Infrastructure | Markets | NGI All News Access | NGI The Weekly Gas Market Report

More NatGas, Pipeline Access, Price Transparency Bound For Mexico

Construction is slated to begin next month on the Texas-to-Mexico Nueva Era Pipeline, and the contract for another major Texas-Mexico connection was recently awarded. Mexico’s natural gas market is progressing toward increased supply, liquidity and price transparency.

Nueva Era is a project of Howard Midstream Energy Partners LLC and Mexico’s Grupo Clisa. Mexico’s Comision Federal de Electricidad (CFE) is the anchor shipper (see Daily GPI, Aug. 12, 2015), and there is still capacity available for others, Howard Energy Mexico President Brandon Seale told NGI.

“We signed the anchor contract with CFE in October of last year,” Seale said. “Since then we’ve been engaged in permitting and right-of-way acquisition; we have 28 people in the field today doing that and the preliminary work necessary to start construction.

“We made the pipe order back in March. We were able to use 100% Mexican steel and 100% Mexican pipe. It’s all going to be rolled right there in Monterrey by a company called Tubacero. They’ve already started rolling that, and a fair chunk is already complete and will be delivered to the right-of-way starting in September.” In-service on the project is expected in June 2017.

Separately in recent days, CFE awarded the contract for the Sur de Texas-Tuxpan undersea pipeline from Texas to Mexico to a joint venture of TransCanada Corp. and Sempra Energy (see Daily GPI, June 13). The contract for the Texas intrastate upstream portion of the project went to Spectra Energy Corp. (see Daily GPI, June 14).

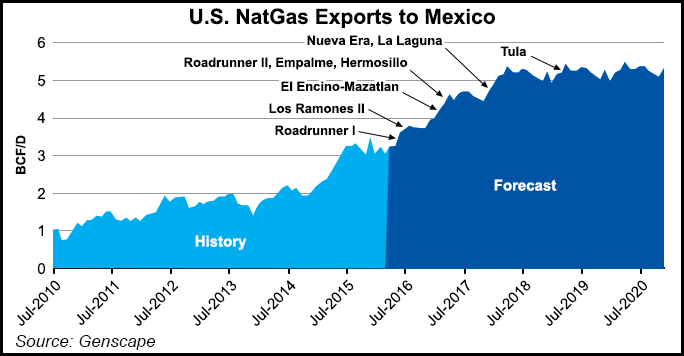

About four years ago, Mexico was importing roughly 1 Bcf/d of U.S. natural gas. That number is up to about 3 Bcf/d now, Seale said. Imports are expected to climb further as Mexico’s domestic gas production is expected to remain in decline until the country can ramp up its own shale gas production, which is years down the road.

According to Genscape Inc., between January 2017 and April 2020 about 6.7 Bcf/d of expansions in pipeline capacity from the United States to Mexico are slated to come online.

“I’ve seen it could go up as high as 6 or 7 Bcf/d,” Seale said of Mexican imports of U.S. gas. “We think there’s a huge latent demand for natural gas in Mexico.”

In recent years, demand for natural gas in Mexico has been artificially suppressed due to, among other things, lack of reliability of supply, Seale said. Artificial pricing formulas also inhibited natural gas consumption, he said, as did subsidies for competing fuels, such as fuel oil.

It’s not just more U.S. gas that is needed to make a competitive market in Mexico. The country’s energy secretary recently released its plan for the development of a competitive natural gas market. The features of what is envisioned are very similar to what exists north of the border, and Seale said it should look familiar to anyone operating in the U.S. gas market. How quickly it all unfolds in Mexico remains to be seen.

A foundation of the market will be pipeline open access. Pipeline capacity will no longer be controlled by Petroleos Mexicanos (Pemex). The national pipeline system will be controlled by Centro Nacional de Control del Gas Natural, which will make capacity available on an open access basis.

“…[I]t is clear that Mexico is taking many of its cues in the planned restructuring of its natural gas industry from the U.S. experience,” law firm King & Spalding (K&S) said in a June 6 client note on the energy secretary’s implementation plan.

There will be open seasons for pipeline capacity, but Pemex and CFE will have the right to reserve some capacity for their own needs. “It is, unfortunately, unclear how much pipeline capacity will be reserved in this manner for use by Pemex and CFE, and therefore unclear how truly ‘open’ the newly granted access to the national pipeline grid will be, at least initially,” K&S said. “Over time, a program through which Pemex will gradually cede its contracts will, in theory, encourage the entrance of new market participants.”

Nueva Era and other privately developed pipelines are a different matter. “Ours was a private project that we initiated that CFE responded to,” Seale said. “We actually have capacity still available that we do sell directly to third parties. The CFE is not in a monopolistic situation or the only source of capacity on our pipeline. They’re our anchor shipper…”

Also included in the energy secretary’s recently released plan is an outline for the creation of a bulletin board system for transportation capacity as well as the development and publication of price indexes for hubs in the natural gas system, K&S said in its client note.

“The Implementation Plan envisions that, by sometime in 2018, Mexico’s natural gas market will be fully competitive, such that natural gas pricing will be left entirely to market forces; Pemex will have ceded its market-dominant role; liquid pricing points will have been established at various points on the national gas transmission grid; and a secondary market in pipeline capacity will have been established,” K&S said.

“All of this, of course, assumes that over the course of the next 24-30 months the number of participants in Mexico’s natural gas market will increase dramatically, and that these new participants will succeed in quickly gaining market share. This has proven to be challenging in other emerging natural gas markets (such as those in the Canadian Maritime provinces of New Brunswick and Nova Scotia).”

The market in Mexico’s northeastern region will be opened first. Natural gas buy-sell transactions will be logged and everyone will be able to see them, Seale said.

“Very quickly you’ll develop very standardized hub-based pricing based on South Texas hubs, or you may even see the development of some hubs in Mexico, like in Monterrey or Reynosa or something like that,” Seale said. “The main takeaway is that all these transactions will be uploaded onto the database where people can see them for the next year, which will really help develop that free market for natural gas in the northern part of the country and then in 2018 that will all extend throughout the entire country.”

Opening the northeastern area first makes sense, Seale said. “That’s what I think is elegant about this rollout strategy that they’ve come up with,” he said. “They’ll have this first year of 2017 where the market will be open; it will still effectively be South Texas-based kind of pricing because that’s the way deals are currently done. But after a year of all these public transactions, enough trends will develop that the marketers — and that’s really who should drive this and, I think, will drive this — eventually someone will pick a point and say, ‘we’re going to start basing gas prices off of this point.’ …[T]here’s nothing sacred about a hub; a hub is just where enough pipelines cross and enough transactions occur that there’s liquidity to talk about pricing gas at.

“So I would think that by the start of 2018 you’ll see some sort of Mexican hub-based pricing.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |