Bakken Shale | E&P | NGI All News Access

Bakken Oil Headed For South Korea, Continental Resources CEO Says

While introducing Republican presidential candidate Donald Trump to an energy savvy audience in Bismarck, ND, Thursday, Continental Resources Corp. CEO Harold Hamm said he has explored an export deal for Bakken sweet crude going to South Korea.

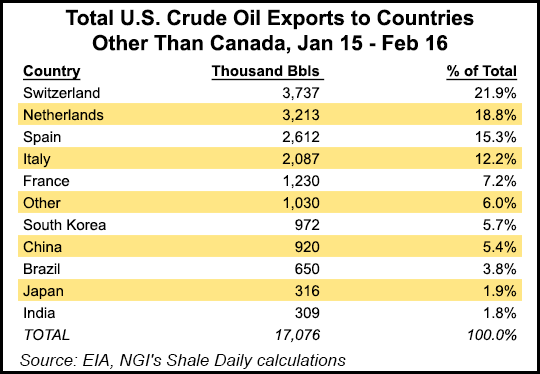

“We’re now able to ship oil around the world,” said Hamm, who drew wild applause from a crowd of 7,000 gathered in the Bismarck Events Center, following the conclusion of the Williston Basin Petroleum Conference (WBPC), which drew 2,700 participants this year.

Hamm said U.S. Rep. Kevin Cramer (R-ND) provided invaluable help in getting the export ban lifted, and he has since raised his status by becoming an informal adviser on energy to Trump. “Kevin was there every step of the way,” Hamm said.

In expressing strong support for oil exports, Trump praised Hamm and Cramer for their work in getting the Obama administration to lift the 40-year ban on crude oil exports from the United States.

Cramer said Trump would promote U.S. energy growth, create jobs and roll back regulations that are inhibiting the industry. Cramer predicted that Trump as president would help make the United States energy secure and should, as President Obama alluded to in Japan, “rattle” some leaders around the world with his “America First” strategy.

In a separate presentation at the WBPC meeting Thursday, John Gerdes, managing director and head of research at Houston-based KLR Group, said the indications are for about 1 million b/d of crude oil demand growth annually between now and 2030. “We see growth in liquid fuel demand globally, at least through 2030,” Gerdes said.

By 2030, the global demand will be 100-110 million b/d, and the investment required to maintain that demand until 2040 is on the order of $1 trillion annually, Gerdes said.

He is favorable toward U.S. oil exports, but thinks it is ironic that while the nation has finally lifted the ban, this is not a good time economically for large amounts of U.S. exports. “Just about the time that you get regulatory relief is about the exact time that you don’t need it,” Gerdes said. “The bottom line is that we now need about a $2 discount relative to Brent prices to justify the arbitrage [of exports].

“The beautiful thing, however, is the lifting of the ban is now in place, and that means free trade of a more flexible, fungible crude oil in the future.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |