NatGas Cash, Futures Slide Following Bearish EIA Report

Natural gas traders Thursday elected to get their deals done before the Energy Information Administration’s (EIA) inventory report, and prices for Friday delivery eased.

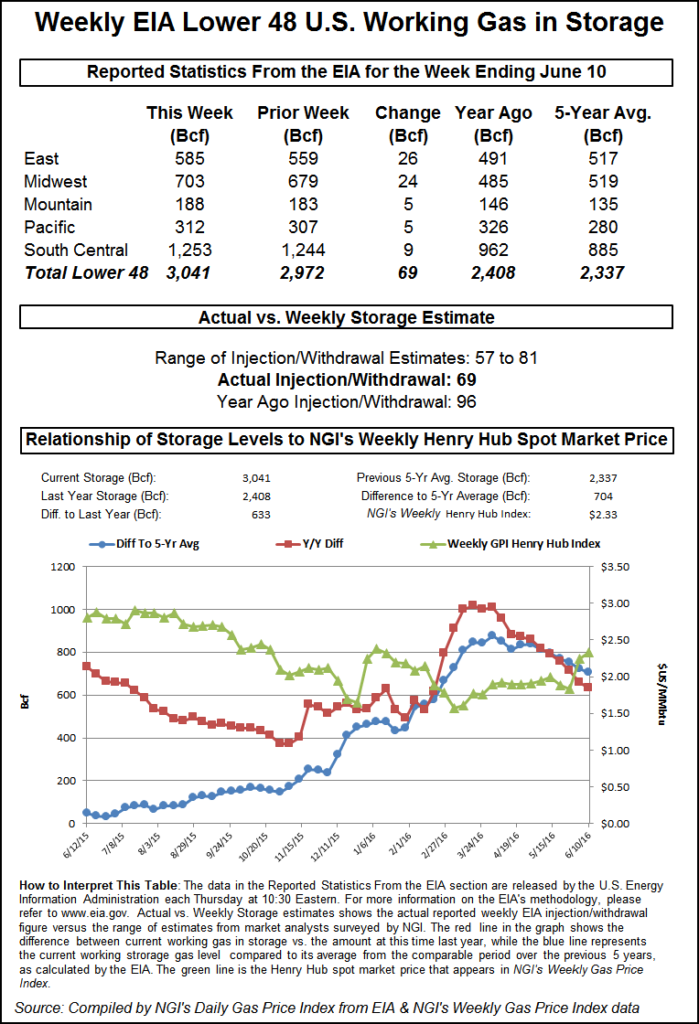

Gains in California and the Rockies were unable to offset soft pricing in the Gulf, Northeast, and Midcontinent and the NGI National Spot Gas Average fell a penny to $2.33.

The primary market driver was the release of EIA storage data and the numbers came in slightly higher than expected. EIA said 69 Bcf was injected for the week ending June 10, about 5 Bcf greater than expected and prices fell, rose to a new high, but slipped into negative territory at the close. When the dust had settled July had given up 1.5 cents to $2.580 and August was off 2.5 cents to $2.627. July crude oil took a hit dropping $1.80 to $46.21/bbl.

Traders were circumspect about the market’s close. “I thought we would settle above $2.60, but it didn’t happen. A close above $2.60 would have been an indication of higher prices,” said a New York floor trader. “We are in limboland, but the market did make a new high at $2.639.”

Going into the report market bulls were reminiscing about last week’s lean build when EIA reported a 65 Bcf injection and caught traders and analysts by surprise. Prices ended up the day about 15 cents higher as industry estimates were coming in around the mid to high 70 Bcf mark. Indications were that there were no errors or adjustments to the numbers. “65 Bcf? What was that all about?” said John Sodergreen, publisher of Energy Metro Desk (EMD).

“Very good question. EIA asserts that there was no funny stuff or mistakes in the process last week, and the number stands at 65 Bcf, like it or lump it. A 10 Bcf miss? Sure enough. The bulls seemed to like the surprise report, but the rest of us were left scratching our heads.”

Nonetheless, the pattern of below-average storage builds continued. The EMD survey this week came in at a 67 Bcf build, about in line with the industry average. Last year, however, 96 Bcf was withdrawn, and the five-year pace stands at a hefty 87 Bcf.

First Enercast Financial calculated a 61 Bcf injection, and the folks at ICAP Energy were looking for a 69 Bcf increase. A Reuters survey of 23 traders and analysts showed an average 64 Bcf with a range of 57 to 70 Bcf.

July futures fell to a low of $2.553 immediately after the figures were released, and by 10:45 a.m. July was trading at $2.570, down 2.5 cents from Wednesday’s settlement.

“I was looking for a 64 to 65 Bcf number. This was a little bit more than expected, but nothing really out of the norm,” said a New York floor trader. “I don’t really know if this had all that much of an impact. All the other markets are down sharply.”

Bespoke Weather Services of Harrison, NY, said, “EIA data this week showed a slightly larger injection than last week with slightly fewer total degree days on the week. The result is that we did not see much week-over-week tightening, and instead see this number as indicative of a new supply-demand balance becoming established in the natural gas market. Record high storage levels for this time of year will still cap short-term upside from here.”

Citi Futures Perspective analyst Tim Evans deemed the storage number “slightly bearish” and noted that it marked a change from recent reports.

“The data for last week followed two bullish side misses versus expectations, suggesting that the trend toward a tighter background supply/demand balance may have come to an end, although we continue to see enough air-conditioning demand to limit injections to something less than the five-year average rate through the balance of the month,” he said.

Inventories now stand at 3,041 Bcf and are 633 Bcf greater than last year and 704 Bcf more than the five-year average. In the East Region 26 Bcf was injected, and the Midwest Region saw inventories increase by 24 Bcf. Stocks in the Mountain Region rose 5 Bcf, and the Pacific Region was higher by 5 Bcf. The South Central Region added 9 Bcf.

Weather models changed little overnight. “The big picture this morning shows mostly minor changes to the forecast from yesterday,” said Commodity Weather Group in its Thursday morning outlook. “Some slightly cooler adjustments in the Midwest to East for next week’s six-10 day offset some slightly hotter changes in the West where we add one extra day of 100 degrees to Sacramento and shift Vegas a bit hotter too. The South is mostly flat for the one-10 day range, but we make some slightly warmer to hotter changes there (mainly deep South and Southeast) in the 11-15 day,” said Matt Rogers, president of the firm.

In physical market trading most points moved a few cents from unchanged. That may change Friday as forecasters are calling for dangerous heat to engulf portions of the Southwest.

Gas at California points proved to be the day’s strongest performers in the physical market. Deliveries to Malin rose 6 cents to $2.37, and gas at the PG&E Citygate added 3 cents to $2.55. SoCal Citygate was quoted 6 cents higher at $2.59, and next-day gas priced at the SoCal Border Avg. Average rose 5 cents to $2.40. Gas on Kern Delivery added 7 cents to $2.43.

Market centers were mostly lower. Gas on Dominion South changed hands 6 cents lower at $1.66, and parcels at the Chicago Citygate fell 3 cents to $2.50. Gas at the Henry Hub was seen a penny lower at $2.61, but deliveries to Opal gained 3 cents to $2.30.

According to AccuWeather.com meteorologists “Extreme heat will persist for several days across the southwestern United States starting this weekend. A strong ridge of high pressure will take control and strengthen into next week, sending temperatures to dangerous levels. “When a ridge of high pressure like this one forms in the middle to late June, it can deliver some of the hottest weather possible to the Desert Southwest,” said AccuWeather.com meteorologist Ken Clark.

“Temperatures will run between 10 and 20 degrees Fahrenheit above average through the early part of next week. The peak of the heat in many areas will be on Monday, but Sunday and Tuesday will be no slouches either in the high heat department,” Clark said. “Not only will it be hot compared to average, but temperatures will likely challenge daily record highs and all-time record highs.”

Denver’s high Sunday is expected to reach 98 while Phoenix hits 120 on Monday and Albuquerque hits 100 Monday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |