Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Antero Bolts On 55,000 Net Acres in $450M Deal to Bolster Growth

Antero Resources Corp. said Friday that its $450 million acquisition of 55,000 net acres in West Virginia creates a new platform for development and consolidation in its core, with a package of mostly undeveloped assets that would boost production and increase Antero Midstream Partners LP’s acreage dedication.

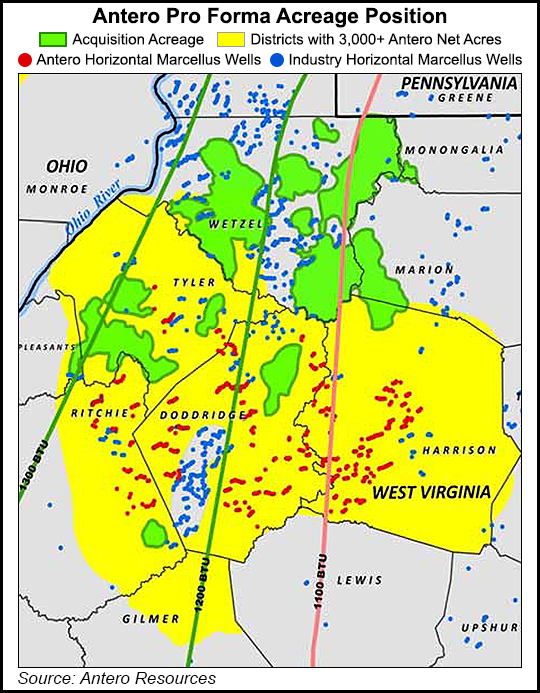

Southwestern Energy Co. sold the assets as part of a larger initiative it highlighted earlier this year to reduce debt and maximize efficiency (see Shale Daily, Feb. 26). The properties being sold are spread across eight counties in northern West Virginia. The bulk of the assets, however, are located in Antero’s core of Wetzel, Tyler and Doddridge counties.

Antero said the deal includes 33,000 net acres of Marcellus leasehold in Wetzel County and adds 12,000 infill net acres of core Marcellus leasehold in Tyler County. The sale also includes 41,000 net acres of deep rights that are highly prospective for the underlying dry Utica Shale.

More than 70% of the acreage being acquired inside of Antero’s southern rich and dry gas windows is undeveloped. While most acreage in the Appalachian Basin is burdened with third-party dedications, Antero CFO Glen Warren said, the entire acquisition would be dedicated to Antero Midstream, which will provide gathering, compression, processing and water services, increasing its footprint by 20% in the area. That would also benefit Antero Resources through its 62% ownership of Antero Midstream.

“Importantly, this acreage is undedicated and sits in the heart of midstream capacity expansions, helping to reduce marketing expense with acceleration,” analysts at Tudor, Pickering, Holt & Co. said in a note Friday.

The acquisition adds 625 locations and enhances another 435 for Antero through working interest or longer laterals. In all, it boosts Antero’s total Marcellus and Utica position in the basin to 859,000 net acres and increases undeveloped locations by 21% to 6,613.

“This acquisition really provides us with a significant amount of dry gas optionality and upside when natural gas prices recover,” Antero CEO Paul Rady told analysts during a conference call on Friday. About 75% of the properties are prospective for the deep Utica.

The assets also include 4.1 Tcfe of unaudited 3P reserves and an estimated 1.8 Tcf of dry Utica potential. Current production is 14 MMcfe/d. Southwestern said it did not plan to begin developing the assets before 2023 and added that most of the production is coming from non-operated wells and consisted of 11 Bcfe of proved reserves at year-end 2015.

“This transaction is one step on delivering on the commitment we made to strengthen our balance sheet in 2016,” said Southwestern CEO Bill Way. “We are bringing forward the value of acreage that is much longer dated in our development plans, enabling us to take action and proactively reduce outstanding debt.”

Southwestern’s rigs in the Appalachian Basin and the Fayetteville Shale remain idle. At the end of the first quarter, the company had $4.8 billion in long-term debt, including $1.55 billion of cash drawn on its revolving credit facility that has since been paid off. But management said in April that it was still exploring all of its options to reinforce liquidity and reduce debt, including equity offerings, joint ventures and asset sales, among other things (see Shale Daily, April 22).

A part of the transaction, which is expected to close in the third quarter and have an effective date of Jan. 1, is an undisclosed third party tag along option, which would allow Antero 30 days to purchase the remaining 19% working interest in a portion of the acquired properties. The tag along includes 1 Tcfe of unaudited Marcellus 3P reserves, 400 Bcf of dry Utica resources and 3 MMcfe/d of net production. Antero said if the tag along option is exercised, the adjusted acquisition price would be about $560 million.

Antero also said that through savings it’s achieved year-to-date from service cost reductions and cost efficiencies, it could add an additional rig later this year without changing its previously announced $1.3 billion drilling and completion budget. The acquisition also prompted the company to increase its 2017 production growth target by up to 25%

Antero said late Thursday, shortly after the deal was disclosed, that it would offer 26.75 million common shares for gross proceeds of $762 million before expenses. The cash it raises would be used to help fund the acquisition and pay for general corporate expenses.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |