Three-Week NatGas Forwards Slide Comes to Screeching Halt After Storage-Driven Surge

Natural gas forwards markets ended July with a bang as bullish storage news and scorching temperatures sent September prices up an average 9.4 cents for the period between July 22 and 28, according to NGI Forward Look.

The Nymex September contract, which rose 12.9 cents during that time, ended its first day at the front of the curve July 29 with a more than 21-cent rally that came on the heels of a storage report that rocked the market.

The U.S. Energy Information Administration (EIA) reported a 17-Bcf injection for the week ending July 22, below the forecast build of 26 Bcf and below last year’s build of 49 Bcf.

U.S. working gas in storage is now at 3,294 Bcf, which is 18.9% above the five-year average of 2,770 Bcf, and 15.3% above last year’s level of 2,858 Bcf.

“Yesterday’s EIA-reported +17 injection was 6 Bcf below our estimate and 9 Bcf below the average of the major storage surveys,” said Genscape’s Rick Margolin, senior natural gas analyst, who added the injection was also well below the lowest published estimate that Genscape was aware of, +21 Bcf.

Compared to degree days and seasonality, a +17 Bcf injection would appear tight by 3.8 Bcf/d versus the prior five years, and is a bit tighter than the trailing 12-week average of 3.2 Bcf/d versus weather and seasonality, according to Louisville, KY-based Genscape, a real-time data and intelligence provider for energy and commodity markets.

“The size of the miss relative to our estimate and market consensus puts us on alert for subsequent reports. If this week’s reported injection was indeed lower than reality, then there is a heightened risk of an overstated injection in the near future,” Margolin said.

The nearly 8% gain in the September contract on Thursday was a swift and telling response to the miniscule storage injection, but the market has mixed views on whether the rally is sustainable.

The most recent weather models turned somewhat more bullish, and the overall theme for the next two weeks seems to swing between periods of slightly above-normal natural gas demand and well above-average demand, forecasters at NatGasWeather said.

While there is some uncertainty over how weather systems play out in the Northwest and Northeast regions, the western and southern portions of the U.S. will remain hot as temperatures reach the 90s and 100s, the weather group said.

“Prices found impressive strength today before and after a fairly big miss in the EIA weekly storage, with an even smaller build to follow next week,” NatGasWeather said Thursday.

“After such a huge move today, it’s difficult to say if prices went up too much too quick, or if the markets are seeing today’s number as showing considerable more tightening than they were expecting in regards to supply/demand balances,” the weather agency said.

Mobius Risk Group said it believed further upside is possible, as next week’s injection is expected to be half of Thursday’s reported gain.

“Early expectations for next Thursday’s report range from a small draw to a single digit build. Any outcome in that range would help to further reduce inventory versus prior seasonal highs,” Mobius said.

If prices are sustained at these levels, or if they manage to further appreciate after next week’s injection, fundamentals could be significantly impacted during calendar month September and October, Mobius said.

Another factor the market could be considering during the recent rally is production, said NGI’s Patrick Rau, director of strategy and research.

“What has become pretty clear to me after the first week of 2Q16 earnings calls is there isn’t likely to be a huge increase in 2H16 natural gas production, if there is any at all,” Rau said

That, combined with storage injection numbers that continue to be on the low side and heavy gas burn from power generators, are setting things up for a more normal gas in storage situation come November, according to Rau.

“We already knew about those last two things, but confirmation that producers aren’t about to go hog wild in increasing natural gas production for the rest of 2016 is constructive as well,” Rau said.

“Unless August turns out to have significantly lower demand than expected, any corrections will likely be driven more by technical and trading factors than by fundamentals, in my view, since it’s looking more and more like the fundamental picture is taking a much clearer shape going into the winter.”

Next year may be shaping up to be stronger as well, according to comments from Range Resources CEO Jeffery Ventura. During the company’s 2Q16 earnings call last week, Ventura noted that “gas pricing remained challenged during the second quarter, but pricing has improved since and there are signs that later this year and into 2017, supply and demand will be more balanced and pricing could significantly improve. We expect natural gas production in the U.S. to continue declining for the remainder of this year.

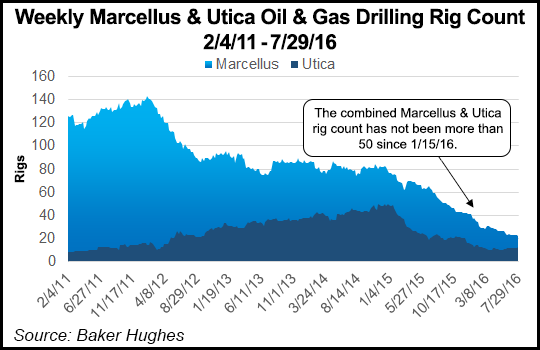

“In Appalachia, there are only about 30 rigs drilling for natural gas in the Marcellus and Utica formations, with the rigs about equally divided between the two plays. We estimate that it would take approximately 50 rigs to hold production flat in the Marcellus and Utica. An estimate to put 20 additional rigs back to work, including all associated costs to put the wells on-line, would result in additional of $4 billion of capital per year.” The Marcellus and Utica haven’t had a combined 50 working rigs since January 15.

But the team at Bespoke Weather Services said the rally appears to be overdone, at least in the short term and said a pullback towards $2.82 looks likely before any potential move higher.

And the looming shoulder season will undoubtedly see a reduction in weather-related demand, Mobius added.

“Additional price-induced demand reductions could leave the market struggling to keep inventory below 4 Tcf,” the group said.

Taking a closer look at individual markets, most points followed the general move higher, except for the Northeast.

In New York, Transco zone 6-New York September dropped 10.2 cents between July 22 and 28 to reach $1.68, according toForward Look.

October was down 7.5 cents during that time to $1.76, while the rest of the country rose by an average of nearly 9 cents.

The prompt winter strip tumbled 15 cents from July 22 to 28 to reach $6.35, while nationally, prices rose an average 5 cents, Forward Look data shows.

At Dominion South, September slipped 7.7 cents during that time to $1.40, and October slid 8.5 cents to $1.46. The winter 2016-2017 strip was down 6 cents to $2.26.

The declines in the Northeast come as a couple of weather systems are expected to traverse through the region during the next couple of weeks, dropping demand back to more seasonal levels.

Genscape shows Appalachian demand averaging 10.03 Bcf/d from Aug. 1 to 5, down from the recent seven-day average of 10.78 Bcf/d.

Demand is expected to slide further the following week, down to an average 9.29 Bcf/d, Genscape said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |