca-operated wells to markets in the Northeast.

The commodities downturn and takeaway constraints have already forced Seneca to curtail 28.4 Bcf of natural gas this fiscal year (see Shale Daily, May 3). It shut in 45 Bcfe last year.

Firming gas prices, however, helped push up production in 3Q2016 to 44 Bcfe from 36.2 Bcfe in the year-ago period and 39.2 Bcfe in 2Q2016. The company’s Marcellus assets accounted for 38.8 Bcf of Seneca’s third quarter volumes, while its California assets produced 728,000 bbl of oil.

Average realized gas prices, including hedges, dropped to $2.86/Mcf from $3.32/Mcf in the year-ago period. Average year/year oil prices were also down from $69.65/bbl to $58.79/bbl.

Seneca’s accounting methods again forced it to record an impairment on its oil and gas properties of $82.7 million during the quarter. It recorded a $588.7 million impairment in the year-ago period.

Earnings increased for NFG’s gathering segment with higher volumes. Earnings in the utility and pipeline segments decreased with higher operating and maintenance expenses during the quarter. The energy marketing segment also saw earnings down on lower gas prices.

NFG and its subsidiaries reported a profit of $8.3 million (10 cents/share) for 3Q2016, up from a net loss of $293.1 million (minus $3.44) at the same time last year. Stay up to date on quarterly earnings and projections for the remainder of the year with NGI‘s Earnings Call and Coverage sheet.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |