NGI All News Access | Infrastructure

Amid Red Ink, Oxy California Spinoff to Add Two Rigs, Take $1B Loan

While reporting larger quarterly losses, California Resources Corp. (CRC) officials indicated that they are starting a modest turnaround, adding two rigs and successfully pricing a $1 billion first lien secured credit facility.

CEO Todd Stevens said during a conference call Thursday that the Occidental Petroleum Corp. spinoff recorded overall production in 2Q2016 of 140,000 boe/d, hitting the mid-part of the guidance range for the period, compared to 161,000 boe/d in 2Q2015. With minimal capital expenditures of less than $50 million annually now, he predicted production could be in the 134,000-139,000 boe/d range in 3Q2016.

CRC said Goldman Sachs Bank USA arranged the secured credit facility, acting as lead arranger and bookrunner, and the syndicated facility would allow the company to reduce outstanding amounts under its existing bank group credit facility. “This financing is supported by the strength of our large and diverse asset base,” Stevens said.

“Given the volatility in the current commodity market, we think we need to further strengthen our balance sheet, position the company for the longer term, and continue to look at all available options for our midstream and upstream assets, as well as new market opportunities,” said Stevens, noting the company continues to have long-term debt-reduction goals.

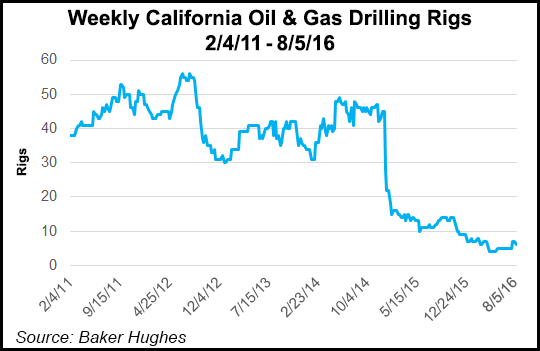

Stevens said CRC is “mobilizing two rigs back into the field that will largely focus on drilling in the company water and steam flood operations” the second half of this year.

While decline in production accelerated the first six months of the year due to power plant and pipeline outages and other factors (dropping 13%), it will slow considerably in the second half, with production for 2016 expected to be down overall in the range of 10%-15%, Stevens said.

“For the second half of the year, we are also seeing significant increases in natural gas prices,” said Stevens, noting that the closure of Southern California Gas Co.’s Aliso Canyon storage field, coupled with peak summer demand, are expected to boost proceeds from gas. CRC is California’s major gas producer.

Oil is still predominant, Stevens said, but at some point the natural gas mix could jump head of oil for a time.

“Obviously, we have an enormous gas inventory, both associated gas in some properties and the Sacramento Basin, and at some point we can take advantage of that,” Stevens said. “We feel there are some opportunities there, and we keep close tabs on the market, but those opportunities have to compete with others we have.

“Right now, we’re not getting gassier; gas has been declining quicker than oil production. If commodity prices for gas shifted relative to oil, then we could become a gassier company.”

If prices do turn around it would take for the company four to six months to increase spending and erase the ongoing decline, Stevens said.

For 2Q2016, CRC reported a net loss of $140 million (minus $3.51/share), compared with a loss of $68 million (minus $1.78) in 2Q2015.

Stay up to date on 2Q16 earnings and projections for the remainder of the year with NGI‘s Earnings Call and Coverage sheet.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |