Infrastructure | Bakken Shale | E&P | NGI All News Access

Tesoro Bakken Crude Rail Shipments to West Can Compete With Pipes to Gulf, CEO Says

Although the low price commodity environment is causing delays in some of its major capital investment projects, Tesoro Corp. likes the economics for its crude by rail option for shipping Bakken Shale supplies to its West Coast refineries, CEO Greg Goff said Thursday on an earnings conference call.

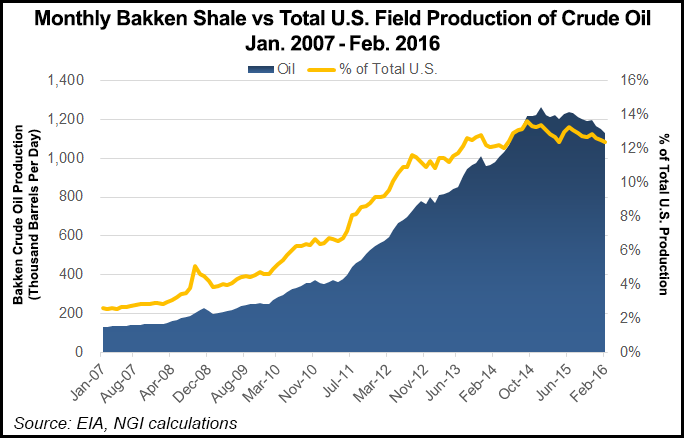

Goff’s comments come at a time when the percentage of Bakken crude being shipped by pipeline has eclipsed rail shipments and is continuing to rise (see Shale Daily, Jan. 19).

When Bakken crude is cleared it goes to the refining centers, so “you need to look at what it costs to move supplies out of the area,” Goff said. “We have to be able to compete with the pipeline to the Gulf of Mexico coast.

The prospects of the new Energy Transfer Partners’ (ETP) Dakota Access oil pipeline (see Shale Daily, May 2) to the Gulf Coast makes it tougher to compete, but he is confident that Tesoro Logistics (TPPL) is going to reduce its supply chain costs enough to compete against the pipeline-to-the-Gulf option. Even with today’s low commodity prices, Tesoro’s refining margin on Bakken crude has stayed in the $3-5/bbl range, he said.

Tesoro’s master limited partnership (MLP), TPPL expects to expand its Mandan crude processing facility in the Bakken by the end of the year and acquire two other projects (drop-downs) from the parent company that could add $70-100 million of earnings before interest, taxes, depreciation and amortization annually as a result, according to TPPL President Phillip Anderson, speaking on a separate conference call Thursday.

“We continue to see strong demand for refined products in our western market which translates into significant growth opportunities for our terminaling and transportation business,” Goff said during the TPPL call. “This market represents about 50% of TPPL’s revenues today.

Tesoro and TPPL remain ultimately focused on the West Coast, and in response to an analyst’s question about recent U.S. oil exports to Asia, Goff said he was unaware of any other than usual amounts going to Mexico, Chile and Peru.

For 1Q2016, Tesoro reported net earnings of $58 million (48 cents/share), compared to $145 million ($1.15) for the same period last year, noting refining recorded a $100 million loss for the quarter that was more than made up by $227 million in net earnings from marketing operations, compared to $133 million of marketing profits in 1Q2015. For TPPL, net earnings for the quarter were $92 million (64 cents), compared to $70 million (63 cents) for the same period last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |