Conventional NatGas Discoveries in 2015 Beat Oil But Still In Multi-Year Decline, IHS Says

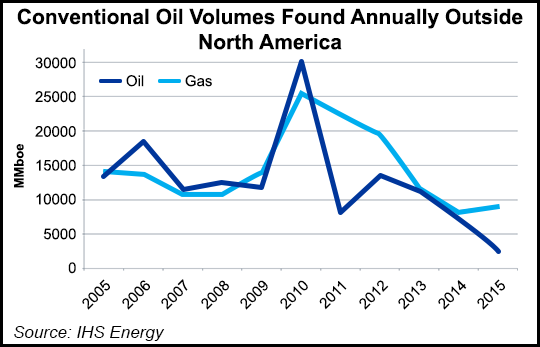

Conventional natural gas and oil discoveries outside North America continued their multi-year decline in 2015, with an estimated 12 billion boe of recoverable resources unearthed, the lowest level since 1952, IHS Inc. said Monday.

In terms of conventional global gas, more than 9 billion boe was discovered in 2015, the fifth straight year in which gas volumes discovered exceeded oil volumes. Oil volumes discovered last year totaled 2.8 billion bbl, a record low since exploration ramped up after World War II, IHS researchers said. Last year’s discoveries were the lowest since 1952 when only 7.8 boe was reported.

The IHS discoveries analysis addresses “conventional oil” and does not include North American shale/tight oil and gas resources.

“The fall in discovered volumes for conventional oil outside North America, in particular, has been steady and dramatic during the last few years,” said IHS Energy’s Leta Smith of the upstream industry future service. She was lead author of the IHS Energy Conventional Exploration and Discovery Trends analysis.

“Oil and gas volumes discovered in 2015 were the lowest in 64 years,” she said. “We’ve seen four consecutive years of declining oil volumes, which has never happened before. The bottom has completely fallen out for conventional exploration, and the result portends a supply gap in the future that is going to be challenging to overcome. In the current cost-cutting environment, the outlook for 2016 discovery volumes is not likely to be better, either.”

The slump in oil prices in 2014 has led many exploration budgets to be reduced for two years. As a result, exploration and appraisal (E&A) drilling for conventional resources fell sharply in 2015, exacerbating the annual drop in resources found.

“Last year, slightly less than 4,300 conventional E&A wells were drilled outside North America, as budgets for exploration were cut,” the report said. “That figure compares to just slightly more than 5,200 conventional E&A wells drilled globally in 2014, and nearly 5,300 E&A conventional wells drilled in 2012, which was the peak year for E&A wells drilled during the years 2005 to 2015.”

In the deepwater, considered 1,000-5,000 feet deep, the number of E&A wells drilled worldwide dropped by more than 20%, while ultra-deepwater (5,000 feet-plus deep) E&A drilling declined by more than 40% from 2014.

“Deepwater activity in 2015 also showed a marked shift toward appraisal drilling as a portion of total exploration compared with prior years,” Smith said. The trend is expected to continue this year.

“One of the most striking developments has been the shift of investment by large independents from the international arena to the United States as the shale opportunity opened up,” Smith said. “Until they shifted their budgets to focus on shale projects in the U.S., many of these companies were among those active in international exploration, but that changed rapidly as they pulled back from the international arena. And now, even with the shift to U.S. shale, exploration budgets have been cut dramatically during the last year, owing to the downturn in price.”

Producers are “laser focused on cost containment and extracting resources from previously discovered or developed assets,” Smith said, where risks and costs are lower, and project cycle times are reduced, until prices show some recovery. Exploration is typically a high-risk and costly endeavor, but it has long been viewed as an essential investment for most E&P companies’ future in terms of reserves growth.

“The major implication of this conventional discoveries drop is that declining discovery volumes, combined with anticipated low E&A drilling activity for the near future, will create a ‘hole’ in oil and gas operators’ portfolios and eventually negatively impact production,” Smith said. “This would be beyond the impact of current low oil prices — more likely in the five-to10-year range, which is typical between discovery and first production.”

Tight oil and gas resources in North America won’t overcome the discoveries shortfall, researchers said.

“Despite its contributions to North American and global supplies, and extraordinary impact on portfolios and investment strategies for many companies, renewed growth in tight oil alone cannot cover the difference in the coming supply gap,” said IHS Energy Vice President Jerry Kepes, co-author of the analysis. “IHS is forecasting global tight oil production in 2040 to still be in the range of 10% to 15% of total global oil production, so the world market will still need significant conventional exploration discovery and production.”

The lack of new discoveries also may increase pressure on operators to develop discoveries already made, grow reserves in their producing fields with improved recovery techniques, change portfolios and investment strategies, or use mergers and acquisitions to restock portfolios in the medium term, Kepes said.

“Conversely, the overall dearth of exploration activity represents an opportunity for some companies, since explorationists have determined that exploration activity will be much less expensive through this period,” he said. Some explorers “are poised to take advantage of this cost-savings and may see attractive exploration results, even if the overall trend for industry remains more challenging.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |