Utica Shale | Bakken Shale | E&P | Eagle Ford Shale | Haynesville Shale | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Production From Big Seven Plays to Continue Decline in August, EIA Says

Oil and natural gas production from the nation’s seven largest unconventional plays, which has been on a downward trend since last fall, will slip again in August, according to the Energy Information Administration (EIA).

EIA released its first Drilling Productivity Report in October 2013 (see Shale Daily, Oct. 22, 2013) but didn’t forecast month-to-month declines until September 2015 (see Shale Daily, Sept. 15, 2015; April 13, 2015). Since then, the agency’s production forecasts have followed a steady downward trend (see Shale Daily,June 13, May 16; April 11).

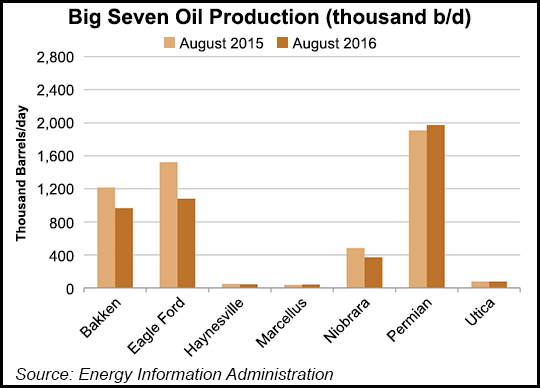

That trend is expected to continue next month, EIA said in its latest DPR, with oil production projected to decline 99,000 b/d to 4.56 million b/d, compared with 4.65 million b/d in July.

EIA forecast oil production out of the Bakken in August to be 966,000 b/d, compared with 998,000 b/d in July, with declines also expected in the Eagle Ford (1.08 million b/d, compared to 1.13 million b/d), Niobrara (371,000 b/d, compared to 383,000 b/d) and Permian (1.97 million b/d, compared to 1.98 million b/d). A marginal decline is also expected in the Haynesville, with unchanged production from the Marcellus and Utica.

Total natural gas production out of the Bakken, Eagle Ford, Haynesville, Marcellus, Niobrara, Permian and Utica will be an estimated 45.73 Bcf/d in August, a 417 MMcf/d decline compared with an estimated 46.14 Bcf/d this month, EIA said. The only play expected to see an increase in gas production is the Utica (up 5 MMcf/d to 3.67 Bcf/d).

For the second month in a row, EIA said it expects the biggest decline in natural gas production in the Eagle Ford Shale, with the agency forecasting 5.81 Bcf/d in August, down 209 MMcf/d from 6.01 Bcf/d this month.

EIA expects 17.95 Bcf/d out of the Marcellus Shale next month, compared with 17.98 Bcf/d in July. The agency also expects to see month-to-month declines in the Bakken Shale (1.56 Bcf/d, compared with 1.59 Bcf/d in July), the Haynesville Shale (5.88 Bcf/d, compared with 5.92 Bcf/d), the Niobrara formation (3.99 Bcf/d, compared with 4.07 Bcf/d), and the Permian Basin (6.87 Bcf/d, compared with 6.91 Bcf/d).

The productivity of new oil wells in the plays is expected to improve slightly in August. On a rig-weighted average basis, oil production per rig will be 558 b/d, compared to 548 b/d this month, according to the DPR. At the same time, new-well gas production per rig in the plays will decrease slightly, from 2.88 MMcf/d in July to 2.85 MMcf/d in August, EIA said.

More U.S. land-based drilling rigs returned to play in the Baker Hughes Inc. (BHI) rig count released Friday, and the Permian Basin turned in another strong showing (see Shale Daily,July 15). During the week ended July 15, the Permian added two units, making it the biggest gainer among U.S. plays, according to BHI.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |