Cash Natgas, Futures Race Each Other Higher; July Up 9 Cents

Natural gas for Thursday delivery jumped once again as weather forecasts called for western heat to migrate east under a broad high pressure ridge. A few points tucked along the Eastern Seaboard registered losses, but otherwise all other market locations scored stout double-digit gains.

TheNGI National Spot Gas Average rose 13 cents to $2.09. Not to be outdone, futures made some impressive gains too. July rose 9.3 cents to $2.381, and August added 7.0 cents to $2.453. July crude oil fell 9 cents to $49.01/bbl.

The surge in cash quotes was enough to trigger a series of new 30-day highs. Among them was Houston Ship Channel, which came in at $2.18 — a level not seen since Feb. 1. Tenn Zone 6 200L and Algonquin Citygate were among the few actively traded points to post losses, and the most expensive gas in the country was traded at SoCal Citygate, where prices averaged $2.41. PG&E Citygate came in a close second, averaging $2.40.

The spot July futures contract posted a new high of its own. The day’s high trade of $2.386 has not been seen by a prompt futures contract since Jan. 11, when the February contract reached a high of $2.480.

Gas at the Algonquin Citygate shed 5 cents to $2.01, but that was an exception to the day’s trading. Gas at the Chicago Citygate jumped 19 cents to $2.24, and deliveries to the Henry Hub added 17 cents to $2.26. Gas at the PG&E Citygate changed hands 13 cents higher at $2.40.

The national weather regime is changing and a shift in the weather pattern “is ongoing for much of the country as June begins,” said Wunderground.com meteorologist Linda Lam in a Wednesday morning report.

“This shift is bringing temperature changes for many, as well as an increase of showers and thunderstorms across portions of the South and East. An upper-level trough, or southward dip in the jet stream, that has been in place over the West is slowly sliding eastward and being replaced by an upper-level ridge of high pressure, pushing the jet stream well into western Canada.

“Hot temperatures will build across the West as the week progresses, just in time for the start of meteorological summer (June 1-Aug. 31). Meanwhile, cooler conditions will be found across parts of the East, although for most locations highs will be close to average for this time of year.”

Nowhere has the issue of warm temperatures and natural gas pricing come to a head as it has in California, particularly Southern California. The loss of most of the Aliso Canyon storage has observers asking how gas will be effectively used to balance what are likely to be surging power requirements once summer officially begins.

Balancing the grid might not be much of a problem now, but what happens if CAISO experiences loads similar to last year? According to CAISO, Tuesday’s peak load was a nominal 34,452 MW, but last year’s summer peak was 47,257 MW. CAISO is forecasting a peak 2016 summer load of 47,529 MW. The all-time record load of 50,270 MW was reached in July 2006.

Under normal circumstances, natural gas generation would be called upon as baseload but also in the form of peaking, and what gas was needed beyond pipeline gas could be supplied by storage. However, the state’s primary storage facility, Aliso Canyon, is greatly diminished (see Daily GPI, May 19).

“They still have 15 Bcf they can draw upon at Aliso,” said Portland, OR-based EnergyGPS principal Jeff Richter. “It’s not like it is off limits, they just can’t inject. You keep it for a ”rainy’ day. You just can’t predict when you are going to need it and for how long. 15 Bcf can go a long way or not depending on when it is, but my take is that the grid is longer this year versus last year [better supplied] and you will have more hydro and more solar capacity. I think they will manage it.

“This week is a good test. Load isn’t 49,000 MW but I think they have had enough preparation to facilitate this thing. The one thing they don’t like is to inject gas [at Aliso Canyon]; they like to withdraw gas as long as they have it.”

Richter said a hot day requiring 49,000 MW gas demand will reach into the upper 4 Bcf/d range. “On these days when demand is 4.7 Bcf/d, you have to go to the well because you can only bring in 3.9 Bcf/d. From a gas perspective, there may be some curtailments in the Los Angeles (LA) Basin, but that’s in real time [unexpected], not day ahead [forecast]. That would happen at noncore power plants where they just can’t get the gas. At the end of the day if you don’t get the gas to the power plant, you don’t get the power.

“I think there is enough scheduling capacity in the LA Basin, the question is can you get it there as quickly as possible? A hot day would require about an extra .7 Bcf/d, and with 15 Bcf at Aliso Canyon you have about 22 days.”

He said there might be as big a problem if high demand is forecast that doesn’t materialize in real time.

“Let’s say the load comes in lower than what you expected, and you have all these units drawing the gas and you don’t need the gas. Where are you going to put it? You can’t put it in Aliso Canyon, and the PG&E system is mostly full. It’s the deviations from normal that cause the problems. Real time is a truth serum, and we are talking to clients every day about this.”

Technical analysts were looking for the July contract to jump higher after June went off the board.

“We got our pop,” said United ICAP market technician Brian LaRose on Tuesday. “The question now, just how much higher can natgas go from here? We see three possible targets. In the most bearish case natgas will not get above $2.292-2.294. In the bullish case natgas is headed to $2.474-2.493-2.568. Between these two objectives $2.382 is the only other level that stands out.”

Despite the obvious correlation between the July contract’s 12-cent price surge Tuesday, analysts see the market responding to previous lean storage builds.

“While the temperature forecast pointed to somewhat more power sector demand for cooling than on Friday, we view the price surge as more of an intermediate-term catch-up move for the reduction in the storage surplus over the past six weeks than a reflection of the latest weather outlook,” said Tim Evans of Citi Futures Perspective.

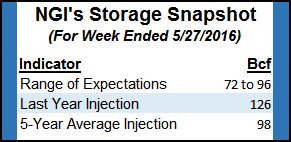

He is calculating a build of 96 Bcf in Thursday’s Energy Information Administration storage report, well below last year but about on target with the five-year average. The year-on-five year surplus is expected to drop from its current 769 Bcf to 732 Bcf by June 17, and “this fundamental price trend tends to limit the downside for prices and often translates into higher prices over the intermediate term, just as the higher lows registered last week and Tuesday’s price rally tend to confirm.”

Other estimates of Thursday’s storage report include ICAP Energy with a 82 Bcf estimate, and a Reuters poll of 18 traders and analysts, which showed an average 85 Bcf with a range of 72 Bcf to 96 Bcf. Last year a plump 126 Bcf was injected and the five-year pace stands at 98 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |