NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

California Out In Front Of Weekly Natural Gas Trading

If you weren’t looking at California, you might think that weekly natural gas trading for the week ended July 22 was in the summer doldrums. Most points moved within a nickel of unchanged, and theNGI Weekly National Spot Gas Average sported a change of all of a 3-cent advance to $2.57.

Traders in California however, were hit with a double whammy of increased weather-driven demand and diminished supply resulting from limited availability from the stricken Aliso Canyon storage facility deep in the Los Angeles Basin. California averaged the week’s highest gain of 17 cents to $2.91 and the week’s strongest points were pivotal southern California market locations. SoCal Citygate posted the week’s greatest gain adding 37 cents to $3.11 and was closely followed by El Paso S Mainline with a rise of 36 cents to $3.10. The week’s greatest loser was FGT Citygate with a 38-cent setback to $3.22.

Regionally, the Southeast was the weakest with a 5-cent loss to $2.83 and Appalachia was down by 4 cents to $1.52.

All other regions were in positive territory. South Louisiana and East Texas both added a penny to $2.71 and $2.69, respectively, and five regions tied for second place behind California with 4-cent gains.

The Northeast averaged $2.55, Rocky Mountains $2.58, the Midcontinent $2.62, South Texas $2.69, and the Midwest at $2.72.

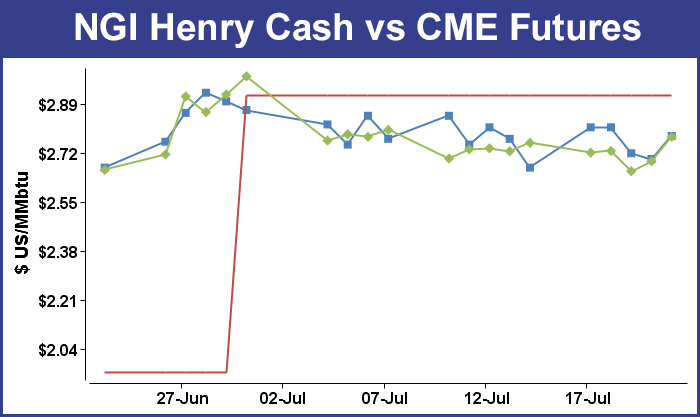

After posting an 8.5-cent gain Friday, August natural gas for the week was up 2.1 cents at $2.777.

Thursday’s Energy Information Administration (EIA) storage report once again came in well below historical averages and the 1 and 5-year storage surpluses contracted. The EIA reported a storage build of 34 Bcf, about 5 Bcf less than market surveys, and even with a bullish tonality to the number, prices managed only a modest advance. At the close August had gained 3.4 cents to $2.692 and September was up 3.8 cents to $2.659.

For a storage report sharply below long-term averages and below market expectations the market response was somewhat tepid. When the EIA’s 34 Bcf figure flashed across trading screens August futures reached a high of $2.710 immediately after the figures were released and by 10:45 a.m. August was trading at $2.686 up just 2.8 cents from Wednesday’s settlement.

“We shot up right after the number came out, and we are about 2 cents higher than when it was released,” a New York floor trader told NGI.

“Just prior to the number, the ICE swap was 37 [Bcf], and it was traded pretty heavily. Off of that number you knew it was going to pop.”

“The 34 Bcf net injection for last week was both less than expected and below the 61-Bcf five-year average benchmark, and so supportive on a seasonally adjusted basis,” said Tim Evans of Citi Futures Perspective. “This may test the market’s ability to look beyond current hot temperatures to the August seasonal cooling trend that will follow. At the same time, storage did reach a new record high for the date, and so any price strength may remain limited.”

Inventories now stand at 3,277 Bcf and are 471 Bcf greater than last year and 559 Bcf more than the five-year average. In the East Region 19 Bcf were injected and the Midwest Region saw inventories increase by 16 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was lower by 1 Bcf. The South Central Region fell 2 Bcf.

Traders of natural gas for weekend and Monday delivery weren’t taking any chances on getting caught behind the weather curve Friday and sent prices sharply higher at California and eastern points.

Weather-driven gains were common at nearly all points, and the NGI National Spot Gas Average added a stout 13 cents to $2.66. Futures traders weren’t above holding long positions over the weekend. At the close, August had risen 8.5 cents to $2.777 and September added 8.4 cents to $2.743.

The heaviest gains were seen in California, where heavy power loads prompted by extreme heat in Southern California sent prices soaring. Forecaster Wunderground.com said Friday’s high for Los Angeles of 90 degrees would rise to 95 Saturday before dropping to 86 Monday. The seasonal high in Los Angeles is 74. Dallas’ high of 104 Friday was forecast to ease slightly to 102 Saturday before easing to 96 Monday, one degree above normal.

Weekend and Monday gas at the PG&E Citygate added 11 cents to $3.13, but at the SoCal Citygate gas changed hands at $3.65, up a whopping 60 cents. Gas priced at the SoCal Border Avg. rose 53 cents to $3.44 and parcels on Kern Delivery jumped 52 cents to $3.48.

Major market centers didn’t quite match the California gains but for the most part put in a solid performance. Gas on Dominion South was unchanged at $1.39, but deliveries to the Henry Hub added 8 cents to $2.78. Gas at the Chicago Citygate rose a dime to $2.84 and gas at Opal gained 8 cents to $2.68.

Analysts are keeping a close eye on weekend temperatures as SoCalGas faces another stress test with Aliso Canyon on limited withdrawal. “The pipeline will use tariff adjustments and OFOs in an attempt to maintain system integrity as the heat persists through Monday,” said industry consultant Genscape.

“This upcoming heat wave in California is forecasted by Genscape to be slightly less intense than the one a month ago, with population weighted CDDs expected to peak at 15.4 this time relative to 18.7 in June. In the desert southwest, this weekend’s temperatures are anticipated to be close to those during the middle of last month.

“SoCal has also adjusted its percentage of storage withdrawal capacity available for balancing in its low OFO calculation down from 15% to 10%, effective Evening Cycle for Gas Day July 22. During times of higher temperatures and increased demand, SoCal has lowered this percentage to help keep a tighter balance on the system. Since 6/1/2016, it has fluctuated between 10% and 15%; 10% when demand is high, 15% when demand is low,” Genscape said.

A building materials manufacturer in southern California on the SoCal system said, “We haven’t had any curtailments, but in four of the last five days we have had OFOs. The odd thing is that we have had a day of high OFOs followed by a day of low OFOs. We are fortunate for we operate 24/7, but the poor guy who runs eight to 10 hours a day and shuts down for a shift, they have to be getting killed.”

Several California points traded at one-year highs. El Paso S Mainline at $3.68, Kern Delivery at $3.48, and SoCal Citygate at $3.65 all bested their one-year highs by close to 40 cents or more.

Analysts don’t see a lot of trading potential in the market at present. Thursday’s smaller than expected EIA storage report might have represented a correction to the holiday-driven storage report of the week before.

“[A] continued narrowing in the supply surplus to the tune of about 27 Bcf was furthered with an additional 20-25 Bcf contraction likely in next week’s EIA report,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning report to clients. “We will reiterate that this dynamic of a narrowing in the surplus will remain price-supportive going forward into next month. But at the same time, we are recognizing that this narrowing in the supply overhang has slowed appreciably during the past month or so in providing an upside price limiter.

“In other words, much focus has shifted back to a very high absolute level of storage that has contributed to this week’s price decline to approximate five-week lows. Furthermore, non-weather-related price drivers continue to provide a mixed bag as production recovery and utility switching toward the lower-priced coal appear to be losing momentum. At the end of the day, this remains a market in which a case for a major price move of much more than 20 cents in either direction is still elusive. Since we still see nearby pricing likely unchanged some three to four weeks down the road, option writing strategies still represent a good strategy, in our view.”

According to forecasters, conditions over the NYISO footprint for the weekend will likely keep gas buyers for power generation busy. Warm, humid conditions will need to be balanced with an inventory of renewables. “Hot and stormy conditions are likely, [and] hot and humid conditions are expected [Friday] with max temps in the mid 80s to mid 90s,” said WSI Corp. in its Friday morning report. “A frontal system and this air-mass will likely trigger heavy downpours and thunderstorms, which may be locally severe. A secondary cold front will support the chance for additional isolated pop up showers and thunderstorms during Saturday, which will finally give way to fair weather by Sunday.

“It will become less humid but remain warm with high temps in the 80s to mid 90s. Another frontal system will support a risk for scattered showers and thunderstorms early next week. Near to slightly higher than average Great Lakes water levels will continue to support hydro generation, [and] recent and expected rain will be highly beneficial as it will likely cause streamflow rates to hold fairly steady. A west-southwest to west-northwest breeze will boost wind generation during the next couple of days.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |