NGI Data | Markets | NGI All News Access

Futures Inch Higher Following Seemingly Bearish NatGas Storage Figures

Natural gas futures advanced Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was somewhat greater than what had been estimated.

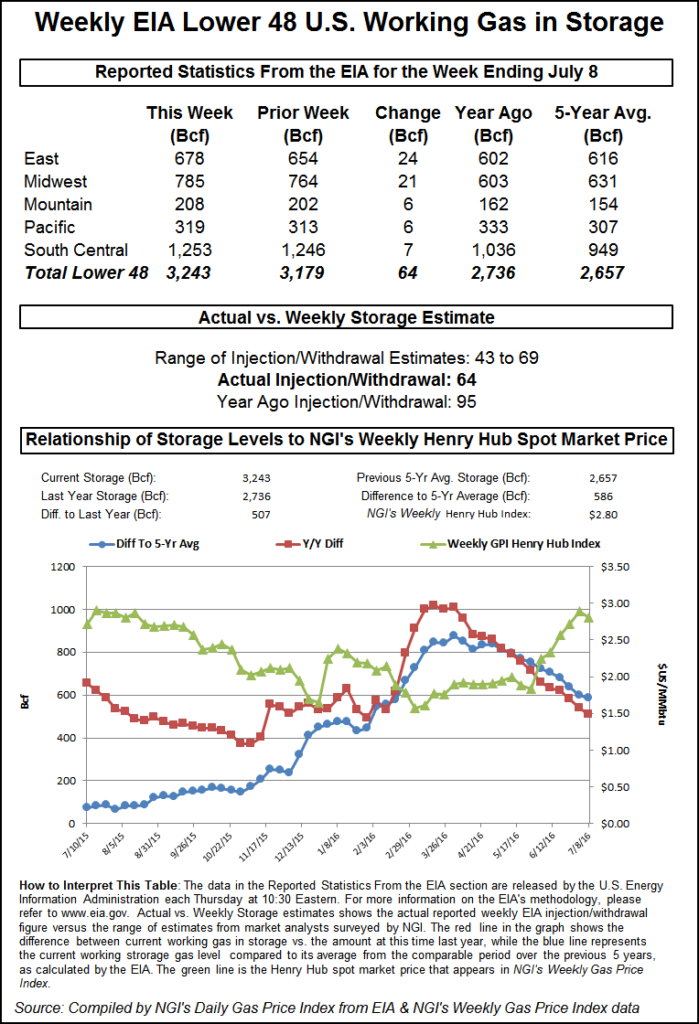

EIA reported a 64 Bcf storage injection in its 10:30 a.m. EDT release, about 5 Bcf more than what traders analysts were calculating. August futures reached a high of $2.769 immediately after the figures were released, and by 10:45 a.m. August was trading at $2.745, up eight-tenths of a cent from Wednesday’s settlement.

“Even though we were looking for a 59 Bcf build, it didn’t have all that much impact. It should have come off, but it held,” said a New York floor trader.

“There is an EIA swap market traded on the ICE (Intercontinental Exchange) and before the number came out it was 65 bid at 67, so based on that market it was probably already factored into the market.”

“The 64 Bcf build was somewhat above the consensus expectation, most likely because the July 4 holiday had a somewhat larger impact on demand than anticipated,” said Tim Evans of Citi Futures Perspective. “The build was still less than the 95 Bcf jump a year ago and the 77 Bcf five-year average, and so still constructive in supporting prices over the intermediate term.”

Inventories now stand at 3,243 Bcf and are 507 Bcf greater than last year and 586 Bcf more than the five-year average. In the East Region 24 Bcf was injected and the Midwest Region saw inventories increase by 21 Bcf also. Stocks in the Mountain Region rose 6 Bcf, and the Pacific Region was higher by 6 Bcf. The South Central Region rose by 7 Bcf.

Salt cavern storage was up 1 Bcf at 355 Bcf, while the non-salt cavern figure was higher by 6 Bcf at 898 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |