Utica Shale | E&P | NGI All News Access

Gulfport’s Production Declines With Little 2Q Utica Activity

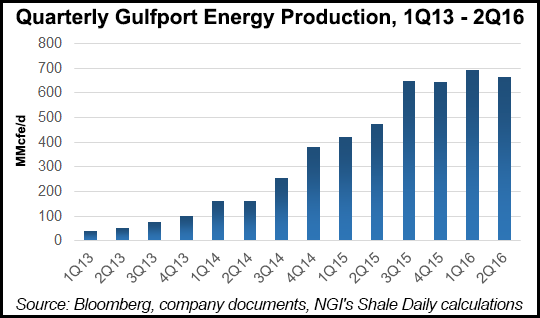

Gulfport Energy Corp. hit the low-end of its second quarter production guidance after another slow period for the company that saw little activity until the end of June, when it started to turn wells to sales as it looked ahead to 2017.

The company produced 664.7 MMcfe/d during the second quarter, up from the 473.9 MMcfe/d it produced at the same time last year.

Production was down from the 692.2 MMcfe/d Gulfport produced in 1Q2016, though. The company did not complete any new wells in the first quarter and instead relied on a backlog of 15 drilled and completed wells to drive up production. It didn’t run a completion crew for the first three months of the year and resumed that work in April, guiding in May for a flat second quarter of 664-692 MMcfe/d on the slowdown and its focus on cost-cutting during the commodities downturn (see Shale Daily, May 6).

While the quarter-over-quarter decline was more than expected by some analysts, average realized prices began to firm during the quarter. Including hedges, Gulfport reported an average realized price of $2.82/Mcfe, down from the year-ago period when it reported $3.41/Mcfe, but an improvement from 1Q2016, when the company reported $2.61/MMcfe.

Other than legacy assets on the Gulf Coast in Southern Louisiana and a stake in the Canadian oilsands, the company primarily operates in Ohio’s Utica Shale. With the fall in oil and natural gas liquids (NGL) prices, Gulfport highlighted a plan earlier this year to focus entirely on its east and central dry gas windows in Ohio’s Monroe, Belmont and Jefferson counties (see Shale Daily, Feb. 18). The company said its production mix during the second quarter consisted of 87% natural gas, 7% NGLs and 6% oil.

Despite a decline in production during the second quarter, Gulfport is still targeting full-year volumes of 730 MMcfe/d, compared to the 548.2 MMcfe/d it produced in 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |