Utica Shale | Bakken Shale | E&P | NGI The Weekly Gas Market Report

Hess Waiting on $60 Oil Before Bakken Ramp-Up

After posting capital spending and production declines during the second quarter, Hess Corp. now plans to wait on $60/bbl oil and signs of a continued price recovery before ramping up activity again.

The New York-based exploration and production (E&P) company, a key player in North Dakota’s Bakken Shale, continued to rein in spending during the second quarter, with deep cuts to its capital expenditure (capex) budget starting to show in its production numbers.

Bakken production for the second quarter totaled 106,000 boe/d, down from 119,000 boe/d in the year-ago quarter, with the drop reflecting the reduced activity. Hess operated on average three rigs in the Bakken during the quarter and brought online 26 gross operated wells.

Total drilling and completion costs in the Bakken declined to $4.8 million/well from $5.1 million/well in the first quarter, even as the company increased its standard well design to a 50-stage completion from 35 fracture stages. Drilling and completion (D&C) costs averaged $5.6 million/well in 2Q2016.

CEO John Hess told investors during the quarterly earnings call Wednesday that the producer has now revised its production forecast in the Bakken to 100,000-105,000 boe/d for full-year 2016, reflecting the upper end of its previous guidance of 95,000-100,000 boe/d.

“We do not believe that accelerating production or drilling up our best locations in the current low price environment is in the best interest of shareholders,” Hess said. “While our Bakken acreage can generate attractive returns at current low prices, we will remain disciplined and begin to increase activity there when oil prices approach $60/bbl.”

CFO Greg Hill said the company has started discussions with vendors to be prepared for an eventual increase in D&C activity. “We all wonder when that will be, but as prices approach $60, we want to be ready for that ramp-up. So we are starting the conversations now, certainly with our vendors in the onshore.”

Hess, whose portfolio includes Utica Shale, deepwater Gulf of Mexico (GOM) and various international offshore assets, reported total net production of 313,000 boe/d in 2Q2016, down from year-ago output, excluding assets sold, of 386,000 boe/d.

The company attributed the production drop in part to unplanned downtime related to subsurface safety valve failures in the GOM at the Tubular Bells field and a mechanical issue at a well in the Conger field. Planned downtime also affected various offshore fields.

Regarding the issues at Tubular Bells, Hill said the company plans to pursue reimbursement from Schlumberger Ltd. for “the cost of the replacement belts, the cost of the remediation work, lost profits due to downtime and all the attorney’s fees. It’s very disappointing.”

Primarily as a result of the unplanned downtime at the offshore fields, full-year 2016 total net production guidance has been reduced to 315,000-325,000 boe/d from 330,000-350,000 boe/d.

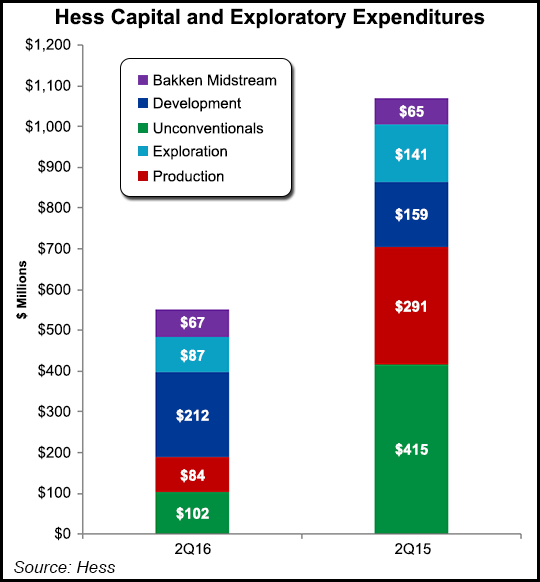

“We remain confident in our ability to manage through the current environment and deliver strong production and cash flow growth as oil prices recover,” Hess said. “During the quarter, we continued to pursue further cost reductions and now project our full-year 2016 E&P capital and exploratory expenditures to be about 48% below 2015 levels.”

Average realized crude oil prices in 2Q2016 were $41.95/bbl including the effect of hedging, down 25% from 2Q2015. The average realized natural gas liquids price was $9.03/bbl, compared with $11.06/bbl in the year-ago quarter, while the average realized natural gas price was $3.58/Mcf from $4.49/Mcf.

Net losses for the second quarter were $392 million (minus $1.29/share), compared with a net loss of $567 million (minus $1.99) in the year-ago quarter. The E&P segment posted a quarterly net loss of $328 million, compared with a net loss of $502 million in 2Q2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1266 | ISSN © 2158-8023 |