E&P | Markets | NGI All News Access

Brexit Bombshell Spreads Collateral Damage Across Energy Sector

The world’s markets went into a tailspin Friday following a referendum vote by Great Britain to leave the European Union (EU), with the oil and gas sector suffering collateral damage.

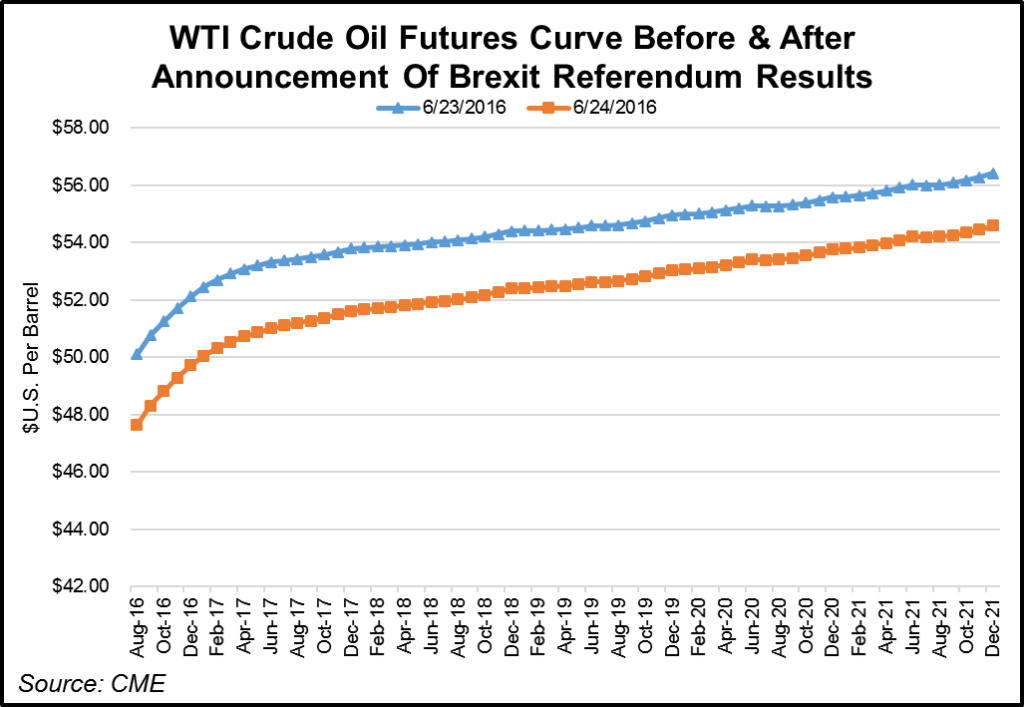

The longer term implications for the “Brexit” vote, with 52% of the electorate in favor of leaving the EU, poses uncertainty for energy markets. Global oil prices settled lower on Friday, with Brent crude off 4.9% ($2.50/bbl) to $48.41/bbl and U.S. crude off 5% to settle at $47.64/bbl — the lowest decline since February. The British pound sterling collapsed to a 31-year low. Concerns were raised about oil reaching $50 anytime soon.

The UK, including Scotland, produces close to 1 million b/d of oil, about 1% of global output. While the referendum is expected to weaken global oil demand, Europe is far from the main driver, eclipsed by emerging economies in the Asia-Pacific region.

Oil and gas companies could take little comfort from that as global stocks tumbled across the board.

BP plc, headquartered in London, saw its share price fall by nearly 5%, while Royal Dutch Shell plc, headquartered in London and The Hague, lost 6%-plus. U.S. firms fared no better, with Houston-based ConocoPhillips losing almost 5%, Southwestern Energy Co. off by about 7%, Chesapeake Energy Corp. down by almost 6%, and Anadarko Petroleum Corp. off close to 5%. U.S.-based supermajors ExxonMobil Corp. and Chevron Corp. each saw their share price off by 2%-plus.

Societe Generale’s Michael Wittner, global head of oil market research, said the initial market response was about risk aversion. “We’re getting big moves now but there will probably be little impact, if any, in the longer-term,” he said.

The U.S. Commodity Futures Trading Commission was “closely monitoring the derivatives markets and working with the exchanges and clearinghouses to ensure that they function properly and with integrity,” Chairman Timothy Massad said. There was “significant volatility” on Friday, but the markets appeared to be “functioning normally.”

Citi Futures Perspective’s Tim Evans said a “range of possible paths” exists for markets to follow in the weeks ahead. He suggested operating from the assumption that the market’s downturn was an initial reaction and not a full price adjustment.

“Some short period of consolidation or upward correction in crude oil is possible, with some argument that none of the direct fundamentals for the market have changed,” Evans said. “However, we think confidence has been shaken and that the lack of physical tightness exposed by the initial decline will be highlighted, leading to a further wave of selling as excess speculative length is liquidated.”

Evans anticipates “price battles” ahead, and “we think Brent will have difficulty regaining the $50 level now.” U.S. natural gas, however, “will trade in its own world, with little if any connection with the Brexit drama,” he added.

The Brexit referendum “is negative for commodities on three levels: the U.S dollar (USD) interest rates, and global trade and mobility,” said BofA Merrill Lynch Global Research analysts led by Francisco Blanch. A $39/bbl target for West Texas Intermediate (WTI) by the end of 3Q2016 was reiterated, with “downside risks” to the firm’s longer term forecast for $61 Brent.

The BofA economics team also has shaved its outlook for U.S. gross domestic product (GDP) growth by 0.2% on the back of the vote, and “we also see weaker growth in other countries, namely the UK,” Blanch said. A stronger USD “will likely be a drag on all commodities.”

The EU actually began as a “commodity agreement,” he noted, a treaty creating a common market initially for coal and steel to stabilize competition over natural resources. The EU today is built around four basic economic freedoms: movement of goods, services, labor and capital.

Less trade and less movement of labor within Europe “would imply less demand for oil and other commodities. Yet the biggest problem commodity markets will now likely face is the uncertainty surrounding the practical consequences of this result, coupled with a potential ‘chain reaction’ in other EU member states that may upset today’s legal, political, and economic order…”

Weaker global trade patterns “could have very detrimental implications for energy, industrial metals and mining commodities over the next few months,” Blanch said. “At the end of the day, global trade is highly connected to global GDP. Most economists would agree with the statement that less trade will lead to weaker growth down the line. And less trade and less mobility of people will naturally result in weaker demand for oil…”

There may be a “silver lining” for U.S. companies, including the exploration and production (E&P) sector, said NGI‘s Patrick Rau, who directs strategy and research. He said he has serious doubts about the Federal Reserve Bank’s Janet Yellen voting to raise interest rates anytime soon. “A stronger U.S. dollar is bad for U.S. exports, ergo for the U.S. economy,” and increasing rates in this scenario would be unwise. “This might translate into a little more debt relief for the besieged and over-leveraged U.S. E&P sector.”

Oil prices were “getting crushed” early Friday “because of the strength of the USD, at least relative to other major currencies like the pound sterling. A stronger U.S. dollar usually leads to a decline in oil prices,” Rau said. “Uncertainty is the key word in the market right now. Nothing like this has ever really happened before. Will Brexit lead to other EU nations following suit? What will that do to trade agreements and economic development, not just in Europe, but globally?”

Tudor, Pickering, Holt & Co. (TPH) said that with the vote over, the “market has what it was looking for — clarity. Although the ‘remain’ prognostications were wrong, the outcome doesn’t change what we articulated…These distractions have little to nothing to do with tightening oil and gas macro fundamentals. We are clearly not in a position to offer expert opinions on UK political outcomes and their ramifications, but nothing in this result changes the structural realities of solid global demand and challenged supply. The torque back to dollar strength in the near-term likely drives energy stocks and commodities lower,” offering a buying opportunity.

“We respect the decision taken by the British electorate in the EU referendum,” BP spokesman Scott Dean told NGI‘s Shale Daily on Friday. “It is far too early to understand the detailed implications of this decision and uncertainty is never helpful for a business such as ours. However, we do not currently expect it to have a significant impact on BP’s business or investments in the UK and Continental Europe, nor on the location of our headquarters or our staff. As details of the process for negotiations around the UK’s future relationship with the EU become clear, we expect to engage with both the UK government and the EU on areas of common interest.”

Shell, which like BP had advocated remaining in the EU, said it would work with the British government and European institutions. The priority is to continue to supply energy to customers. “We will work with the UK government and European institutions on any implications for us,” a spokesman said.

TPH analysts said there “clearly…will be short-term volatility, but for those taking a long-term view, we see this as an attractive buying opportunity. Both Shell and BP pay dividends in U.S. dollars, so the yield has increased to 7.5% for Shell and to 7.6% for BP, with no change at all in their abilities to fund the dividends.”

UBS equity strategist Julian Emanuel said the vote to leave the EU is “unlikely to result in a change in the fundamental outlook for U.S. equities.” The UK economic slowdown would have “limited first-order effects” on U.S. stocks, with only 2.9% of S&P 500 revenues from the UK.

However, the energy sector has the largest exposure to the UK, with 6.4% of revenue. The Federal Reserve Bank likely would hike rates at a slower pace, which could prolong “the late stages of the current bull market.”

Trade association Oil & Gas UK, which represents the offshore energy industry, noted that it had maintained neutrality during the referendum campaign and its role “is to represent our members throughout the transition ahead. We hope that all those involved will now come together and work constructively to make this transition as smooth as possible and we ask that the UK government clearly outlines the process which will follow to minimize any potential period of uncertainty.

“The UK oil and gas industry is at a critical juncture and we need to ensure the UK Continental Shelf continues to attract investment and be seen as a great place to do business. We will be consulting closely with our members in the coming weeks and look forward to engaging with all governments to play our part in this process.”

Also facing potential blow back are global science and technology agreements, and specifically the United Nations push to reduce global carbon emissions, according to the Massachusetts Institute of Technology (MIT).

“Ahead of the vote, 83% of scientists claimed to be against Brexit, fearing that its impact on funding and collaborative research could prove disastrous,” MIT said. The UK would no longer be “directly involved with Europe-wide technological and scientific initiatives, such as those to create a digital single market and protect the climate,” of which BP and Shell have been key participants. “Until now, the UK has punched above its weight in science and technological development…Today, we might all lose out as a result of its choice to leave the EU.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |