Shale Daily | Bakken Shale | E&P | Eagle Ford Shale | NGI All News Access | NGI The Weekly Gas Market Report

ConocoPhillips Raises Production Guidance, Plans More Shareholder Payouts

ConocoPhillips reported a net loss of $1.1 billion in the second quarter and lowered its budget for capital expenditures (capex) for the remainder of the year, but it also raised its production guidance as executives touted plans to reduce debt and increase payouts to shareholders.

During a conference call Thursday to discuss 2Q2016, CEO Ryan Lance said the Houston-based company has five priorities moving forward. Fourth on the list is for ConocoPhillips to provide shareholders with a 20-30% payout of cash flow from operations through a combination of ordinary dividend and flexible share repurchases.

“We don’t believe our ordinary dividend represents enough return of capital to shareholders through the cycles for a company our size and maturity,” Lance said. “So when we have available cash flows, we expect to return additional capital through share buybacks. We believe this will be a differential aspect of our offering. It will also force discipline on the system while giving us a more flexible means of returning capital to our owners.”

Focus on returning value to shareholders

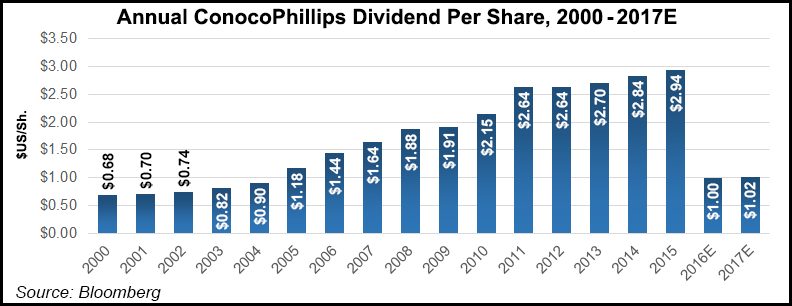

Returning value to shareholders has been an issue since last February (see Shale Daily, Feb. 4). That’s when ConocoPhillips, the largest independent in the country, cut its quarterly dividend for the first time in at least 25 years, from 74 to 25 cents/share.

According to slides presented during the 2Q2016 call, number three on the company’s top five list of priorities is to maintain a strong balance sheet and reduce its debt to less than $25 billion. The debt is currently $28.7 billion, with a debt-to-capital ratio of 43%. The company began 2016 with $2.4 billion in cash, and was exiting 2Q2016 with $4.2 billion in cash and short-term investments.

The slides show the remaining three priorities are to use existing dividend and capital to maintain the company’s production base, target real annual dividend growth, and to maintain disciplined growth capital.

During the Q&A session of the call, Lance conceded that the 20-30% payout range is “pretty broad” but said the company recognizes that even if commodity prices recover, they would not provide enough of a payout to its shareholders.

“As you get down to those fourth and fifth priorities, it’s about what kind of investments do we have that the shareholders would want us to be making in the portfolio,” Lance said. “What kind of returns do they have? What kind of costs of supply do they have, and how does that compare to where our stock is trading at the time and the value that we see in the shares and compare those two and make those decisions as we go down the road?”

ConocoPhillips opened at $39.77/share on the New York Stock Exchange on Friday, and was up 1.44% to $40.84 in mid-afternoon trading. Overall, the stock is down 28% from a high of $56.73, which it hit on Nov. 3, 2015.

Production affected in part by Canadian fires

Second quarter production was about 1.55 million boe/d, down 3% (49,000 boe/d) from about 1.6 million boe/d produced in 2Q2015. But the company said that after factoring in 95,000 boe/d from dispositions and downtime, production actually increased by 46,000 boe/d, or 3%. ConocoPhillips also blamed wildfires in Canada for part of the decline in production.

In the Lower 48, overall production totaled 503,000 boe/d in 2Q2016, a 3.3% decline from the previous second quarter (520,000 boe/d). During the same time frame, unconventional production fell 3.6%, from 272,000 boe/d in 2Q2015 to 262,000 boe/d in 2Q2016.

During the Q&A session of the call, Al Hirshberg, executive vice president for production, drilling and projects, said production in the Eagle Ford Shale was 171,000 boe/d in 2Q2016, a 1.8% increase from the first quarter of 2016 (168,000 boe/d). Meanwhile, production in the Bakken Shale slipped 1.5%, from 65,000 boe/d in 1Q2016 to 64,000 boe/d in 2Q2016.

The company raised its full-year production guidance from 1.54 to 1.57 million boe/d, citing strong year-to-date performance from its portfolio. It also raised its production guidance for 3Q2016, from 1.51 to 1.55 million boe/d, and said it plans to continue running three operated rigs.

Hirshberg said the company did not have a set commodity price in mind for when it would add rigs in the Lower 48.

“We have the volume momentum and better volume performance we’re getting from just the rigs we’re running,” Hirshberg said. “We’re not going to get excited and rush out there and add rigs every time the price bumps up. The price since the last call [for 1Q2016] has been up, it’s been down. We’re not on a hair trigger to go out and add rigs in that kind of situation, even though we do have a very high quality opportunity set to invest in.

“We’re ready [to add rigs], but we’re patient. And when we do add rigs, we’re going to be very mindful about it.”

With that in mind, ConocoPhillips cut capex for the second half of the year, from $5.7 to $5.5 billion. It has entered into an agreement to terminate its drilling contract in the deepwater Gulf of Mexico (GOM) for $140 million before taxes, a move that will be recorded in 3Q2016 as a special item (see Shale Daily, April 29).

Lance said that although ConocoPhillips is on track to complete $1 billion in asset sales in 2016, the company has taken several oil-producing assets off the market.

“We just don’t think the market is there for a fair value,” Lance said. “We’re not going to sell assets into that kind of a headwind. We have done some North American dry gas assets and we continue to look at those in the portfolio and see if we can get what we believe is a fair value relative to how we view the assets.”

ConocoPhillips recorded a net loss of $1.1 billion (minus 86 cents/share) for 2Q2016, compared to a net loss of $179 million (minus 15 cents/share) in 2Q2015. Excluding special items — specifically, non-cash impairments in the Lower 48, primarily in the GOM; pension settlement expenses; deferred tax adjustments, and a gain on an asset sale — adjusted earnings in 2Q2016 were a net loss of $985 million (minus 79 cents/share), compared to adjusted earnings of $81 million (seven cents/share) in 2Q2015.

Stay up to date on 2Q16 earnings and projections for the remainder of the year with NGI’sEarnings Call and Coverage sheet.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |