Bakken Shale | E&P | NGI All News Access

Halcon to Restructure, Joins List of E&P Bankruptcies

Another day, another bankruptcy in the exploration and production (E&P) sector, more evidence of the financial pain inflicted by the oil and gas commodity price rout.

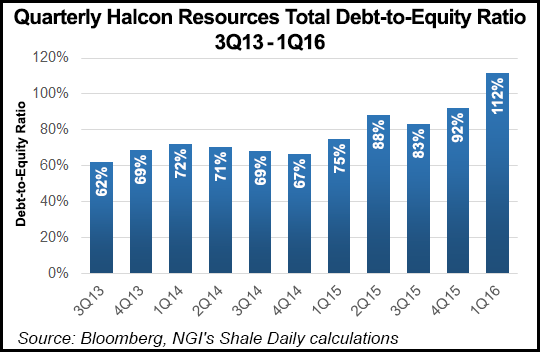

Houston-based Halcon Resources Corp. announced Wednesday that it plans to restructure its balance sheet and file for Chapter 11 bankruptcy protection. The E&P said it has reached an agreement with various stakeholders on a restructuring plan that would eliminate roughly $1.8 billion of debt and approximately $222 million of preferred equity.

Under the agreement, certain lenders affected by the restructuring plan would receive shares in the newly reorganized Halcon or other forms of compensation, the company said.

According to Halcon, those “representing a majority of the value outstanding in each class of affected stakeholders have indicated their willingness to support the restructuring plan.” The agreement is still subject to change and must be negotiated and voted on by stakeholders before being officially documented and filed for court approval, the E&P said.

Halcon is being represented in the restructuring process by financial advisor PJT Partners, legal counsel Weil, Gotshal & Manges LLP and restructuring advisor Alvarez & Marsal.

Halcon’s stock (HK) was trading lower Thursday on the news, around 30 cents/share, down from 97 cents/share at the previous day’s close.

Halcon dropped to one rig companywide — deployed in the Williston Basin — in the first quarter, suspending drilling activity completely in its “El Halcon” acreage in the Eaglebine in East Texas (see Shale Daily, May 12).

The Halcon restructuring is the latest in a string of bankruptcy announcements in the E&P sector in recent days. Earlier this week it was Sandridge Energy Inc. and Breitburn Energy Partners LP (see Shale Daily, May 16). Last week it was Linn Energy LLC and Penn Virginia Corp. (see Shale Daily, May 12), and Chaparral Energy Inc. (see Shale Daily, May 10).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |