Utica Shale | E&P | NGI All News Access

Quebec Prepares to Drill, Frack Its Utica Shale

After being excluded from Quebec for six years by a drilling moratorium, natural gas suppliers saw June mark a turning point toward access to French Canadian cousins of shale formations in the northeastern United States.

The signs of change included approval of the first fracking wells, a start on liquefied natural gas (LNG) deliveries to remote consumers, government participation in both ventures, and a new energy policy that dials down official eco-disdain for fossil fuels.

Junex Inc., a Quebec City-based startup petroleum firm, described the breakthroughs as foreshadowing a bright future for its pre-moratorium accumulation of 944 square kilometers (364 square miles) of shale formation exploration permits.

Work is beginning on the first of three horizontal drilling and hydraulic fracturing exploration wells planned by Anticosti Hydrocarbons LP, a consortium of Petrolia Inc., Corridor Resources Inc. and Investissement Quebec.

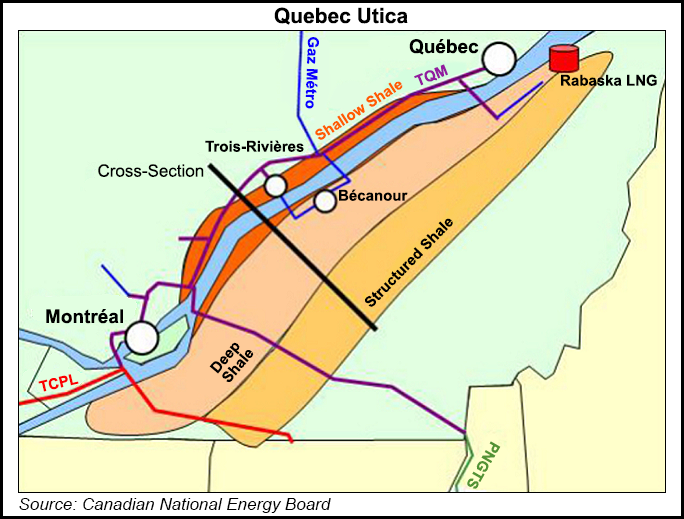

The drilling will test a formation described as a northern counterpart to the gas, liquid byproducts and tight oil geological zone known as the Utica Shale in the United States. The exploration sites will provide Quebec with a gentle introduction to fracking, far from public view and popular resistance on remote Anticosti Island in the Gulf of Saint Lawrence.

Investissement Quebec, a provincial agency set up to support industry startups with all forms of finance including part-ownership, is also a partner in tanker truck deliveries that Gaz Metro LNG began in June to locations off the gas pipeline grid.

As a subsidiary of province-wide distributor Gaz Metropolitain Inc., the LNG specialist has started up by supplying a diamond mine known as Stornoway Renard, in the Otish Mountains about 1,040 kilometres (655 miles) of northern bush away from Montreal.

Investissement Quebec is putting about C$42 million (US$32 million) into the drilling and C$50 million (US$39 million) into the LNG program. The commitments are large by Quebec standards as a “have-not” recipient of Canadian “equalization,” an income redistribution scheme that taps federal corporate and personal taxes to raise per-capita revenues to the national average of all the provinces.

Provincial Energy Minister Pierre Arcand called Gaz Metro LNG’s inaugural deliveries “a landmark project for Quebec.” He wrapped the new operation in a green cloak by adopting the international environmental movement’s view of gas as at best a stand-in until zero-emission sources entirely replace carbon-based fuels with renewable energy sources.

Arcand’s formal statement was studded with words chosen carefully for a jurisdiction that boasts being Canada’s cleanest energy consumer and exporter to the United States as a result of mammoth northern power dam-building by provincial government-owned Hydro Quebec.

“Natural gas is a profitable transition energy that will play an important role during the next few decades in supporting the economic development and competitiveness of our companies, particularly those in Northern Plan territory,” said the Quebec minister.

The Northern Plan is a long-range development program, enshrined in legislation, for the thinly populated majority of 1,542,056-square-kilometer (595,381-square-mile) Quebec, which is 2.2 times the size of 696,241-square-kilometer (268,589-square-mile) Texas.

As in the case of Hydro Quebec’s electricity generation and transmission network, public planning and participation in industrial development are hallmarks of the grand design. Investissement Quebec is also a participant in the Stornoway diamond mine, for instance.

As a companion to the Northern Plan, the new provincial energy policy unveiled this spring emphasizes central planning and hybrid enterprises, especially in priority fields such as development of renewable sources.

As a plus for the Canadian gas and oil sector, which is used to a high degree of regulation by U.S. standards, the policy includes creation of an agency resembling the Alberta Energy Regulator (AER) for coordinated engineering, economic and environmental approvals of projects. Although the intricate web of rules, inspectors and approval procedures at times annoys companies, the AER is dedicated to rendering projects publicly acceptable rather than to stopping development.

Gas ranks second only to hydroelectric development in the new Quebec energy policy. The agenda’s top priorities include: “Ensure natural gas supply at competitive prices to enhance the profitability of mines, reduce greenhouse gas emissions, attract new investments and supply liquefied natural gas in the North.”

Current Quebec industrial proposals include two LNG export terminal projects at potential tanker port sites along the St. Lawrence River. Both rely on supplies from the U.S. and western Canada but do not rule out eventually using Quebec production if it becomes available.

With exploration and field trials of fracking only beginning, knowledge of Quebec shale remains largely in the realm of geological theories about in-place resources that do not predict the eventual size of supplies within economic reach.

A preliminary estimate by the Canadian Energy Research Institute says fracking known bits of Quebec’s Utica and similar Macasty formations could yield early output of one billion cubic feet of gas and 60,000 barrels of oil per day. But the figures are rated as speculative and liable to grow or shrink depending on drilling results, commodity prices and policy developments.

The new Quebec policy pledges to create a permanent task force on industrial energy supply that includes the provincial government’s energy, economic development, science and Hydro-Quebec departments.

“Natural gas is a transition energy that is profitable for Quebec and will play a key role in the coming decades in supporting economic development and the competitiveness abroad of Quebec companies,” says the policy. “The government therefore intends to ensure that Québec households and businesses have reliable, secure, stable access to natural gas throughout the territory where demand and economic profitability warrant it.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |