Unfazed By Brexit Weekly Natgas Marches Higher; Longer Term Impact Uncertain

Weekly natural gas prices for the week ending June 24 scored another round of broad gains led by advances in the Rockies and California. The NGI Weekly Spot Gas Average added a stout 23 cents to $2.55 as a broad ridge of high pressure in the Southwest prompted well above normal temperature readings with the high in Los Angeles at one point topping 100.

The market point showing the greatest advance was Northwest Sumas adding 61 cents to $2.41 and Westcoast Station No. 2 ended up with the week’s only loss of 0.10 Cdn$/Gj to $1.59.

Regionally California captured top honors advancing 34 cents on the week to average $2.81, but the smallest 15-cent gains made by South Texas, East Texas, and South Louisiana were still respectable at $2.64, $2.65, and $2.66, respectively.

The Midwest advanced 17 cents to $2.65 and the Midcontinent added 22 cents to $2.58.

The Northeast improved by 27 cents to $2.19 and the Rocky Mountains gained 30 cents to average $2.53.

July futures rose 3.9 cents on the week to $2.662.

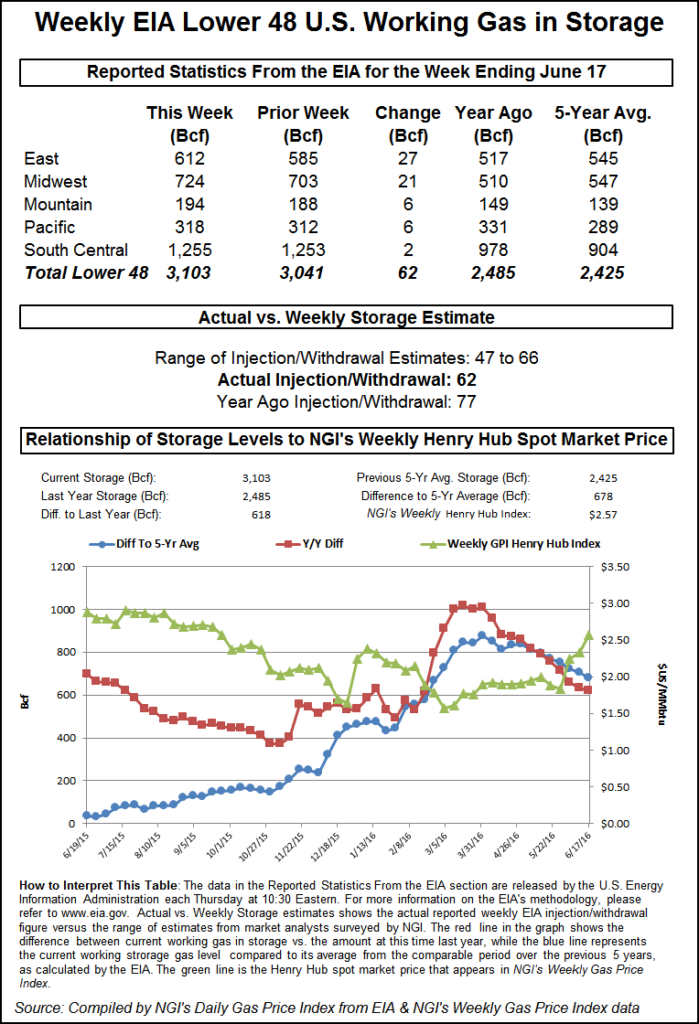

Thursday’s trading saw the Energy Information Administration (EIA) report a somewhat larger than expected storage build of 62 Bcf for the week ending June 17, about 4 Bcf above expectations, and prices eased initially only to recover by the end of trading. At the close July had added 2.1 cents to $2.698 and August had gained 2.6 cents to $2.737.

Going into the EIA storage report it was unclear whether traders might be in for a surprise adjustment. According to industry consultant Genscape, Monday saw SoCalGas report an adjustment to its storage inventory that could affect this week’s EIA storage number.

“SoCal announced on May 26 they would be adjusting system inventory down by 4.62 Bcf due to adjustments applicable to Aliso Canyon storage. However, the change was not actually reported on the SoCal website until this Monday,” Genscape said.

“At this point it is unclear when SoCal will report this change to the EIA and when it will appear in EIA’s weekly storage report. Significant adjustments are required to be reported to EIA, and adjustments greater or equal to 4 Bcf are noted in the weekly report. However, the timing of when the adjustment makes it into the report depends on when SoCal reports it to EIA. Last fall, ANR posted a surprise 9 Bcf inventory change midweek, which was reported in that week’s report released the following Thursday.”

“They are not obligated to tell EIA the moment they know anything,” Energy Metro Desk publisher John Sodergreen told NGI.

“If they told them 3 days after the fact, that is very possible, but the rules are very vague as to what people have to do or necessarily not have to do. Particularly if they are intrastate. If they don’t go outside the state [which SoCal Gas doesn’t] what they post is voluntary.

“The adjustment didn’t show up this week, but it might show up next week, or the week after. That just gives you a little sense of angst. There may be internal reporting issues. Did they reduce it all at once or factor it in over a period of days?”

With or without the 4.62 Bcf adjustment, additions to inventory once again failed to reach longer-term averages. Last year 71 Bcf was injected and the five-year pace stands at a stout 88 Bcf. IAF Advisors calculated an inventory gain of 60 Bcf while United ICAP was looking for a build of 64 Bcf. Citi Futures Perspective expected an increase of 56 Bcf and the Energy Metro Desk survey resulted in a 60 Bcf estimate.

Inventories now stand at 3,103 Bcf and are 618 Bcf greater than last year and 678 Bcf more than the five-year average. In the East Region 27 Bcf were injected and the Midwest Region saw inventories increase by 21 Bcf . Stocks in the Mountain Region rose 6 Bcf, and the Pacific Region was higher by 6 Bcf. The South Central Region added 2 Bcf.

In Friday’s trading natural gas for weekend and Monday delivery inched lower as steady prices in the Gulf, Rockies and Midcontinent were unable to offset weakness in the East, Midcontinent and Midwest. The NGI National Spot Gas average was down 2 cents to $2.48.

Natural gas markets for all intents and purposes were immune, at least in the short term, from the market turmoil surrounding Britain’s vote to exit the European Union.

July natural gas fell 3.6 cents to $2.662 and August skidded 4.3 cents to $2.694. August crude oil tumbled $2.47 to $47.64/bbl, as a rising dollar instigated by “Brexit” crushed crude oil and refined products prices.

Longer term impacts of Brexit relative to the natural gas market are unclear, but short term crude oil and products are expected to bear most of the market blows as a rising dollar is a big negative for commodities priced in dollars. Tim Evans of Citi Futures Perspective anticipates “price battles” ahead, and thinks “Brent will have difficulty regaining the $50 level now.” U.S. natural gas, however, “will trade in its own world, with little if any connection with the Brexit drama,” he added.

Future prices of U.S. liquefied natural gas will likely be more costly and less competitive. The Dollar Index surged 2.28% to 95.66.

Analysts are focused on the Brexit referendum and its negative implications “on three levels: the U.S. dollar (USD), interest rates, and global trade and mobility,” said BofA Merrill Lynch Global Research analysts led by Francisco Blanch. A $39/bbl target for West Texas Intermediate (WTI) by the end of 3Q2016 was reiterated, with “downside risks” to the firm’s longer term forecast for $61 Brent.

The BofA economics team also has shaved its outlook for U.S. gross domestic product growth by 0.2% on the back of the vote, and “we also see weaker growth in other countries, namely the UK,” Blanch said. A stronger USD “will likely be a drag on all commodities.”

Others see the Brexit vote as less centered on financial and economic factors and more focused on politics and culture. “It should be glaring[ly] obvious to everyone by now that the Brexit vote to leave was a decision that was motivated by neither financial nor economic considerations,” said United ICAP’s Walter Zimmermann in a note to clients. “However it is a big mistake to chalk it up to low brow and uninformed populism.”

Zimmermann scored the Brexit vote at EU “Zero, Cultural Integrity 1 and with it a deep look at the collective mood of a nation.” He contended that “in this age of aggressive and sustained manipulation of the global financial markets by central banks, the ability of price trends in the equity markets to reflect the collective mood of nations was seriously compromised. [T]he clear goal of central bank manipulation of the financial markets was an attempt to place the mask of a bull over the reality of a bear.

“Prior to QE [Quantitative Easing], stock markets were always driven higher by an upsurge in collective hopes. The unstated but very real mechanics of QE [were] to harness a global upsurge in fear into buying the stock markets. The fear of lower to zero to negative interest rates would drive investors into buying equities. The greater the fear, the higher the equity prices. What a brilliantly devious enterprise! An actual upsurge in global fear would raise equity prices, not collapse them. Well, that hitherto successful attempt at market manipulation stopped working last night. The big problem that I see from here is that the media coverage of the Brexit aftermath has been 100% focused on the financial consequences. This is a serious distraction from what is actually going on here.

“The Brexit vote to ‘leave’ was neither an economic nor a financial decision. And as long as EU policymakers focus on the financials and the economics, they will have learned nothing. And if the EU policy makers cannot quickly figure out what is going on here, then the EU is truly doomed.”

Top natural gas traders are sitting tight as the market consolidates. “From a technical perspective, we will await a close to below the $2.65 mark before expecting any significant downside price follow through,” said Jim Ritterbusch of Ritterbusch and Associates in closing comments to clients. “This week’s stall in the strong spring price advance has resulted largely from a significant shift in the short term temperature views that have been mainly featured by a significant cool down next week across a broad portion of the U.S. Midcontinent.”

“But, while this could force a storage increase toward normal levels next month, the market may still need to deal with another downsized injection next Thursday that could easily fall some 10 Bcf below [last Thursday’s] reported upswing. All in all, we remain in a neutral camp for now as we still see a possible renewed advance toward the $2.80 mark should weekend updates to the short term temperature views suggest a renewed hot spell across the Midwest.”

Gas buyers across the broad MISO footprint tasked with procuring gas for weekend power generation were faced with high power demand, but they have wind generation available as well.

“A heat alert is in effect, [and] a return southerly flow ahead of a frontal system along the Canadian border will promote a general warming trend during the next couple of days with widespread max temps in the 80s, 90s to near 100 in a few spots,” said WSI Corp. in its Friday morning report. “Humidity levels will trend upward into the 60s to low 70s. The frontal system will slowly push a cold front southward across the Mid West during Saturday night through Tuesday with a chance for scattered showers and storms. This will begin to ease back temperatures across the north into the 70s and 80s, while suppressing 90+ temps into MISO South.

“After a lull in wind generation [Friday] morning, a surge of south to west-northwest winds should drive up wind gen…into the weekend. Output will peak 7-9 GW. Wind gen will subside from this peak early next week.”

In physical market trading, that frontal system was enough for eastern locations to take a few big hits. Gas on Dominion South tumbled 13 cents to $1.75, and deliveries to Tennessee Zone 4 Marcellus shed 18 cents to $1.60. Gas on Transco-Leidy Line fell 14 cents to $1.65.

Other market centers saw more benign price movement. Gas at the Chicago Citygate shed 2 cents to $2.60, and deliveries to the Henry Hub fell a penny to $2.67. In the Rockies Kern Receipts lost 2 cents to $2.50, and gas at the PG&E Citygate rose a penny to $2.76.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |