Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Oil Producer Capex Cuts Improving Bottom Line, Says EIA

U.S. onshore producers are far and away more stable financially today than they have been since the oil price bust, the Energy Information Administration said Monday.

When crude oil prices crashed in the second half of 2014, exploration and production companies (E&P) saw their operating income crash too, and many have been financially strapped.

EIA, led by principal contributor Jeff Barron, reviewed 39 publicly held U.S. crude oil producers that only operate in the onshore. Collective production averaged 2.1 million b/d, or about 30% of Lower 48 production in 1Q2016.

The E&Ps had been big spenders prior to the crash in late 2014, with operating income peaking at almost $40 billion in 3Q2014, while capex exceeded $60 billion. By the 1Q2016, however, operating income and capex both had fallen by half.

By reducing their capital expenditures (capex) to more closely align with operating income, the need to find external sources of funding appears to be on the decline, thus reducing financial strain going forward.

First quarter results revealed an “improving balance between capital expenditure and operating cash flow,” said Barron. “Although operating cash flow was the lowest in any quarter in the past five years, larger reductions to capital expenditure brought these companies closest to self-finance,” when capital investments are paid entirely from operating cash flow.

Price-wise the news was even more encouraging in the second quarter, as crude oil averaged above $45/bbl, more than one-third higher (34%) than in the first three months. As second quarter earnings are unveiled, E&Ps should be able to demonstrate that cash flow is improving and offsetting declining revenue from lower production.

The difference between operating cash flow and capex, also known as free cash flow or the financing gap, represents whether a company is able to pay for its investment through after-tax profits.

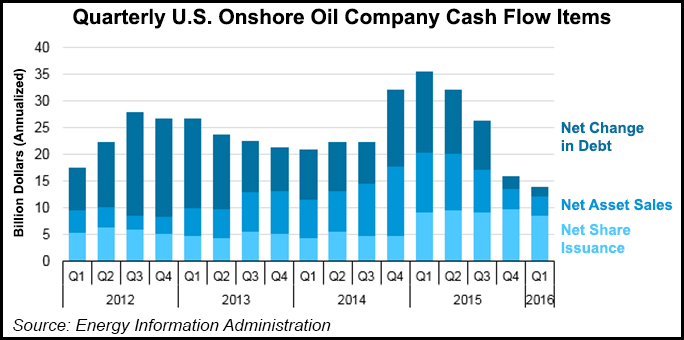

“Over the past five years, companies substantially increased investment spending to raise production,” Barron said. “In 2012 and early 2013, operating cash flow was about half of capital expenditure, making external finance necessary to pay for investment in production growth.”

Sources of cash outside operating activities typically come from selling assets, issue stock and taking on debt.

“Operating cash flow has declined over the past year, but it nonetheless has covered an increasing share of capital expenditure as companies are reducing their investment budgets more quickly,” Barron noted. “Smaller investment budgets are lowering the amount of cash U.S. onshore oil producers need to raise through outside sources.”

A decline in capex, however, may lead to slumping production. The first quarter saw the first year/year decline in crude oil and other liquids production in the past five years, driven by declines from existing fields and a lack of new drilling.

“Falling production would likely reduce revenue and cash flow absent an increase in crude oil prices,” Barron said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |