Markets | NGI All News Access | NGI Data

NatGas Cash Little Changed, But June Contract Exits Weaker Than May

Natural gas for Friday delivery moved little as traders, for the most part, got their deals done before the morning’s Energy Information Administration (EIA) inventory report.

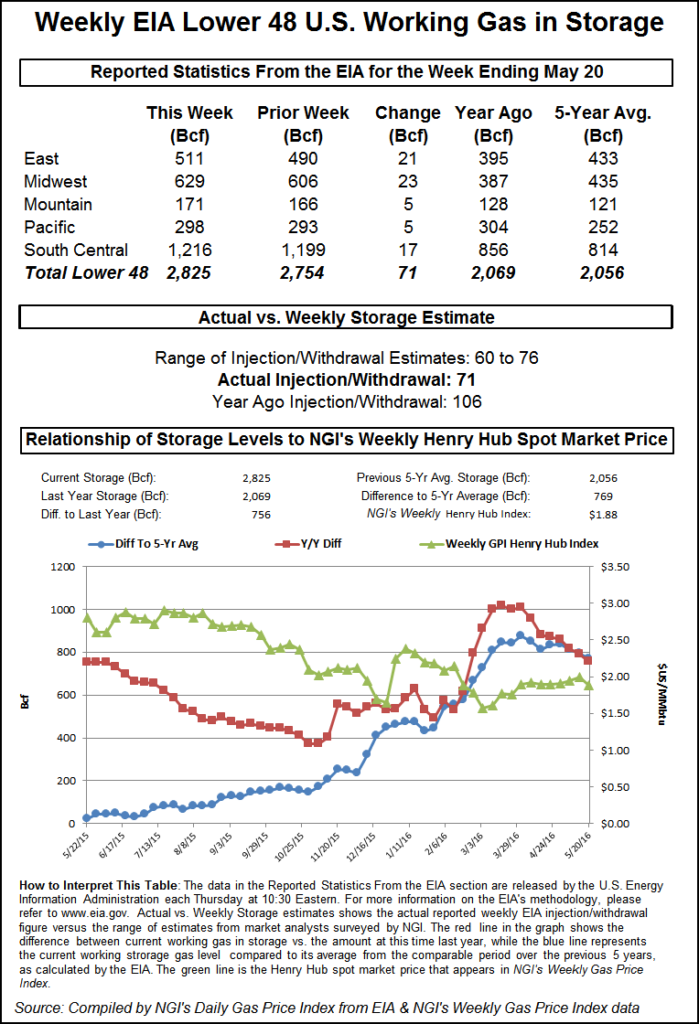

Modest strength in the Midwest and Midcontinent was offset by weak pricing in California, and most points outside the Northeast traded within a few pennies of unchanged. The NGI National Spot gas average down a penny at $1.67. EIA reported a storage build of 71 Bcf, slightly greater than traders expectations, though well below historical averages.

Prices nonetheless slumped, and June went out like a lamb. At the close, June settled at $1.963, down 2.9 cents, and July had shed 3.0 cents to $2.151. July crude oil settled 8 cents lower at $49.48/bbl after trading as high as $50/21.

Hopes for ongoing advances in natural gas futures were dealt something of a setback as June couldn’t even muster a settlement better than the May contract’s $1.995.

The 71 Bcf was about 3 Bcf more than what traders were anticipating, and June futures dropped to a low of $1.914 shortly after the figures were released. By 10:45 a.m. June was trading at $1.935, down 5.7 cents from Wednesday’s settlement.

“I don’t think there is a strong intention to force [the market lower]. The market is just drifting with a lean towards the downside,” a New York floor trader told NGI.

“The 71 Bcf net injection for the week ended May 20 was slightly more than the consensus expectation but still supportive compared to the 97 Bcf five-year average for the date,” said Tim Evans of Citi Futures Perspective.

“The data followed a bullish surprise in the prior week, suggesting that there may have been some temperature swings at the margin between the two periods. Overall, this could be a modest bearish correction to what had been signs that the background supply/demand balance was tightening.”

“We believe the storage report will be viewed as slightly negative,” said Randy Ollenberger of BMO Nesbitt Burns. “Storage remains at record levels, but the level of injections is below last year and points to a rebalancing over the course of the summer. We believe that U.S. working gas in storage could exit the summer season at five-year average levels, assuming normal weather.”

Inventories now stand at 2,825 Bcf and are a stout 756 Bcf greater than last year and 769 Bcf more than the five-year average. In the East Region 21 Bcf was injected, and the Midwest Region saw inventories increase by 23 Bcf. Stocks in the Mountain Region rose 5 Bcf, and the Pacific Region was higher by 5 Bcf as well. The South Central Region added 17 Bcf.

Going into the report traders were comparing estimates in the upper 60 Bcf area with last year’s 106 Bcf build and the five-year average build of 97 Bcf. The fact that this week’s report was light years below seasonal norms didn’t register. Analysts at IAF Advisors calculated an increase of 65 Bcf, and a Reuters poll of 20 traders and analysts showed an average 68 Bcf with a range of 60 to 76 Bcf.

John Sodergreen, editor of Energy Metro Desk, in his weekly survey hinted at somewhat higher risk to the report. “Our range this week is actually a little wider than the Early View. Not a good sign. And while the spread between the three categories we track was tight at 1.85 Bcf, we do see a LowBaller report on Thursday, closer to the editor at 63-65 Bcf.”

Sodergreen’s GWDD Model came in at a 62 Bcf injection, somewhat on the low side “due to cold weather in the North, thus the LowBaller forecast. Bias is to the low side of consensus it appears. Last week’s weather was 52% colder than last year/same week and 67% colder than the five-year average, same week.”

In physical market trading Northeast points were the day’s big movers, dropping up to a dime as power forecasts up and down the Eastern Seaboard showed declining loads. NEPOOL forecast that peak load Thursday of 17,500 MW would fall to 17,190 MW Friday before making it up to 17,660 MW Saturday. New York ISO expected peak loads Thursday of 23,943 MW to slide to 23,081 MW Friday and 21,706 MW Saturday. PJM Interconnection showed peak Thursday load of 41,691 MW dropping to 41,313 MW Friday and 37,724 MW Saturday.

Gas at the Algonquin Citygate dropped 15 cents to $1.86, and deliveries to Iroquois, Waddington fell 2 cents to $1.89. Gas on Tenn Zone 6 200L shed 15 cents to $1.85.

Gas on Texas Eastern M-3, Delivery fell 5 cents to $1.48, and gas bound for New York City on Transco Zone 6 skidded 8 cents to $1.54.

Deliveries to major market centers were narrowly mixed. Gas at the Chicago Citygate added 6 cents to $1.83, and parcels at the Henry Hub changed hands 2 cents lower at $1.75. Gas on El Paso Permian added a penny to $1.59, and deliveries to the SoCal Citygate fell 4 cents to $1.81.

Extended heat seems to be nowhere in the forecast. Commodity Weather Group in its Thursday morning report said, “Western heat looks to pop, then fade. The start of meteorological summer features lots of moving parts rather than a stable pattern regime. Warmer weather in the eastern U.S. in the first few days is forecast to give way to a cooler pattern arriving in the Midcontinent later next week, while western heat is expected to rebuild stronger. Right now, the peak heat day in the West looks to be toward the first weekend of June with potential 90s in Portland and 100-degree readings in Sacramento.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |