NGI All News Access | E&P | M&A

Azure Midstream Posts Loss, Sells East Texas Assets

Azure Midstream Partners LP is selling a processing plant and gathering pipeline in East Texas as it posts an $8.4 million net loss for the second quarter. In early June, partnership units were delisted from the New York Stock Exchange.

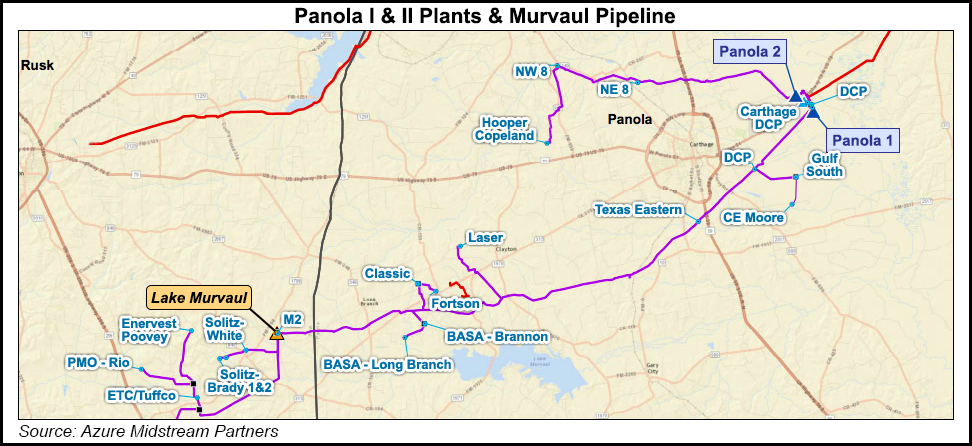

Dallas-based Azure is selling the the 100 MMcf/d Panola I processing plant and Murvaul pipeline to Align Midstream Partners for $44.9 million in cash. The partnership continues to own and operate 210 MMcf/d of natural gas processing capacity in East Texas and has more than 950 miles of gathering pipeline in East Texas and North Louisiana, it said Monday.

“The transaction announced today, is unique in that it allows us to reduce our debt by $41.0 million and effectively increase our annual EBITDA [earnings before interest, taxes, depreciation and amortization] run rate by about $1.5 million through the elimination of fixed costs associated with the plant and pipeline which was sold,” said CEO Chip Berthelot.

Azure’s $8.4 million net loss for the second quarter compares with pro forma net income of $1.7 million for the year-ago period.

Gross margin for the gathering and processing segment for the second quarter 2016 was $6.9 million compared to $15.2 million in the second quarter of 2015. Gathered gas volumes were 246 MMcf/d and gas processed volumes were 62 MMcf/d for the second quarter 2016. Gathered gas volumes were 338 MMcf/d and gas processed volumes were 185 MMcf/d for the second quarter 2015.

Early this year Azure suspended distributions in order to shore up its finances (see Daily GPI, Feb. 1). Azure was launched in 2012; an early acquisition by the partnership was gathering assets in the Haynesville Shale (see Shale Daily, Oct. 17, 2013).

“I’m not going to belabor the challenges we’re all working through,” Berthelot said during a conference call. “I think you guys have probably heard enough of that from me and others. But what I would like to say is that I’m not here to call the bottom in terms of commodity prices or activity levels. But what I would say is that we believe over here at Azure that there’s a heck of a lot more upside than downside to the current operating environment.”

Azure will continue to work on righting its balance sheet, he said, looking at “strategic alternatives,” cost reductions and other measures.

Stay up to date on 2Q16 earnings and projections for the remainder of the year with NGI‘s Earnings Call and Coverage sheet.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |