NGI Data | Markets | NGI All News Access

NatGas Traders Stunned By July Storage Draw And Unexpected Price Reaction; Cash, Futures Move Little

Physical natural gas traders for the most part hunkered down and got their deals done prior to the release of Energy Information Administration (EIA) storage data. Looking back they are probably just as glad they did, for once the highly unanticipated withdrawal of 6 Bcf flashed across trading desks, September futures carved out both the day’s high and low in a heartbeat, ultimately closing fractionally lower on the day.

At the close September was $2.834, down five-tenths of a penny, and October was off by four-tenths to $2.877. September crude oil gained $1.10 to $41.93/bbl.

In physical trading strength in California and the Rockies as well as the Midcontinent and Midwest helped offset soft pricing in Appalachia, the Northeast and Southeast. The NGI National Spot Gas Average added a penny to $2.61.

Many traders were caught flat-footed by the stunning revelation of a 6 Bcf pull in August. NGI calculations show the 6 Bcf withdrawal for the week of July 29 is only the third time since 1994 that the U.S. has experienced a weekly withdrawal during the June, July, and August summer months. The other two occasions were both in 2006: a 7 Bcf withdrawal for the week ended July 21, and a 12 Bcf withdrawal for the week ended August 4.

Traders knew going into the report that any build would be minimal, but the 6 Bcf pull was way at the end of the range of expectations.

ICAP Energy was looking for a 4 Bcf pull and Tradition Energy saw a 1 Bcf injection. A Reuters survey of 20 traders and analysts showed an average 2 Bcf build with a range of -6 Bcf to +10 Bcf.

The EIA reported a 6 Bcf withdrawal in its 10:30 a.m. EDT release. The pull on storage put inventories at 3,288 Bcf and September futures rose to a high of $2.885, but by 10:45 a.m. September was trading at $2.836 down 3-tenths of a cent from Wednesday’s settlement.

Others were more surprised by the reaction. “It was really kind of shocking. It really surprised me the market’s reaction,” said Steve Blair, Vice President at Rafferty and Co.

“We surged higher, but now we are trading lower on the day.”

“The 6 Bcf net withdrawal from natural gas storage for last week was the first summer draw since August 2006,”said Tim Evans of Citi Futures Perspective. “The result was bullish relative to consensus expectations for a 2-3 Bcf net injection and in comparison with the 54-Bcf five-year average build for the date. The report also extends the recent string of bullish storage misses, tending to confirm that power sector demand has been more sensitive to summer heat than anticipated.”

Others weren’t quite so surprised. “The ICE Swap was trading -4 Bcf to -6 Bcf just before the number came out, so it was already in the market,” a New York floor trader told NGI.

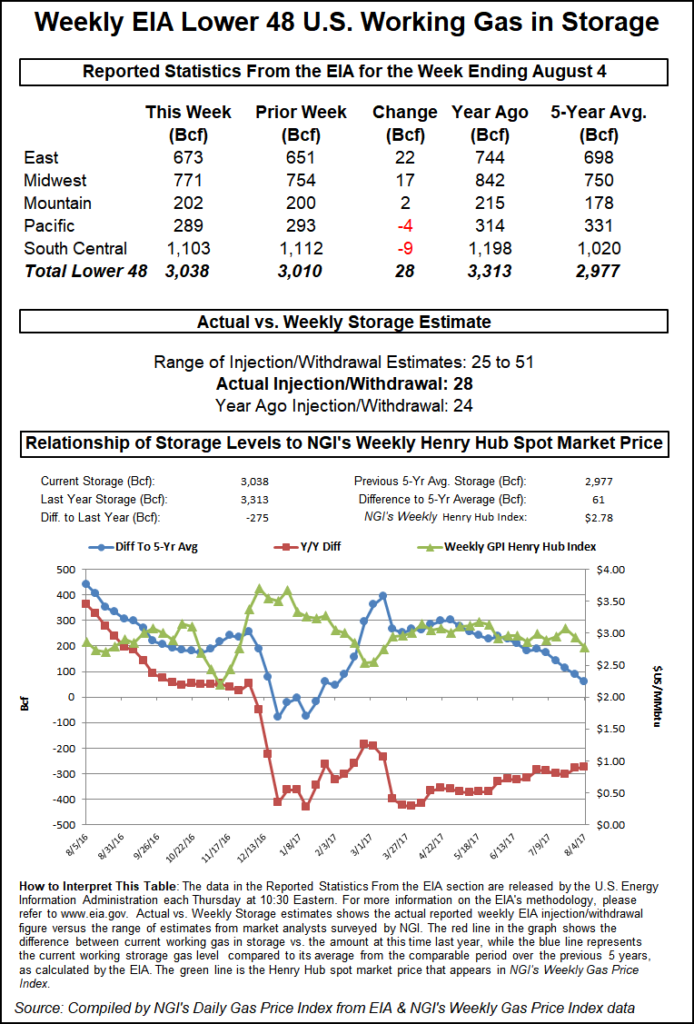

Inventories now stand at 3,288 Bcf and are 389 Bcf greater than last year and 464 Bcf more than the five-year average. In the East Region 14 Bcf injected, and the Midwest Region saw inventories grow by 10 Bcf. Stocks in the Mountain Region were unchanged and the Pacific region was down 4 Bcf. The typically opaque South Central Region fell a stout 26 Bcf.

Even with the anomalous 6 Bcf pull, inventories stand at 3,288 Bcf, nearly as high as ever for this point in the injection season. Trouble is that it is not growing fast enough for those who earlier forecast that ending stocks might reach upwards of 4 Tcf, set a new record as well as provide an ample supply cushion and keep prices in check.

Last year supplies set a record at 3,953 Bcf at the end of October, and this year the Energy Information Administration (EIA) is projecting ending supplies at 4,022 Bcf.

Industry consultant Genscape said its latest calculations do not show inventories at “acceptable” levels. “The largest revisions to the forecast based on recent gas price gains have been to production and power burn. The production projection was revised upward to capture the higher prices available, as well as revisions to rig counts coming in higher than expected. Power burn for winter was revised down from previous forecast as higher gas prices nudge gas out of some regional stacks,” said Eric Fell, ea Genscape analyst.

In physical trading California posted gains as strong as anywhere as warm temperatures were expected to engulf major market points. Forecaster Wunderground.com predicted the high in Los Angeles Thursday of 81 would rise to 83 Friday and ease back down to 81 by Saturday. The normal high in the City of Angels this time of year is 75.

Deliveries to Malin were quoted 8 cents higher at $2.77 and packages at PG&E Citygate added 3 cents to $3.21. Gas at the SoCal Citygate added 9 cents to $2.88 and gas priced at the SoCal Border Avg. Average jumped 13 cents to $2.86.

Gas at major hubs was mixed. Gas at the Algonquin Citygate fell 6 cents to $2.87 and parcels at the Henry Hub rose a penny to $2.89. Deliveries to Chicago Citygate were quoted a penny lower at $2.84, and gas at Opal rose 9 cents to $2.73.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |