Shale Daily | E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

QEP Adding Rigs in 4Q After Permian Bolt-On

QEP Resources Inc. continues transitioning to an oilier production mix, with the exploration and production (E&P) company planning to add rigs in the Permian Basin by the end of 2016.

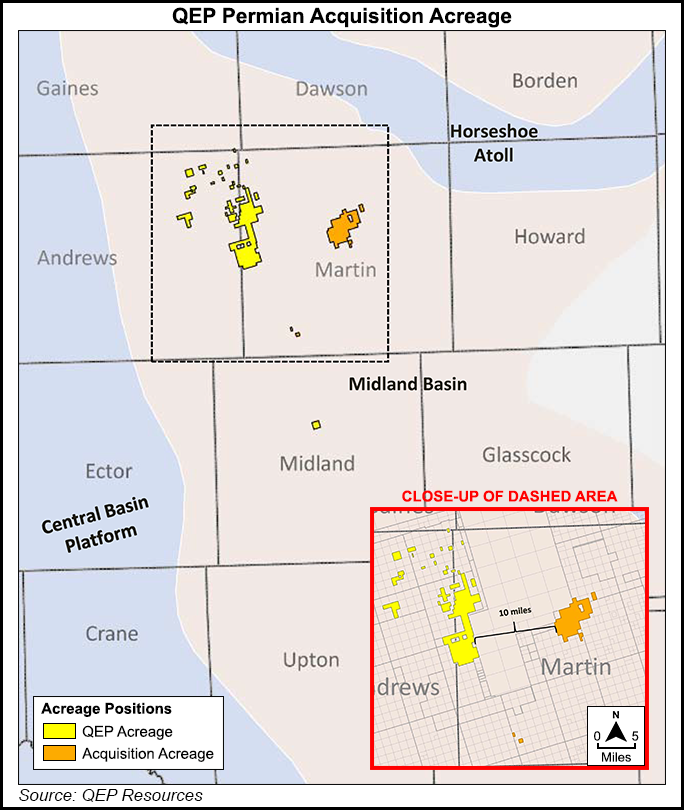

In June, the Denver-based QEP announced a deal to expand its Permian drilling locations by more than half with a $600 million, 9,400 net acre bolt-on in the Midland sub-basin in West Texas (see Shale Daily, June 23).

With the transaction expected to close by September, CEO Charles Stanley said QEP plans to add two rigs to the Permian during 4Q2016.

“The rigs may start on our existing acreage and migrate to the acquisition acreage, or they may start directly on the new acreage, depending on both the timing of rig arrival and the timing and completion of land work to form drilling units on the new acreage,” Stanley told investors during the company’s 2Q2016 earnings call last week.

As a result, QEP upped its 2016 capital expenditure guidance by $50 million to $500-550 million.

Putting the Permian acquisition into “strategic context,” Stanley said it reflects the company’s focus “on growing crude oil as a percentage of both proved reserves and production in our asset portfolio. And over the past several years, we’ve made tremendous progress toward this goal through a combination of targeted acquisitions and through the drill bit [see Shale Daily, May 7, 2014].”

Answering a question on the oil price sensitivity of QEP’s plans, Stanley said the E&P has “been looking at a forward price of roughly $50/bbl in 2017, and our risk management group has been aggressively hedging into that price, and at $50, we think that the economics are supported. The economics support adding the rigs going into 2017.”

Meanwhile, Stanley said QEP intends to maintain the one rig deployed in the Williston Basin during the second quarter through the remainder of 2016.

“I would not say that we’re parking or putting the Williston Basin asset in neutral. Far from it,” Stanley said. “We think there’s still a tremendous amount of running room on that asset. And as we go into 2017, obviously we’re very excited about the Permian…but I don’t want you to think that we’re walking away from or that we’re going to starve the Williston Basin asset.”

As for the Haynesville Shale, Stanley couldn’t give a prediction on when it might make sense for QEP to put more capital into the play.

“I guess the answer is it depends. And in part, it depends on where crude oil prices are and where they head into 2017. Certainly, we’ve watched with interest the well results from some offset operators where we’ve had an opportunity to participate in some wells at fairly low working interest outside our operated wells,” he said.

Lower well costs, longer laterals and higher proppant concentrations are all improving the economics in the Haynesville, he said.

“It’s clear from watching the well performance of the new wells that the bigger fracs are making a huge difference in the performance of the wells that are currently being drilled into place,” Stanley said. “So the economics are pretty interesting, and it’s a great gas option to have in our portfolio, so we’re continuing to monitor results. It’s too early to give 2017 view on how much, if any, capital we allocate to the asset, but stay tuned.”

Production for the second quarter totaled 83.3 Bcfe, including 42.9 Bcf of gas, 5,210 bbl of oil and 1,521 bbl of natural gas liquids (NGLs). Production in the year-ago quarter totaled 80.9 Bcfe, including 44.5 Bcf, 4,876 bbl and 1,198 bbl, respectively.

Permian production increased 53% year/year to 9.5 Bcfe in 2Q2016, while Haynesville production declined from 10.4 Bcfe in the year-ago period to 9.2 Bcfe. Williston Basin production increased 10% year/year to 31.6 Bcfe, while production from the Pinedale Anticline declined to 22.8 Bcfe from 24.9 Bcfe in the year-ago quarter.

QEP completed 4 gross (3.4 net) operated wells in the Pinedale in 2Q2016, along with 1 gross (1 net) operated and 4 gross (0 net) non-operated wells in the Williston. In the Permian, QEP completed 6 gross (6 net) operated wells during the quarter, along with 4 gross (0.7 net) non-operated wells in the Haynesville.

Average realized prices for the quarter, including the effect of hedges, were $2.51/Mcf for gas, $43.69/bbl oil and $14.97/bbl NGLs, for a net equivalent price of $4.31/Mcfe.

General and administrative expenses for the quarter totaled $43.7 million, compared with $51.3 million in the year-ago quarter. CFO Richard Doleshek said QEP completed a company reorganization in April that reduced its headcount by 6%, resulting in $1.8 million in severance expenses during the quarter.

QEP reported a quarterly net loss of $197 million (minus 90 cents/share), compared with a net loss of $76.3 million (minus 43 cents/share) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |