Markets | NGI All News Access | NGI Data

Bullish NatGas Storage Injection Unable to Move Futures, Cash

Largely ignoring a somewhat supportive natural gas inventory report, cash and futures action were both relatively quiet on Thursday as temperatures nationally remained very much in their traditional shoulder season zone. Natgas cash values largely stayed within a nickel of flat, and NGI‘s National Spot Gas Average — reflecting the melancholy attitude of the day — ended a penny higher at $1.89.

Natural gas futures bulls and bears were equally unimpressed Thursday morning following news that a slightly-less-than-expected 56 Bcf was deposited in underground storage for the week ending May 6. In the minutes leading up to the Energy Information Administration’s (EIA) 10:30 a.m. EDT report, June natural gas futures was trading around $2.168.

Immediately after the report’s release, traders weren’t quite sure what to make of the number as the front-month contract oscillated between $2.160 and $2.185. After the initial reaction, June futures crept lower to notch the day’s $2.125 low around noon before inching higher over the remainder of the session to close at $2.155, down 1.8 cents from Wednesday’s regular session close.

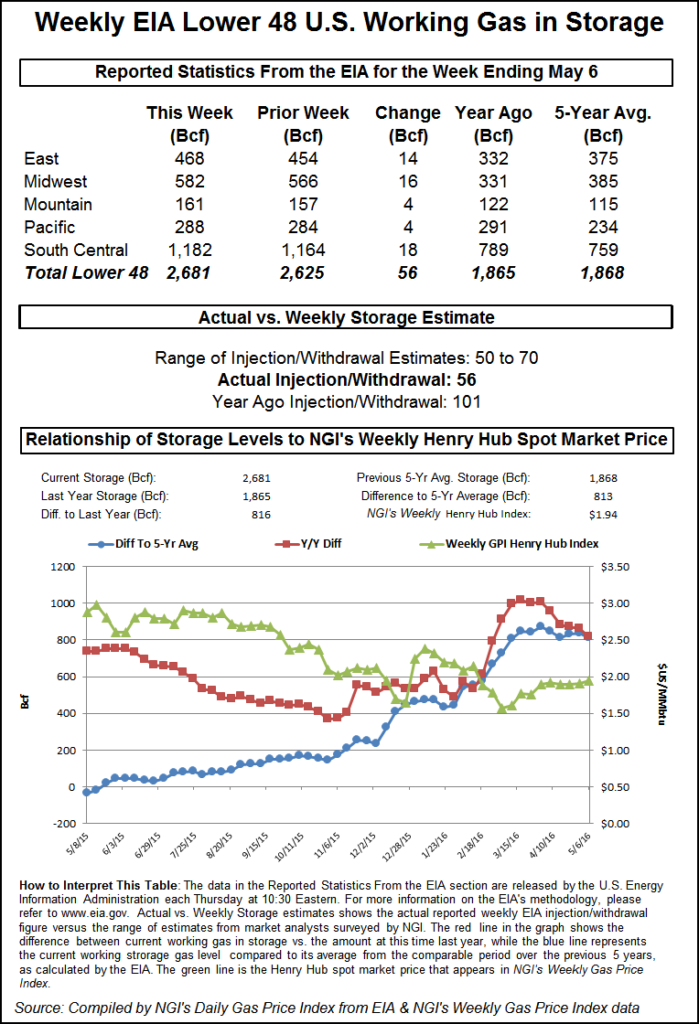

The actual 56 Bcf build was bullish when compared to historical figures as well as industry expectations. It was well below both last year’s 101 Bcf build and the five-year average injection of 79 Bcf. Heading into the report, a Reuters survey of industry experts produced a 50-65 Bcf injection estimate with a consensus expectation of a 58 Bcf build, while a Bloomberg survey extended the upside range with injection predictions between 50 and 70 Bcf. Citi Futures Perspective was expecting a build of 60 Bcf, and ICAP Energy estimated an increase of 55 Bcf. IAF Advisors/ION Energy’s Kyle Cooper was expecting a 57 Bcf build.

“The build of 56 Bcf was somewhat below the 58 Bcf consensus expectation and also supportive compared with the 79 Bcf five-year average increase,” said Citi Futures Perspective Analyst Tim Evans. “With the current temperature forecast supporting at least a few more weeks of below-average injections, we also see a constructive context here, with the declining year-on-five-year average storage surplus tending to support prices over the intermediate term.”

As of May 6, working gas in storage stood at 2,681 Bcf, according to EIA estimates. Stocks are now 816 Bcf higher than last year at this time and 813 Bcf above the five-year average of 1,868 Bcf. For the week, the South Central, Midwest and East regions injected 18 Bcf, 16 Bcf and 14 Bcf, respectively, while the Mountain and Pacific regions each chipped in 4 Bcf.

Over in the physical market, most regions recorded modest gains with the exception of the Northeast. In the Midwest, Chicago Citygate and Michigan Consolidated each added a penny to average $2.02 and $2.03, respectively, while Consumers Energy declined one cent to $2.04.

The only region that saw gains of more than a few pennies was the Midcontinent, where Panhandle Eastern added 7 cents to average $1.90 and Northern Natural Demarc picked up 4 cents to $1.99.

Individual points within the Northeast region saw more red than black, but the declines were mostly a nickel or less, leaving the region to average $1.67, down 2 cents from Wednesday.

Some areas of the Southeast and Mid-Atlantic could see upward pressure on prices through the rest of the month, thanks to a pair of East Tennessee maintenance events at the Boyd’s Creek Compressor station, which will reduce flows to zero. Compressor station work and hydrostatic testing will combine to cut 105 MMcf/d of flows through May 27, which Genscape believes could put upward pressure on Transco Zone 5 prices.

“The drop in flows at the Boyd’s Creek Compressor Station corresponds with a significant drop in flows at several other compressor stations and locations across both the 3100 and 3300 lines of the system,” Genscape Analyst Thomas Jennings wrote in a Basis Commentary note on Thursday. “Compressor stations from Dixon Springs to Topside and northward to Flatwoods and Rural Retreat are all showing flow decreases from 70-100 MMcf/d. Interstate activity is seeing some effects as well: as of the timely cycle for 5/12, receipts from Texas Eastern at Hartsville are down 41 MMcf/d to 59 MMcf/d while deliveries to Transco at Cascade Creek are down 109 MMcf/d and are currently reporting receipts of a little under 10 MMcf/d. This reduction of flows could prove bullish for Transco Zone 5 prices.”

Surrounded by mostly red on Thursday, Transco Zone 5 managed a 1-cent gain to average $2.00 for Friday gas delivery, according to NGI’s Daily Gas Price Index.

In addition to maintenance issues, natural gas price bulls may also have some room to roam in the Midwest and Northeast as temperatures are expected to plummet into the weekend and into early next week.

AccuWeather.com Meteorologist Brett Rathbun said residents will “reach for their heavy jackets” as brisk, chilly air sweeps across the midwestern and northeastern United States this weekend. A shot of cool air will precede a round of showers and thunderstorms marching eastward across the Midwest Friday and Friday night and the Mid-Atlantic and Northeast on Saturday and Saturday night.

He said temperatures may fail to get out of the 50s F from Boston to New York City, Philadelphia and Pittsburgh on Sunday, adding that there is a risk of a frost and freeze Sunday night and Monday over the interior Northeast. The chill is expected to be felt as far south as the central Plains and Carolinas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |