NatGas Cash, Futures Diverge; Moderating Temps Ahead

Next-day gas traded higher at most points Wednesday with gains in California, the Midwest, and Gulf picking up the slack from modest declines seen at eastern locations. The NGI National Spot Gas Average added a respectable 5 cents to $2.34 with eastern points sliding a couple of pennies.

Futures have carved out a ceiling in the $2.60 area, and in Wednesday’s trading July fell 9-tenths of a cent to $2.595 and August fell 1.4 cents to $2.652. July crude oil dropped 48 cents to $48.01/bbl.

In New England quotes for next-day deliveries fell as temperature forecasts called for highs as much as 16 degrees less than Wednesday’s peak readings. Forecaster Wunderground.com predicted Boston’s Wednesday high of 84 would slide to 75 by Thursday and reach 68 by Friday. The normal high in Boston in mid-June is 76.

Deliveries to the Algonquin Citygate skidded 30 cents to $2.15 and gas at Iroquois, Waddington added a nickel to $2.51. Packages on Tenn Zone 6 200L were quoted 27 cents lower at $2.14.

Gas prices in the Mid-Atlantic and Midwest seemed to defy gravity as moderating temperatures had no impact on next-day delivery pricing. Wunderground.com predicted Wednesday’s high in New York City of 89 would slide to 75 Thursday before inching back to 77 Friday. The normal high in New York City is 79. Chicago’s high Wednesday of 90 was expected to plunge to 74 Thursday and rebound to 79 Friday, 1 degree below normal.

Gas on Texas Eastern M-3, Delivery was flat at $1.77 and gas bound for New York City on Transco Zone 6 was flat at $1.85.

At the Chicago Citygate Thursday gas changed hands at $2.53, up 6 cents, gas on Consumers changed hands 6 cents higher at $2.53 and deliveries to Michigan Consolidated came in 7 cents higher at $2.53.

Industry consultant BTU Analytics has recently undertaken a study to determine the sensitivity of natural gas demand in the Northeast to prices and temperatures. In order to construct the forecast “average monthly temperatures from the last 5 years were used for future weather estimations along with the forward pricing strip as of June 13, 2016, for natural gas.” BTU ran two cases comparing the sensitivity to $2 and $4 natural gas.

What BTU found was that “both the $2 and $4/MMbtu case resulted in natural gas consumption rising or falling by about 0.25 Bcf/d compared to the current natural gas strip price. There is a clear trend that when gas prices are higher, there is less incentive for power burn growth and the result is lowered natural gas consumption for that region. The high price sensitivity in this region is strongly related to the coal to gas switching potential of the Northeast, resulting in an average power burn difference of 15% between the $2/Mcf and $4/Mcf cases.

“As gas prices move higher and coal becomes more competitive, the available infrastructure for switching allows the supply stack to shift towards the cheaper fuel source. The impact of such a large demand shift can greatly affect the overall supply and demand balance of the U.S.”

Futures prices at the open were firm Wednesday but Tuesday the market stumbled out of the gate, and by the close had managed to reach positive territory. “The natural gas market continued to ward off a technical correction by finding some incremental cooling demand on Tuesday as the nearby temperature forecast turned warmer than a day ago,” said Tim Evans of Citi Futures Perspective in closing comments Tuesday.

In a noon Wednesday update Natgasweather.com said, “Fresh mid-day weather data continues streaming in and again no major changes as a strong upper level ridge of high pressure continues dominating large stretches of the US, which it’s likely to do into early July. The ridge is currently anchored over the central and southern US with widespread highs of 90s to 100s, including over all of Texas.

“But Friday, the ridge will shift westward as a weather system drops into the Southeast with showers and several degrees of welcomed cooling. There’s currently still a few notable weather systems and associated cool blasts impacting the western and northern US with slightly cooler than normal temperatures, including some snowfall into the highest elevations of the West.”

In the near term, cooling loads aren’t forecast to be that demanding. The National Weather Service (NWS) said it expects about average cooling loads over major Midwest and East markets. For the week ended June 18, NWS predicts that New England will see 10 CDDs, or three fewer than normal. The Mid-Atlantic should see 14 CDDs, or 12 fewer than its normal tally. The greater Midwest from Ohio to Wisconsin is expected to see 47 CDDs, or 13 more than normal, and the total U.S. is forecast at 60 CDDs or 11 more than normal.

Higher shale gas prices may be on the way. A prominent investment firm said a cyclical recovery in legacy shale drilling will be needed to balance the market beginning in 2017, pointing to natural gas prices of $3.00-3.50/MMBtu to stimulate exploration and production (E&P) activity (see Shale Daily,June 14).

“But a subsequent increase in production presents a downside risk to prices in 2018,” said Damien Courvalin, global head of energy research for Goldman Sachs during a keynote presentation at the 21st Annual LDC Gas Forums Northeast conference, held last week in Boston.

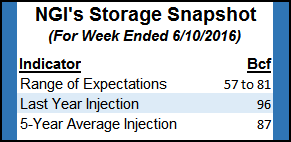

Near-term supply will be on the minds of traders Thursday when the Energy Information Administration (EIA) releases weekly storage figures. The trend of below normal injections remains on track as estimates are coming in in the mid-60 Bcf range, well below last year’s 96 Bcf build and the five-year pace of 87 Bcf. First Enercast Financial is estimating 61 Bcf and ICAP Energy is looking for an increase of 69 Bcf. A Reuters poll of 23 traders and analysts revealed an average 64 Bcf with a range of 57 Bcf to 70 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |