Markets | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Global NatGas Output, Demand Slowing, With Prices Under Pressure For Years, IEA Says

Natural gas production is slowing worldwide, but it still is seen increasing by more than 100 billion cubic meters (bcm) between 2015 and 2021, one-third of incremental global output, the International Energy Agency (IEA) said Wednesday.

Weak global demand, low prices and a sharp reduction in investments will result in slower growth in global gas production over the next few years, according to the annual Medium-Term Market Report.

“In the United States, production is expected to remain relatively flat across 2016 and 2017, pressured by a fall in output of associated gas and much slower growth elsewhere,” said the analysis, which was coordinated by senior gas expert Costanza Jacazio. “Given the drastic fall in both oil and gas prices, stagnation in output must be looked at as a remarkable achievement and a testament to the technological and financial resilience of the U.S. shale industry.”

The report, which provides five-year projections for demand, supply and trade, expects global gas demand to increase by 1.5%/year through 2021, compared with 2% projected in last year’s outlook. Slower primary energy demand growth and a decline in energy intensity of the world economy have reduced demand growth for all fossil fuels, including gas. Still, the share of gas in the energy mix still is expected to increase modestly by 2021.

Global gas prices are expected to remain under pressure for the next few years. U.S. gas prices are “likely to recover from their 2015 lows as domestic demand needs and a steep ramp up in exports will require continued robust production growth.”

“Massive quantities” of liquefied natural gas (LNG) exports are forecast to come online, but demand is softening in the traditional markets, IEA Executive Director Fatih Birol said.

“These contradictory trends will both impact trade and keep spot gas prices under pressure,” he said. The combined factors of cheaper coal and continued strong renewables growth are blocking gas from expanding more rapidly in the power sector.

A period of gas oversupply is expected over the next five years as the global LNG trade is revamped.

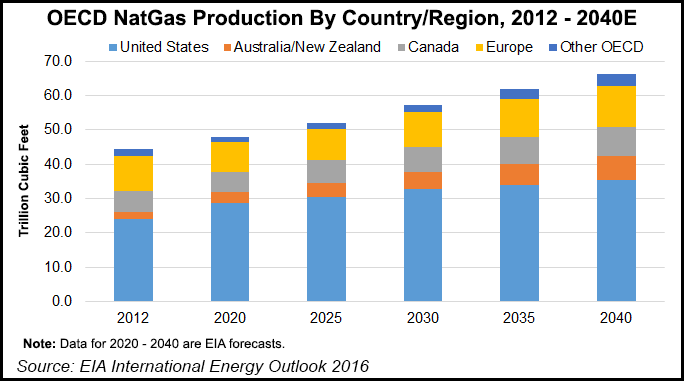

“Production in the United States and Australia is increasing robustly, underpinned by a massive expansion in LNG export capacity in both countries,” Birol said. “Yet, these new LNG supplies are coming to market just as global gas demand growth slows. Weakening demand in Japan and Korea, which together account for almost half of global LNG trade, will result in major shifts in global gas trade patterns: ample LNG supplies will look for a home elsewhere.”

In the first five months of 2016, the average differential between Asian LNG spot prices and U.S. prices was only US$2.50/MMBtu, versus an average spread of around US$11.00/MMBtu that had prevailed between 2011 and 2014. Asia gas prices are expected to be influenced by the oil price level. “Yet, a period of oversupply coupled with increasingly flexible LNG markets is expected to gradually lessen such linkage.”

The U.S. oil market to expected to be “close to balance” in the second half of this year and “in balance” in 2017, which “should help gas production growth resume, as gradually recovering oil prices improve the economics of associated/wet gas.” Big cost reductions achieved during the downturn also should allow drilling activity to return at a lower price than before.

However, U.S. gas demand growth is slowing as consumption in the power sector stagnates. The extension of federal incentives for solar and wind in 2015 “will ensure their continued strong deployment over the remainder of the decade,” IEA said. As well, total domestic electricity generation is forecast to increase by around 150 TWh between 2015 and 2021, which is only half that recorded over the six-year period leading up to the financial crisis in 2008.

U.S. gas prices are unlikely to fall much more from the lows of 2015, largely exhausting coal-to-gas switching potential. Increases in gas-fired generation from 2015 levels “will be limited to the need to replace some of the coal capacity that retires. As a result, the IEA expects U.S. gas-fired generation to stagnate, with risks skewed to the downside.”

Global gas demand actually began to once again grow in 2015, but expansion has remained below the historical average. Since 2012, worldwide gas demand has increased by only 1% a year, lower than the 10-year average of 2.2%, IEA estimated. In 2021, gas demand worldwide is forecast to reach 3.9 trillion cubic meters, increasing at an average annual rate of 1.5%, which is equivalent to an incremental 340 bcm between 2015 and 2021.

No relief is seen in oversupply before the end of the decade.

“Gas is faced with the twin challenge of a large wave of price-inelastic supplies coming online — the result of investment decisions taken when oil and gas prices were much higher — and structural changes on the demand side, mainly in the power sector,” IEA said. “These issues weigh on the degree of demand responsiveness to low prices.”

Slumping generation growth, low coal prices and robust renewables deployment are constraining the ability for gas to grow quickly in today’s low-price environment. LNG export capacity worldwide is expected to increase by 45% to 2021, with 90% originating from the United States and Australia — and almost all from investment decisions already taken. That means today’s low gas prices would have “little impact” from projects under way.

Barring a significant supply disruption, however, absorbing incremental LNG supply is going to be a challenge.

Europe’s ability to take in additional LNG is limited by slow demand growth, inexpensive coal and competitive Russian supplies. Demand in Japan and Korea, which account for almost half of global LNG imports today, is forecast to stagnate or possibly decline, depending on the scale of a nuclear comeback in Japan. While Latin America and the Middle East “offer pockets of growth,” neither region is a natural home market for baseload LNG imports.

“It is therefore clear that the trajectory of global gas markets — and how fast they rebalance — will depend on the scale of expansion in China and the rest of developing Asia,” IEA said. The potential exists for a boost in demand, if there’s “progress” on market and environmental regulations.

By 2021, LNG imports in developing Asian economies, including China, are expected to increase by more than 100 bcm, but it won’t be enough to balance the market, particularly during 2017 and 2018.

“As a result, global LNG export infrastructure will need to run below capacity,” IEA said. Utilization should recover by the end of 2021, but it won’t reach the high levels of 2011-20112. These supple gas markets should help accelerate changes in contract structure, however.

“As spot prices remain under pressure, buyers will search for better pricing and nonpricing terms from sellers,” according to IEA. “Moreover, with oil markets expected to rebalance before gas markets do, renewed pressure to move toward hub pricing and reduce oil exposure in long-term contracts will likely reemerge before the end of the decade. How producers will respond to that challenge remains to be seen.”

One issue of concern is that unsustainable low prices has reduced LNG investments sharply, taking out around 25 bcm of planned investments last year alone, according to IEA.

“Consequently, it is only in 2016 that the true impact of falling prices on LNG investment is finally emerging: almost halfway through the year, no new export project has been sanctioned. Until gas demand picks up and prices recover, new investments in liquefaction capacity are set to remain low.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |