NatGas Cash Inches Lower, But Futures Traders Get ‘Buy’ Signal

Physical natural gas for Thursday delivery was content to make small moves in trading on Wednesday, as weather forecasts called for seasonal temperatures and little to no heating or air conditioning load. Power markets also were steady, and most points traded within a few cents of unchanged. The NGI National Spot Gas Average fell 2 cents to $1.88.

Futures trading ahead of the weekly Energy Information Administration (EIA) storage report was equally lackluster, and at the close, June had gained 1.5 cents to $2.173. July was up 1.6 cents to $2.301, and June crude oil rose $1.57 to $46.23/bbl.

To followers of the Market Profile, the day’s trading was anything but lackluster as high prints of $2.183 and $2.181 signaled to traders to take a long position. Market Profile methodology calculates an initial balance each week, and price moves outside of the initial balance, either higher or lower, are expected to be indicative of future market direction.

FCStone Latin America LLC Vice President Tom Saal, a devotee of Market Profile, calculated this week’s initial balance from $2.085 to $2.173.

“Whenever you have these types of breakouts or breakdowns, there is a very good chance that the market could follow and test the 50% level,” an FCStone trader said. “Obviously, there aren’t any guarantees, but for the most part it tends to do it. Maybe there will be new longs coming in or short covering. There are plenty of shorts in this market.”

The 50% trading target higher is $2.217 and the 100% target is $2.261.

“Maybe if we get an [EIA] injection number below what the market is expecting and that could be translated as a little bullish, and get short term traders buying and selling on the way up.

Reaching that 50% target is definitely in the cards,” the trader said.

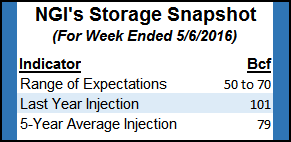

Looking at estimates for Thursday’s EIA storage report, conditions may be in place for a market advance. Estimates of the week’s injection are coming in well under last year’s 101 Bcf build and the five-year average of 79 Bcf.

Citi Futures Perspective is expecting a build of 60 Bcf, and ICAP Energy estimated an increase of 55 Bcf. A Reuters poll of 23 traders and analysts revealed an average 58 Bcf with a range of +50 Bcf to +65 Bcf.

Still on the minds of traders is the EIA’s latest Short-Term Energy Outlook issued on Tuesday (see Daily GPI, May 10). The updated forecast added some bullish tonality to the market, with EIA raising its forecast of Henry Hub spot prices to average $2.25/MMBtu in 2016 and $3.02/MMBtu in 2017, compared with an average of $2.63/MMBtu in 2015.

Second quarter Henry Hub prices were increased by EIA to $2.02 from $1.81, while 3Q2016 prices were revised to $2.34 from $2.28. Fourth quarter prices are unchanged at $2.65.

Although shoulder season weather has limited near-term price-driving capability, warmer or cooler trends may impact long-term storage balances and ultimately influence prices. Natgasweather.com in a noon Tuesday update said a weather system was “tracking across the north-central U.S. with heavy showers and thunderstorms, with even snowfall into the northern Rockies. In addition, a weak cool blast is also exiting New England. A fresh weather system will track into the northern Rockies and Plains Wednesday, while beginning to tap a heftier dose of cooler Canadian air. Cooler air will then fan out across the Great Lakes, Mid-Atlantic and Northeast this weekend for slightly stronger than normal demand and an increase of several heating degree days.

“After the weekend cool blast sweeps through, temperatures will slowly moderate over the northern U.S. next week back into the 60s and 70s, but still with the potential for some cooler air over Canada to occasional spill just across the U.S. border into the Great Lakes and interior Northeast regions.”

In physical market trading, most points removed from the Northeast traded within a penny or two of Tuesday as weather forecasts in major markets remained close to the 65 degree cusp of no heating load and no cooling load.

Forecaster Wunderground.com predicted the high in Boston Wednesday of 71 would hold Thursday before sliding to 67 Friday, 3 degrees above normal. Chicago’s temperatures were seen advancing to 71 Thursday and dropping to 66 Friday, 3 degrees below normal.

At the Algonquin Citygate, next-day gas was quoted at $2.06, 15 cents less than Tuesday, while deliveries to Transco Zone 6 in New York were quoted at $1.56, down 8 cents. On Dominion South, next-day gas came in at $1.44, up 3 cents.

Gas at major hubs moved a few pennies. Deliveries to the Henry Hub fell 3 cents to $2.01, and gas at the Chicago Citygate eased a penny to $2.01. Gas on El Paso Permian shed a penny as well to $1.89, and packages at the SoCal Citygate fell 3 cents to $2.14.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |