NatGas Forwards Prices Maintain Strength on Heat, Storage

Natural gas forwards markets showed no signs of hitting the brakes June 24-30 as scorching temperatures continued to drive power burn and storage data once again reflected a tighter supply-demand balance.

The Nymex August gas futures contract jumped 22.4 cents between June 24 and 30 as heat that has been dominating the western and central U.S. is expected to further its reach into the eastern part of the country next week.

By mid-day Friday, August was up another 5 cents despite the upcoming holiday weekend and returning production.

Not to be outdone, the Nymex July contract shot up some 20.1 cents on June 28, rolling off the board at $2.917/MMBtu.

Other natural gas forwards markets posted similarly solid gains across the front of the curve.

August prices averaged about 20 cents higher between June 24 and 30, while September prices averaged 19 cents higher, according to NGI’s Forward Look.

The balance of summer (September-October) rose an average 18 cents, while the winter 2016-2017 strip climbed an average 14 cents.

Packages further out the curve posted more moderate single-digit gains, Forward Look data shows.

The hefty increases in the near-term months indeed have been partly fueled by above-normal temperatures that have driven power burn significantly over historical levels, according to Genscape’s Eric Fell, senior natural gas analyst.

Genscape, based in Louisville, KY, is real-time data and intelligence provider for energy and commodity markets.

“Degree days in June should end around 30 CDDs hotter than normal, and the current forecast for the first half of July looks to be around 25 CDDs hotter than normal,” Fell said.

Meanwhile, weather-adjusted power demand hasn’t declined as much as one may have expected after a 70-cent rally in prices, he said.

“Many gas market participants may be perplexed by this, but only because they aren’t paying close attention to the rest of the power stack,” Fell said.

While gas is in fact ceding market share back to coal, nuclear and hydro have gone from being much above normal in April and May to being below normal in June, which is increasing the call on thermal generation (both gas and coal) and partially offsetting the reduction in gas burn versus coal, Fell said.

Nuclear generation, in particular, has been a big driver, having gone from around 5 average gigawatt hours above normal in May to 2.5 AGWH below the five-year average in the last week, a swing of 7.5 AGWH versus normal over the last month, Fell said.

Much of the lost generation is concentrated in the U.S. Northeast and Southeast.

“Our power demand forecast incorporates all of the elements of the stack and while we did not expect nuclear generation to be as strong as it was in Q2, we have been predicting that nuclear would come back to normal, and we have been adjusting our western hydro outlook to below normal for the balance of the summer as hydro conditions have been getting drier in the West,” Fell said.

Meanwhile, the latest weather models offered varying outlooks for the middle of July, with American models pointing to bullish risks for the medium term and international models pointing to more bearish trends, according to Bespoke Weather Services.

“These differences are not uncommon, and the higher verification scores of European and Canadian model guidance have us favoring slightly less bullish forecasts than we did the previous day, especially for the middle of July, as we are similarly seeing evidence in another slowdown in La Nina development,” said Bespoke’s Jacob Meisel, co-founder and chief meteorologist.

Regardless, the forecast is a hot one for the near term and given the uncertain returns of the nuclear units that are currently offline, demand for gas will surely be on the rise in key population-dense regions of the country.

Genscape projects Appalachian demand to hit 9.74 Bcf on July 5, up from 9.29 Bcf on July 1, and then peaking for the week at 11.09 Bcf on July 7.

Southeast and Mid-Atlantic demand is expected to hit 16.51 Bcf July 5, up from 15.07 Bcf on July 1, and then peak at 17.76 Bcf on July 7.

Meanwhile, last week’s storage report provided additional headwind for natural gas as the reported injection came in below market expectations and reflected an increasingly tighter supply-demand picture.

The U.S. Energy Information Administration on Thursday reported a 42 Bcf injection into storage for the week ending June 24, below market expectations in the mid-40 Bcf range.

Although only a slight miss, the injection was far below last year’s 73 Bcf injection for the same week and the 78 Bcf five-year average.

“We are 13 weeks into the season and aggregate refills have been 40% below last year,” said analysts at investment bank Jefferies.

The year-over-year storage surplus is now around 560 Bcf — versus 1 Tcf at the start of April — and is likely to narrow further, Jefferies said.

The bank said the next two storage reports combined look likely to come in well below 100 Bcf versus 185 Bcf for the same period last year amid strong weather-induced power demand and supply on its lows.

Genscape, which updates their models weekly using market prices and assumes normal weather, projects storage closing out October at 4 Tcf at prices as of June 24, which are about 20 cents lower than today.

Current prices would push inventories closer to 4.1 Tcf, which is about 95% full versus demonstrated capacity and where significant storage injection issues could occur, Fell said.

“While we believe that the recent rally has been justified by the fundamental backdrop, the rally in the front of the curve (summer prices) has little room to the upside from here unless it stays hot or supply comes in below our current forecast,” Fell said.

And while production indeed has been on a downward trajectory over the last few months, and is projected to end the year below year-ago levels, volumes in the Northeast are starting to return after heavy rains wiped out a pipeline near the MarkWest Sherwood plant in West Virginia on June 24 (see Shale Daily, June 28).

Nominations have resumed at the TCO Sherwood 1 and Braxton production points, restoring nearly 0.5 Bcf/d of production, according to Genscape.

Evening cycle nominations from Sherwood 1 to TCO came in at 120 MMcf/d.

In the 30 days prior to the disruption, flows had averaged 273 MMcf/d.

The last time there was a complete outage at Sherwood (July 7, 2015) it only took volumes two days to recover to pre-outage levels, Genscape said.

TCO Braxton receipts are also recovering, with evening nominations back up to 1,064 MMcf/d after having averaged 710 MMcf/d during the outage, the company said.

The outage inhibited nearly 400 MMcf/d of production on the Stonewall Gathering system from reaching TCO at Braxton.

Thirty-day volumes prior to the outage averaged 1,101 MMcf/d, Genscape said.

There was still no update at about noon Tuesday on when the Pascagoula GasProcessing Plant would come back into service following an explosion at the Mississippi straddle plant on June 27. Destin, the primary pipeline from the Gulf of Mexico, in a customer notice late Monday said it was using an alternate offshore gas delivery option via the Viosca Knoll Gathering System (VKGS), while total gas flows from Main Pass 260 were limited by operational capacity to 305 MMcf/d from 350 MMcf/d.

“Flows have begun to stabilize and there has been some positive progress made toward reducing imbalances,” the pipeline said. “Once the system has been brought back into balance, it may be possible for Destin to return the operational capacity back to 350 MMcf/d.”

Fluctuations in pressure were the result of “downstream balance issues at various processing plants.” Once those issues are resolved, metered capacity should be able to return to 350 MMcf/d. Nominations across the system as of Tuesday morning were running at around 317 MMcf/d, according to Genscape. Destin also said it had doubled the allowable volumes of condensate build-up in the mainline to 16,000 bbl from 8,000.

“Assuming their revised estimations for condensate build-up are correct, Destin could potentially see 11 days of total production,” Genscape analysts said. “This would mean production would continue throughout the week” as Saturday (July 9) would be day 11. “Presently, though, we do not have a precise method of estimating how much condensate is building in the pipeline because Destin handles condensates at the Pascagoula slug catcher, not the gas plant.”

Destin said its onshore operations were not affected.

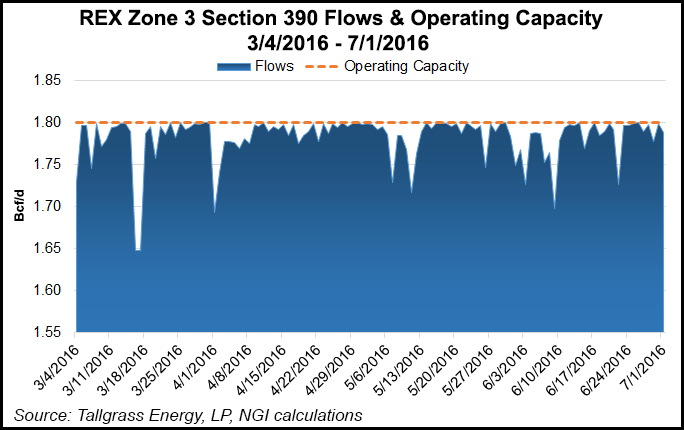

Further complicating matters, however, is planned maintenance in July that could shut in production in areas like eastern Ohio, where Rockies Express will be staging a compressor station tie-in as part of ongoing work related to the Zone 3 Capacity Enhancement Project.

The work could leave production in Zone 3 with no outlet for the duration of the outage, which is set for July 19-25.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |