NGI All News Access | E&P | M&A

Freeport-McMoRan Continues Scaling Back Oil, Gas Ops in Favor of Mining Business

Freeport-McMoRan Inc. (FCX) continues to pull back on oil and gas activity and focus on its core mining business, selling assets and canceling $1.1 billion in drilling contracts in the second quarter.

Hit by declining commodity prices, the Phoenix-based copper mining giant has been looking to cut back after making substantial investments to return to the oil and gas game in early 2013 (see Daily GPI, Jan. 23, 2013).

After announcing in April that it had laid off 25% of its oil and gas workforce (see Daily GPI, April 27), FCX continued pursuing cost-cutting measures in the second quarter designed to reduce leverage and strengthen its balance sheet.

The company has been looking to sell off assets under its wholly-owned oil and gas subsidiary, FM O&G. In the second quarter, FM O&G sold some of its oil and gas royalty interests for $102 million, and in July it exited the Haynesville Shale, selling its northern Louisiana assets for $87 million.

“We had an effort to sell our oil and gas business or assets. It was a tough time to do that. We restructured the business to operate within its cash flows,” CEO Richard Adkerson told investors during a conference call Tuesday to announce 2Q2016 results. “We dealt with some major obligations that had been committed to in past times when the strategy was to grow that business aggressively, and we made some tough decisions to restructure drilling contracts and other contracts, and we continue to view strategically how these assets fit into our long-term business.”

During the second quarter, FCX struck a deal to terminate $1.1 billion in drilling contracts between FM O&G and Noble Drilling LLC and Rowan Companies plc. FCX said it reached agreements to pay a total of $755 million to terminate the contracts, for a total savings of approximately $350 million. FCX said it has also identified another $150 million in savings from reduced general and administrative expenses related to the restructuring.

FCX raised $540 million to help pay for the termination by issuing 48 million shares of common stock. The company said it paid $85 million in cash and will pay another $130 million during the third quarter, plus up to $105 million in contingent payments depending on the trailing 12-month crude oil price as of June 30, 2017.

“We have achieved our goal of ending the subsidy of our oil and gas operations from the mining business,” Adkerson said.

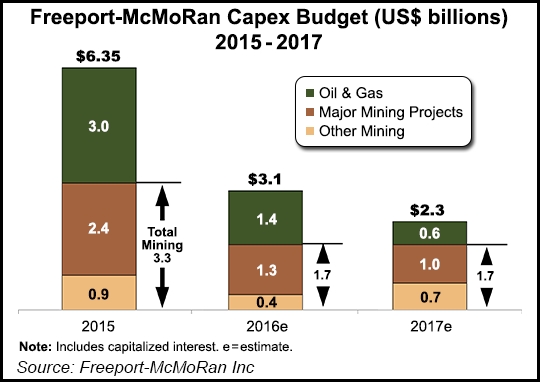

Oil and gas capital expenditures (capex) totaled $392 million in the quarter. Full-year 2016 oil and gas capex is expected to reach $1.4 billion, with 90% going to activity in the Deepwater Gulf of Mexico (GOM), the company said. Estimated oil and gas capex for full-year 2017 is $600 million, Adkerson said.

During the second quarter, FM O&G saw 20 mboe/d production from its 25% working interest in six wells in the Lucius field and Keathley Canyon area.

Three wells in the 100%-owned Holstein Deep area commenced production during the quarter and are producing at 9 mboe/d gross rate, below earlier estimates, which the company attributed to “lower than expected crude oil quality and lower permeability.” The Holstein Deep area is located west of FM O&G’s 100%-owned Holstein platform.

In FM O&G’s 100%-owned Horned Mountain field in the Mississippi Canyon, the Quebec/Victory and Kilo/Oscar wells began production during 2Q2016, the company said.

In January, production commenced on three initial subsea wells in the Heidelberg oil field in the Green Canyon area, where FM O&G holds a 12.5% working interest. During the second quarter, the operator drilled a fourth well, with results this month confirming oil pay “with similar characteristics to a good offset producing well.” Drilling began on a fifth and final well in the Heidelberg in the third quarter.

Second quarter sales volumes totaled 12.4 million boe, including 8.7 million bbl of oil, 18.8 Bcf of natural gas and 600,000 bbl of natural gas liquids. For the year-ago quarter, volumes totaled 8.6 million bbls, 23.5 Bcf and 600,000 bbl, respectively.

Average realized prices for 2Q2016 were $41.10/bbl for oil, $2.04/MMBtu for gas and $18/bbl for NGLs, down from 2Q2015 prices of $67.61/bbl, $2.66/MMBtu and $16.44/bbl.

Cash production costs declined to $15/boe for the quarter, down from $19.04/boe in the year-ago quarter.

FCX recorded a $291 million impairment charge in 2Q2016 on its oil and gas properties.

FCX posted a seventh-straight quarterly loss of $479 million (minus 38 cents/share) in 2Q2016, compared with a net loss of $1.85 billion in the year-ago quarter. Through the first six months of 2016, FCX reported a net loss of $4.66 billion (minus $3.70/share), compared with a net loss of $4.33 billion (minus $4.18/share) in the year-ago period.

For a full listing of 2Q2016 industry earnings calls, including links to NGI‘s coverage of both the company and the call, please see NGI’s 2Q16 Earnings Calls List PDF.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |