Marcellus | E&P | NGI All News Access | Utica Shale

Private Appalachian Producers Highlight Different Approaches During Downturn

Privately owned EdgeMarc Energy Holdings LLC is coping with the commodities downturn no differently than its larger, publicly traded peers operating in Appalachia, aiming to keep its leverage low and leaning on its dry natural gas assets in Ohio’s Utica Shale to keep moving forward.

“Most of our capital has been focused on Butler County, PA,” COO Callum Streeter said. “It was the first asset that we received, so that’s where we started focusing. But as commodity prices have shifted away from natural gas liquids (NGL) and oil, we’ve kind of shifted our capital focus into the dry gas phase of the Utica.”

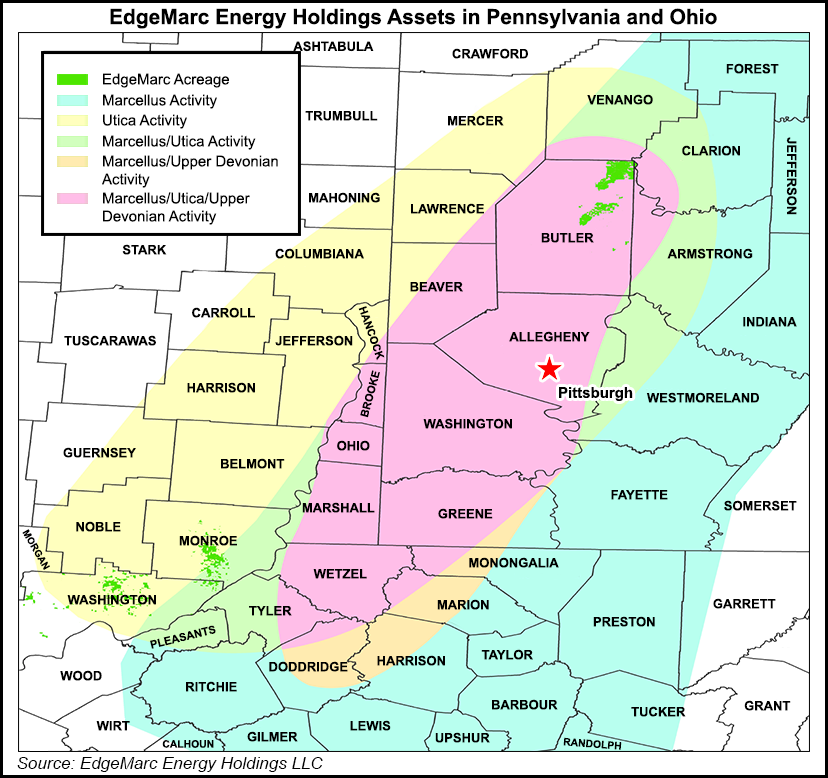

EdgeMarc holds 50,000 net acres across Ohio and Pennsylvania. About 25,443 acresof that is located in Butler County, while the rest is in Ohio’s Monroe and Washington counties.

The Canonsburg, PA-based company is not drilling any wells today. It was focused on maintenance and completions in Butler County earlier this year.

Most of the Appalachian Basin’s leading producers have retreated almost exclusively to their dry natural gas acreage, where low breakeven prices and prolific wells have outperformed wetter assets during the price collapse (see Shale Daily, April 7). Streeter saidEdgeMarc’s dry gas assets in Monroe County are more attractive for the time being. “That’s where the focus of our capital will be for the remainder of this year and into next,” rather than in the wetter areas in Butler and Washington counties, he said.

The rig count has continued to decline in Pennsylvania and Ohio. In Ohio, it stood at 12 at the end of last week, down from 18 at the same time a year ago. The decline was even steeper in Pennsylvania over the same period, going to 13 from 47, according to Baker Hughes Inc. data.

Apex Energy LLC CEO Mark Rothenberg said his company has taken a different approach. The company’s assets are in Westmoreland County, PA, where it’s focused on proving-up its acreage. Rothenberg joined Streeter for a private operators panel last month at Hart Energy’s DUG East Conference & Exhibition in Pittsburgh.

“We spent the last 12, 18 months during this market downturn drilling some wells, proving up the well performance and then building up the permit inventory, and we were able to do that because we are wholly focused on just that initial project build phase of development,” Rothenberg said. “We had no distractions of trying to do development programs somewhere else.”

Rothenberg said he anticipates a natural gas supply shortage after a prolonged rig decline. He added that he expects Marcellus and Utica shale production to be flat this year compared to last.

Given fewer new wells, a dwindling inventory of drilled but uncompleted wells and increasing demand from the power sector, liquefied natural gas and other exports, Rothenberg joined his peers at the conference in predicting firming natural gas prices beginning next year (see Shale Daily, June 23).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |