Recent U.S. Rig Recovery Halted, But Canada Jumps 10%

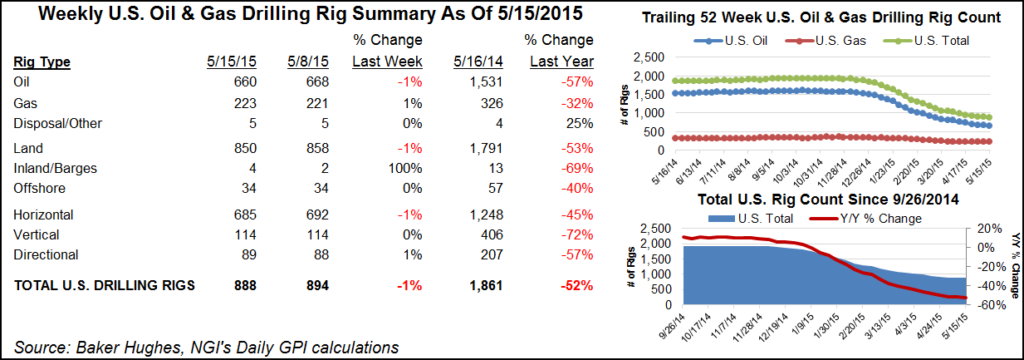

The recent rig count rally in the United States took at least a temporary pause, with the dismissal of seven oil rigs outweighing the addition of four natural gas rigs, according to the Baker Hughes Inc. (BHI) rig count for the week ending June 24.

The U.S. land rig count, which stood at 398 on June 17 (see Daily GPI, June 17) and 388 a week before that (see Daily GPI, June 10), retreated to 397 as of June 24, BHI said. Three of those rigs were running in inland waters and 21 active in the offshore.

Texas added three rigs (to 194), but losses were greater in Oklahoma (down 4 to 54) and Louisiana (down 5 to 41).

There were 53 vertical units in action, the same as the previous week, and 325 horizontal rigs, one less than the previous week.

The Haynesville Shale, Permian and Williston basins put in strong showings in the most recent week, adding two, four and two rigs respectively, to 19, 150 and 26 rigs. Sticking out to the downside was the Cana Woodford, which lost three rigs to 24 for the week.

The number of rigs operating in Canada jumped more than 10% to 76 this week from 69 last week, with Eastern Saskatchewan adding five and single startups in Manitoba, Newfoundland & Labrador, and NL Offshore.

Some market watchers believe the backlog of drilled but uncompleted wells (DUCs) combined with the current level of active rigs don’t stand a chance against coming natural gas demand, which could lead to rig recovery (see related story). Speaking at Hart Energy’s annual DUG East Conference & Exhibition, Ponderosa Advisors LLC Managing Partner Bernadette Johnson said she believes higher prices are coming sooner than expected.

“Natural gas production volumes are coming off pretty significantly,” she said. “They were up above 73 Bcf/d on the dry gas side and now we’re only at about 70.5 Bcf/d, and that’s only over the past few months, so we’re seeing some declines.

“The forward [price] does not support natural gas production growth, but a cold winter could push natural gas production prices north of $4,” she added. “We’re out in the world saying, ‘we think gas prices could be over $4 next year,’ and a lot of people think we’re crazy.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |