Rig Return Partial to Oil as NatGas Plays Wait in Wings

Eleven rigs returned to U.S. land-based action for the week ending July 1 as the drilling comeback, of sorts, continued.

The week saw 11 oil-directed rigs return and one natural gas rig leave. That was a flip from the previous week when the oil rig census dropped by seven units and natural gas gained four rigs (see Shale Daily, June 24).

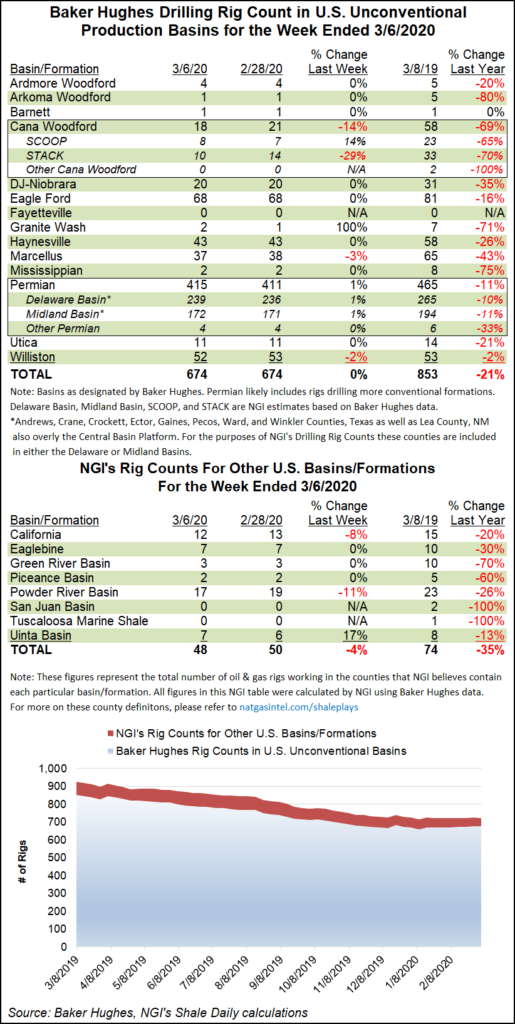

In the latest Baker Hughes Inc. count, one rig returned to the inland U.S. waters while two left offshore action, making for a U.S. gain of 10 rigs to 431 running. Of these, 408 units were active on land. Canada held pat at 76 rigs running, so the North American tally gained 10 to land at 507 active rigs, a bit more than half the 1,001 rigs operating in North America one year ago.

There were 341 U.S. oil rigs running and 89 rigs targeting gas. Directional rigs fell by five units, but seven horizontal rigs were added, and eight vertical units joined the force.

Oklahoma and Texas each gained four units, as did the Permian Basin, making them the leading states and play among the week’s gainers. The latest weekly shift in the rig roundup shows a clear preference for oil, but that could change as natural gas prices strengthen, analysts said.

“Natural gas began to rally in June, and we believe the key factors are shale gas finally declining; June 2016 has been hot; and natural gas prices are still very depressed and cheaper than coal (until now),” Wunderlich Securities Inc. analysts said in a Wednesday note.

Wunderlich analysts turned their attention to some producers that have natural gas optionality that could ramp up their gas production should prices improve. PDC Energy in the Utica Shale is one. Noble Energy in the Marcellus is another. And Devon Energy can refrack its Barnett Shale wells economically at $2.50/Mcf gas, the Wunderlich analysts said. Further, Newfield Exploration has been trying out new completion designs in the Arkoma Basin, and these also work at $2.50 gas.

And producers targeting the South Central Oklahoma Oil Province (SCOOP), and the Sooner Trend of the Anadarko Basin (Canadian and Kingfisher counties), called the STACK, can shift from the plays’ oil windows to those yielding more natural gas, Wunderlich said. “Cimarex Energy is likely the best positioned to take advantage of gas prices with its overpressured acreage to the south,” the firm said. “Devon is also a partner with Cimarex in the area.” Continental Resources Inc. “…has been stepping out to the west and could go more gassy if it wanted to.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2158-8023 |