Regulatory | Infrastructure | Markets | NGI All News Access | NGI The Weekly Gas Market Report

FERC Decision Looming On Access Northeast Capacity Proposal

A looming FERC decision on a proposed tariff revision for Algonquin Gas Transmission LLC’s system could reshape winter natural gas and electric pricing in New England and determine the fate of the Access Northeast expansion project.

In a plan submitted to the Federal Energy Regulatory Commission in February, Algonquin proposed allowing New England electric distribution companies (EDC) to purchase firm capacity on the system and then release that capacity to electric generators that otherwise wouldn’t commit to year-round firm transportation [RP16-618]. This would all take place as part of state-regulated electric reliability programs, according to Algonquin filings with FERC.

The proposal is tied to the 900,000 Dth/d electric generation-focused Access Northeast expansion (see Daily GPI, Nov. 4, 2015). It would require FERC to exempt Algonquin’s system from its competitive capacity release bidding requirements.

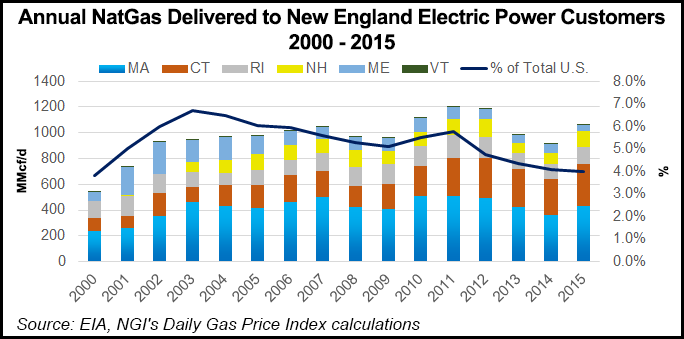

Access Northeast, still in the pre-filing stage with FERC, is under development by Algonquin parent company Spectra Energy, Eversource Energy and National Grid. It proposes new pipeline capacity and liquefied natural gas (LNG) storage on Algonquin’s system as a solution to the problems that arose in New England during the winters of 2013/2014 and 2014/2015, when peak heating and electric demand competed for limited capacity and sent prices skyrocketing.

Algonquin’s proposed tariff revision quickly drew extensive comments from industry players both in opposition and in support, leading FERC to schedule a technical conference in May to discuss the plan in light of ongoing gas-electric coordination issues and New England’s winter peaking woes.

The deadlines have passed for all comments to be submitted following the technical conference, leaving a Commission order as the next step, but there is no deadline for a final decision, a FERC spokeswoman told NGI.

While Algonquin has defended its proposal as helping to improve electric reliability by guaranteeing gas supply to electric generators during periods of peak demand, opponents have called the plan anti-competitive, saying it would privilege select shippers and suppress the true market value of the capacity.

Algonquin’s tariff revision is part of the bigger debate on how best to satisfy New England’s winter peak demand. Representatives for regional LNG competitors Engie Gas & LNG LLC and Repsol Energy North America said during the recent LDC Gas Forums Northeast conference in Boston that they didn’t think an expansion like Access Northeast would be the most cost-effective way to meet short-term peak demand (see Daily GPI, June 13).

The debate took another turn this week, when NextEra Energy Resources LLC and PSEG Cos. filed a complaint asking FERC to stop the state reliability programs referenced in the Algonquin proposal from being implemented [EL16-93].

“State regulators in Massachusetts, New Hampshire, Connecticut and Rhode Island are on the verge of implementing a scheme expressly intended to artificially suppress prices in wholesale energy markets in New England,” the complainants wrote. The various state regulatory agencies “have before them for review contracts filed by their [EDCs] to buy substantial quantities” of capacity on Algonquin’s system through the Access Northeast expansion.

“Having no use for the pipeline capacity, the EDCs would release the capacity at below market rates — first to gas-fired generators…and then whatever is left will be released to the marketplace. This transportation subsidy would artificially flood ISO-New England [ISO-NE] markets with gas, thereby unreasonably suppressing gas prices and wholesale power prices.”

Algonquin’s tariff filing has “started the conversation on whether this is a good way to address” New England’s recent peak demand price spikes, Colette Breshears, a natural gas and infrastructure analyst for Genscape, told NGI. “FERC has had technical meetings, and they still haven’t come to a conclusion on this tariff. The fact that this conversation is happening, this is a potential solution. It’s not the only solution…but it’s at least a step closer to finding something that will work and will help prevent those high prices in the future.”

Indicated Shippers Claim Plan to Suppress Prices

In arguments filed following the May technical conference, the indicated shippers maintained that Algonquin’s tariff revision is anti-competitive and would “create [an] unwarranted, preferred carve-out for electric generators that results in discrimination in price and possibly quality of service as to other market participants.” The shippers said it’s problematic that regulated EDCs, and not the electric generators themselves, are the ones entering the contracts needed for Access Northeast to move forward.

“Proponents universally agree that the reason electric generators will not commit to long-term pipeline capacity is because under regional electric market rules, they are unable to recover those costs. However, trying to correct distortions and inefficiencies in one market by creating market distortions and inefficiencies in another market is not the solution…Such an approach will only serve to damage a properly functioning natural gas and capacity market,” the indicated shippers wrote.

“The Commission implemented” capacity release bidding requirements “so that the value of the prearranged release was correctly priced. Algonquin and the other proponents of the scheme offer no persuasive reason why the current capacity release rules would not work in the context of releases to electric generators. Under a prearranged release, an electric generator would be able to obtain the capacity released from an EDC as long as it was willing to pay market price.”

Opponents also rejected Algonquin’s contention that its proposal to bypass capacity release bidding would function similarly to a retail choice program for local distribution companies (LDCs) as permitted under FERC Order No. 712.

“The Commission’s current rules under Order No. 712 do not reference electric markets at all. Algonquin proposes that EDCs should be able to go out into the market to obtain capacity that it can effectively reserve for and release to electric generators, who otherwise have no incentive to do so on their own,” they wrote. Unlike a retail choice program for LDCs, “there is no retail consumer choice that would increase competition in the retail market or any other market and there is no stranded capacity due to decreased retail customer demand.”

Algonquin Said Plan Helps Consumers

Replying to critics of its proposal following the technical conference, Algonquin said its plan is designed to help consumers who are currently bearing the cost of limited available capacity into the region.

“Although a generator may be the replacement shipper” protected from open bidding on released capacity, “Algonquin and the EDCs have made it abundantly clear that the goal of the proposed targeted releases is to support the development of pipeline infrastructure to address electric reliability and price volatility that is currently borne by electric customers,” Algonquin wrote. “Accordingly, it is consumers, not generators, who are the intended beneficiaries of the savings that are estimated to be in the amount of approximately $1 billion annually.”

The proposal to allow EDCs to release capacity to generators without open bidding is meant to ensure that ratepayers, bearing the costs of acquiring firm transportation on Access Northeast, realize the intended benefits, Algonquin wrote.

Algonquin said marketers and LNG suppliers opposed to its plan stand to benefit from the New England market’s “price differentials and are aligned on maintaining the status quo of pipeline constraints. Natural gas marketers and LNG companies benefit from higher and more volatile prices, which make their supply more valuable.” And depending on the circumstances, “higher market prices generally create opportunity for generators to earn higher revenues.”

Claims that the market is working and sending the appropriate price signals “are all squarely contradicted by the uncontroverted evidence of higher New England natural gas and electricity prices due to pipeline constraints,” Algonquin wrote. “…the current pipeline capacity market is constrained and the EDCs should be allowed to respond to high New England prices that demonstrate that electric consumers would benefit from removal of pipeline constraints, i.e., price signals.

“Further, claims that there is no reliability problem because the lights have not gone out are inconsistent with the efforts of the Commission to plan for electric reliability (instead of reacting to outages), disregard specific concerns repeatedly articulated by ISO-NE, and minimize the efforts of Algonquin, and other pipelines.”

Future of Access Northeast in Balance

Without state regulatory approval, and without FERC’s approval of its proposed tariff revision, Access Northeast would be unable to move forward, according to Genscape’s Breshears. “If they can figure out how these shippers can take this gas from the project and redistribute it, if they can get the tariff stuff figured out, the project is very viable,” she said.

Both sides in the proceeding have disagreed on whether a capacity release bidding exemption for Algonquin would set a precedent for future gas-electric coordination efforts. The specific circumstances surrounding New England’s peaking problems make it a unique case that may not translate to other regions, according to Patrick Rau, NGI’s director of strategy & research.

“No doubt other areas will look at this case for guidance, but not sure if it would establish any kind of hard-core precedent for other regions of the country,” Rau said. “New England is a very different place, especially with regards to new facilities. Most everyone lives near a pipeline right of way in New England. Not necessarily so in other sprawled out places. Natural gas prices are definitely the most volatile in New England, and the FERC knows that. I think in certain ways, the FERC has to treat things a bit differently in New England.”

Algonquin’s proposed tariff revision and the resistance it has encountered represents yet one more regulatory hurdle for major Marcellus/Utica shale takeaway projects like Access Northeast, according to Matt Hoza, an analyst with BTU Analytics.

“This…really represents a new obstacle that pipeline operators must overcome to bring their projects to market and additional heartburn for any Marcellus and Utica producers who are desperate for takeaway capacity and basis relief,” Hoza said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |