NGI Data | Markets | NGI All News Access

NatGas Cash, Futures Up Slightly as Traders Digest Supportive Storage Stats

Most traders Thursday attempted to get their deals done before the release of Energy Information Administration (EIA) inventory figures, and with most of the hot weather baked into the market, prices moved little.

Most points moved within a few pennies of unchanged with the exception of the Northeast, which managed to add about a quarter as buyers had to adjust to the hottest weather for the region expected Friday. The NGI National Spot Gas Average added 1 cent to $2.53.

The EIA reported a storage build of 34 Bcf, about 5 Bcf less than market surveys, and even with a bullish tonality to the number, prices managed only a modest advance. At the close, August had gained 3.4 cents to $2.692 and September was up 3.8 cents to $2.659. September crude oil tumbled $1.00 to $44.75/bbl.

At eastern points, next-day gas posted double-digit gains as next-day power prices shot higher, making incremental purchases of gas for power generation effective. Intercontinental Exchange reported that on-peak power deliverable Friday to ISO New England’s Massachusetts Hub jumped $11.96 to $46.74/MWh. On-peak power at the PJM West terminal added a healthy $13.08 to $57.36/MWh.

Gas bound for New York City on Transco Zone 6 vaulted 56 cents to $2.77, and gas on Tennessee Zone 5 200 L rose 5 cents to $2.54.

Other market points were less inspired. Gas at the Chicago Citygate added a couple of pennies to $2.74, and deliveries at the Henry Hub shed 2 cents to $2.70. Parcels on El Paso Permian were quoted 4 cents higher at $2.64, and gas delivered to the PG&E Citygate changed hands 2 cents higher at $3.02.

Temperature forecasts called for double-digit variations to seasonal norms at major market centers on the Eastern Seaboard. AccuWeather.com forecast that Thursday’s high in New York City of 88 degrees was expected to jump to 92 Friday with a heat index of 98. Saturday’s high was forecast to reach 94. The seasonal high in New York City is 84. Philadelphia’s Thursday high of 90 was seen rising to 94 Friday with a heat index of 99. Saturday’s max was seen at 98, 11 degrees above normal.

AccuWeather.com meteorologists said, “Some of hottest weather of the summer will affect part of the northeastern United States late in the week and into this weekend. Oppressive heat and humidity will punch eastward across the Ohio Valley and Great Lakes on Thursday, then extend toward the mid-Atlantic coast on Friday.

“Hot weather is no stranger to July, but 100-degree Fahrenheit heat in July has been relatively uncommon from Chicago to New York City so far this century,” according to AccuWeather.com meteorologist Elliot Abrams. “In New York Central Park, the only 100-degree July daily heat records were set on two days in 2010 and two days in 2011.”

“While actual temperatures will stop short of the century mark in most of the eastern states this time, daytime temperatures will surge well into the 90s from Virginia and West Virginia to parts of New York and Massachusetts. Highs well into the 80s are in store for northern New York state, Vermont, New Hampshire and Maine. Metro areas including New York City, Philadelphia, Pittsburgh, Baltimore, Washington, DC, Richmond and Charleston, WV, can expect a heat wave with at least three days in a row of 90-degree highs.”

For a storage report sharply below long-term averages and below market expectations, the market response was somewhat tepid. When the EIA’s 34 Bcf figure flashed across trading screens, August futures reached a high of $2.710 immediately after the figures were released and by 10:45 a.m. August was trading at $2.686, up 2.8 cents from Wednesday’s settlement.

“We shot up right after the number came out, and we are about 2 cents higher than when it was released,” said a New York floor trader. “Just prior to the number, the ICE swap was 37 [Bcf], and it was traded pretty heavily. Off of that number you knew it was going to pop.”

“The 34 Bcf net injection for last week was both less than expected and below the 61 Bcf five-year average benchmark, and so supportive on a seasonally adjusted basis,” said Tim Evans of Citi Futures Perspective. “This may test the market’s ability to look beyond current hot temperatures to the August seasonal cooling trend that will follow. At the same time, storage did reach a new record high for the date, and so any price strength may remain limited.”

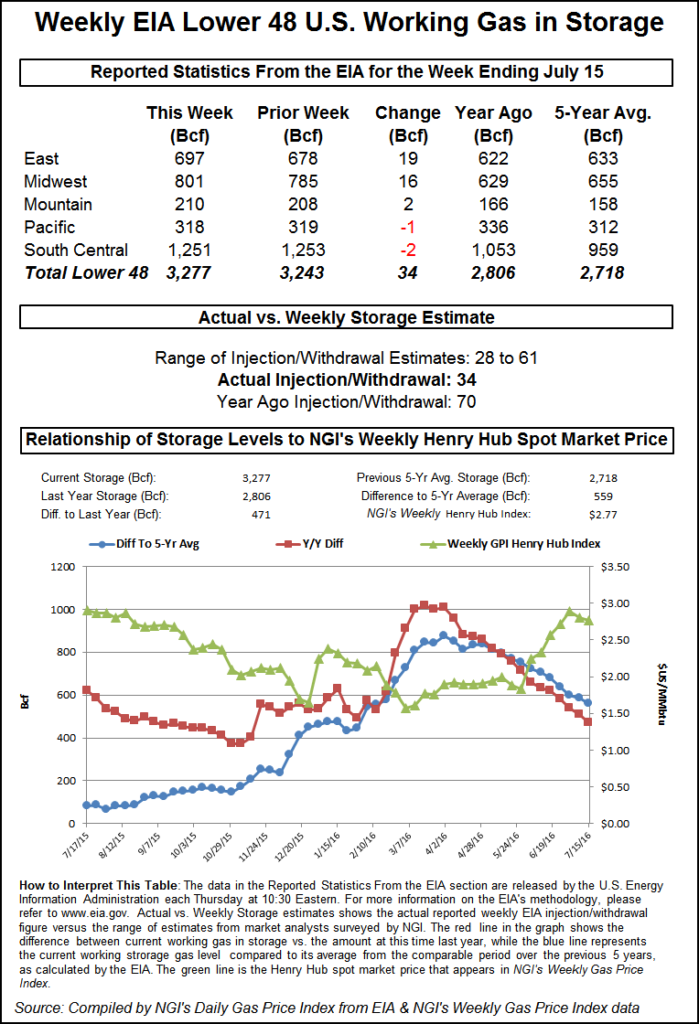

Inventories now stand at 3,277 Bcf and are 471 Bcf greater than last year and 559 Bcf more than the five-year average. In the East Region 19 Bcf was injected, and the Midwest Region saw inventories increase by 16 Bcf. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was lower by 1 Bcf. The South Central Region fell 2 Bcf.

The continued erosion of the long-term storage surplus remained intact. Last year 70 Bcf was added to storage, and the five-year average was for a 61 Bcf increase. Analysts at ICAP expected an increase of 41 Bcf, and industry consultant Bentek Energy’s flow model predicted a build of 39 Bcf. A Reuters survey of 20 traders and analysts revealed an average 39 Bcf with a range of 28 Bcf to 61 Bcf.

The folks at The Desk calculated a 38 Bcf build. “As for this week, the heat kicked into gear nicely and rocked the draw situation by a huge margin,” said John Sodergreen, Desk editor. “Last week’s weather was 9% warmer than last year in the same week and 8% warmer than the five-year average. Since May, the temps have been about 8% warmer than last year. Recall, however, that last year, this week, EIA delivered a massive reclassification and the market went nutty “

Traders working markets in the central U.S. not only had to deal with warm temperatures but potentially load-killing storms as well. “[A] low-pressure system will bring active weather to the Midwest on Thursday, while monsoonal thunderstorms fire up across the Southwest,” said Kari Strenfel, a Wunderground.com meteorologist.

“An area of low pressure will move eastward over the upper Great Lakes. This system and a cold frontal boundary will produce showers and thunderstorms across the northern Plains, the upper Mississippi Valley and the Midwest. Severe thunderstorms will be possible in eastern Wisconsin and Michigan. These thunderstorms will be capable of producing large hail, dangerous straight line winds and isolated tornadoes.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |