Shale Daily | E&P | NGI All News Access | Permian Basin

‘Traditional,’ Smaller E&P Deals Dominating in North America

Few mega-deals have hit the oil and gas sector for awhile, but North American oil and gas transactions have accelerated, particularly in the Permian Basin and in Oklahoma, as commodity prices strengthen, the bid/ask spread tightens and capital markets access improves, Fitch Ratings said Thursday.

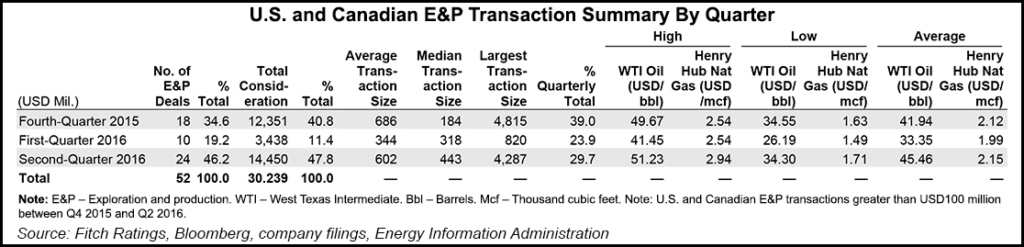

A review of exploration and production (E&P) transactions worth more than $100 million, tallied between 4Q2015 and 2Q2016, found 52 pending and completed transactions worth more than $30 billion.

The “traditional” E&P deals dominated the pack for acquisitions, representing 69% of total transactions and 76% of total consideration. When oil prices were higher, it was the private equity players that were grabbing acreage. Corporates mostly now are focused on improving the size and quality of existing U.S. unconventional/shale positions, acquiring new acreage and/or raising liquidity, the credit ratings agency said.

Devon Energy Corp. was among the “most active companies” both on the acquisition and sales side, with $2.5 billion of purchases and a series of asset sales totaling more than $2 billion (see related story). “By contrast, financially backed acquirers seemed to have a more opportunistic focus, with transactions observed across a variety of basins/regions,” Fitch said.

E&P transactions mostly have been smaller, onshore deals, with median total consideration of slightly more than $350 million. The Permian represented about 25% of deal volume, with median transactions of roughly $300 million.

The Permian leasehold mix, a combination of many leaseholders and few large, contiguous positions, offered more opportunities for deal-making, especially by companies with strong capital market access, according to analysts.

Overall, the 15 largest E&P transactions during the quarter represented roughly two-thirds of total consideration. Suncor Energy Inc.’s purchase of Canadian Oil Sands Ltd. for around $4.8 billion, was the largest for the period.

In the Lower 48, the largest transaction was the $4.4 billion acquisition by Range Resources Corp. for Haynesville Shale specialist Memorial Resource Development Corp. (see Shale Daily, May 16). Devon scored the second largest U.S. deal with its $2.7 billion deal with Felix Energy LLC, and it had another one of the other largest deals with its $600 million purchase to buy Powder River Basin assets (see Shale Daily, Dec. 7, 2015).

The median E&P transaction prices for the period were estimated at $12,000/acre, $62,000/flowing bbl and drilling location of $814,000. Permian and Anadarko basin assets tended to receive valuations above the median price. For example, the median price/drilling location in the Permian was estimated at around $1.5 million, while locations in the Anadarko’s stacked reservoirs averaged $1.4 million.

Offshore transactions have failed to attract much interest, with only two announced over the period that met the threshold. In the biggest deal, Marathon Oil Corp. agreed to sell most of its Gulf of Mexico assets for $205 million (see Daily GPI, Nov. 9, 2015). In the second, Memorial Production Partners LP received about $101 million for acreage offshore Southern California.

“Fitch believes the longer cycle and higher capital-intensive nature of offshore assets makes them less attractive at current hydrocarbon prices. The higher operational flexibility, shorter cash-conversion cycle and improving cost profile of U.S. shale assets, in particular, appear more attractive to a wider range of E&P asset acquirers.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |