NGI Data | Markets | NGI All News Access

NatGas Cash Weakens, Futures Ease Following Storage Report

Most traders elected to get deals done prior to the release of government storage figures Thursday, and next-day natural gas drifted lower.

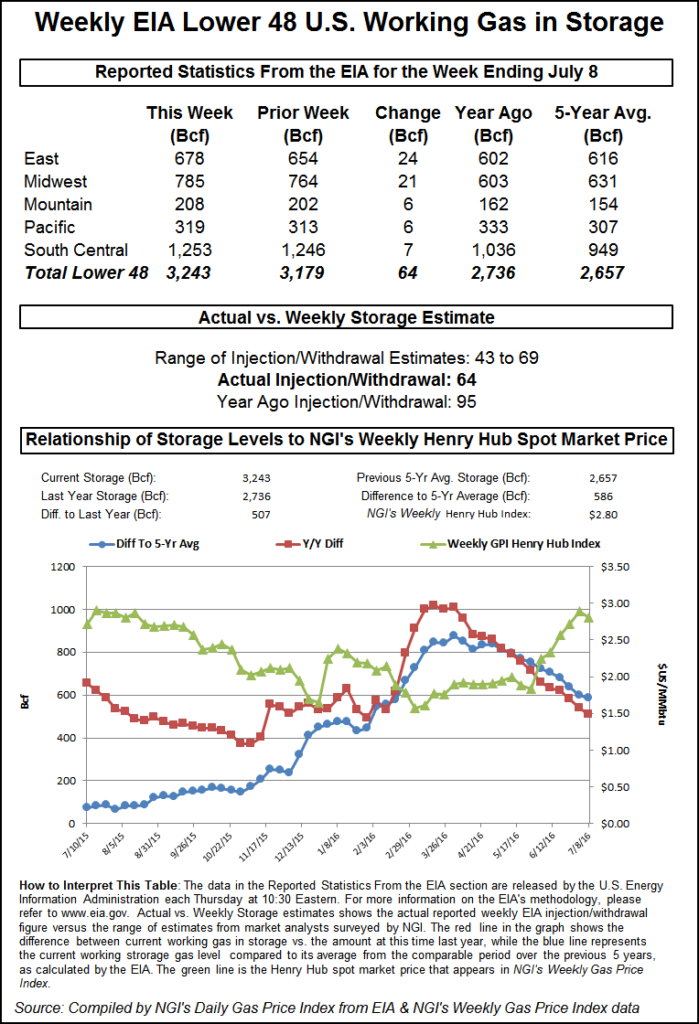

A strong Northeast was no match for broad declines in the Midcontinent, Midwest, Louisiana and Texas. The NGI National Spot Gas Average fell 2 cents to $2.57. The Energy Information Administration (EIA) reported a storage build of 64 Bcf, about 5 Bcf above expectations, and the market counterintuitively rose after the number was released.

In derivatives market trading, however, the higher build was already in the market. At the close, August had fallen 1.0 cents to $2.727 and September was unchanged at $2.707. August crude oil rose 93 cents to $45.68/bbl.

Market points in and around New York City continued to see the strongest pricing as extensive heat was forecast into the weekend. Forecaster Wunderground.com predicted that the high in New York City of 94 degrees Thursday would hold Friday and ease to 87 by Saturday. The normal high in New York City is 84. Philadelphia’s Thursday high of 93 was anticipated to reach 95 Friday before settling down to 91 on Saturday.

Gas bound for New York City on Transco Zone 6 gained a stout 29 cents to $2.58.

In the Mid-Atlantic, however, next-day gas sagged as an unsupportive power price environment proved of little help to make incremental gas purchases. Intercontinental Exchange reported on-peak Friday power at the PJM west terminal skidded $6.44 to $41.85/MWh. Next-day power at the ISO New England’s Massachusetts Hub, however, rose $1.28 to $46.34/MWh.

Gas on Texas Eastern M-3, Delivery fell 4 cents to $1.48, and gas delivered to Dominion South was quoted 2 cents lower at $1.38.

A decline in peak load and soft power pricing helped keep California next-day gas prices in check. CAISO forecast that Thursday’s peak load of 40,171 MW would slide to 39,870 MW Friday.

Deliveries to Malin were quoted a penny lower at $2.69, and gas at the PG&E Citygate was unchanged at $2.99. Deliveries to the SoCal Citygate shed 9 cents to $2.77, and gas priced at the SoCal Border Avg. Average was flat at $2.74.

Intercontinental Exchange reported on-peak power Friday at SP-15 fell $5.29 to $33.96/MWh and peak power at COB skidded $4.48 to $25.69/MWh.

Immediately after EIA reported a storage injection that was greater than what had been estimated, August futures curiously traded to a high of $2.769, and by 10:45 a.m. August was trading at $2.745, up 8-tenths of a cent from Wednesday’s settlement. EIA reported a 64 Bcf storage injection in its 10:30 a.m. EDT release, about 5 Bcf more than what traders and analysts were calculating.

“Even though we were looking for a 59 Bcf build, it didn’t have all that much impact. It should have come off but it held,” said a New York floor trader.

“There is an EIA swap market traded on the ICE [Intercontinental Exchange] and before the number came out it was 65 bid at 67 so based on that market it was probably already factored into the market.”

“The 64 Bcf build was somewhat above the consensus expectation, most likely because the July 4th holiday had a somewhat larger impact on demand than anticipated,” said Tim Evans of Citi Futures Perspective. “The build was still less than the 95 Bcf jump a year ago and the 77 Bcf five-year average, and so still constructive in supporting prices over the intermediate term.”

Inventories now stand at 3,243 Bcf and are 507 Bcf greater than last year and 586 Bcf more than the five-year average. In the East Region 24 Bcf was injected, and the Midwest Region saw inventories increase by 21 Bcf also. Stocks in the Mountain Region rose 6 Bcf, and the Pacific Region was higher by 6 Bcf. The South Central Region rose by 7 Bcf.t

According to EIA figures, working gas inventories at the end of October 2015 tallied 3,953 Bcf. Currently, supplies stand at 3,243 Bcf. With 17 weeks left in the traditional injection season, only about 43 Bcf would have to be injected weekly to reach last year’s record fill. This week’s estimated increase was expected to put storage well on the way to reaching that goal.

Last year 95 Bcf was injected, and the five-year average stands at 77 Bcf. For the week ended July 8, estimates are swirling around a 60 Bcf increase. IAF Advisors calculated a 67 Bcf increase, but the folks at Citi Futures Perspective were on the low end of the range with a 46 Bcf estimate. A Reuters poll of 20 traders and analysts showed an average 59 Bcf with a range of plus 43 to 66 Bcf.

A top consulting firm nearly nailed the actual figure as it was looking at a 66 Bcf increase as generation loads declined. “A plus 66 would appear tight by 2.7 Bcf/d, including an estimated 17 Bcf holiday impact in this week’s stat (the average of the last five years for July 4),” said Genscape in a Thursday morning report. “We saw a big week/week decline in gas-fired power generation (down 2.4 Bcf/d or 12.1 average gigawatt hours (AGWH) due to a 13.4 AGWH overall decline in generation (4th of July holiday impact) and a 6.1AGWH increase in nuclear/renewable generation, while coal also fell by 7.6 AGWH.”

Going forward, however, increased nuclear outages and increasing power loads are expected to increase demand. “Over the past couple of weeks, the nuclear fleet has seen some volatility in the units that are offline as we get deeper into summer,” said EnergyGPS in a Thursday morning note to clients. “As a result, the year-on-year delta is showing 2.5 GWs more offline for today compared to a year ago. The month-to-date average is showing just under 3 GWs more offline. From a gas perspective, that equates to roughly 0.5 Bcf/d.

“This, along with above-normal temperatures seen across the country (except California and Pacific Northwest), plays into how strong the power burns are now that we are almost halfway through the month of July. [T]he power burns have increased by 2.6 Bcf/d from Monday to Wednesday.

“[T]he biggest increase in the two day period shows up in the East and the Pacific regions. The Midwest and South Central regions are shifting up as well. Reinforcing the tick up in power burns is the fact that the net load has jumped from 363 GWa to 390 GWa for Wednesday and is expected to shift up another 7 GWa for Thursday.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |