Markets | NGI All News Access | NGI Data

Weekly NatGas Cash Grinds Higher, But Futures Give Up 8 Cents

If futures remain true to their role as a leading indicator, natgas cash next week may have something of an uphill battle. That was not the case for the week ended May 6, however, as most points gained ground and the few that slipped into the loss column were mostly off by a penny or two.

The NGI National Weekly Spot Gas Average rose a nickel to $1.87. The market point scoring the week’s greatest gain was Transco Zone 6 New York with a gain of 37 cents to $1.80 as downstream locations from the Tetco rupture and fire had to secure alternate supplies and endure higher prices. Tetco M-3 Delivery was right behind with a jump of 26 cents to $1.64. The week’s greatest loser was Northwest Sumas with a 10-cent decline to $1.32.

Regionally, the Northeast came out on top of the leader board with an 11-cent rise to $1.82 and South Texas and South Louisiana brought up the rear with no change on the week to $1.85 and $1.86, respectively. East Texas added a penny to $1.86, and both the Midwest and Midcontinent gained a nickel to $2.20 and $1.87, respectively. California added 7 cents to $1.96 and the Rocky Mountains tacked on 8 cents to $1.75.

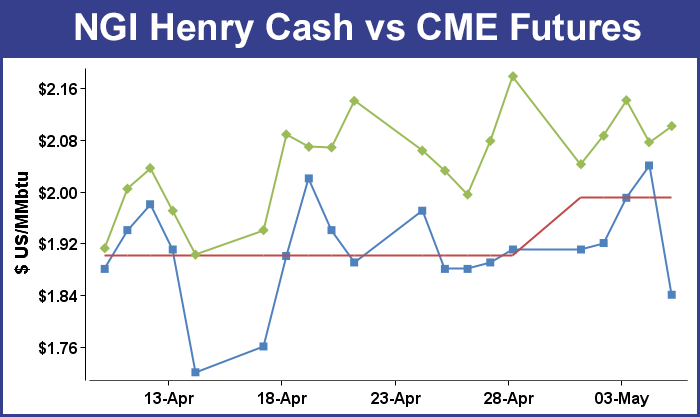

For the week, June futures dropped 7.7 cents to $2.101 and much of that resulted from a bearish government storage report. On Thursday. The Energy Information Administration (EIA) reported a build of 68 Bcf, slightly more than what traders were expecting, and upon release of the data June futures slipped to the lows of the session. At the close, however, June had fallen more and at the close June settled 6.5 cents lower at $2.076 and July was off by 5.8 cents to $2.238.

The 68 Bcf increase was about 4 Bcf more than what traders were anticipating. Once the number crossed trading desks, June futures dropped to a low of $2.086 and by 10:45 a.m. June was trading at $2.090 down 5.1 cents from Wednesday’s settlement.

“I was looking for a 64 Bcf number, and I think the numbers that were out were anywhere from 52 Bcf to 74 Bcf,” a New York floor trader told NGI.

“I think $2 is a good support level. If we break $2 we may see another 10 cents down. If it stays above $2 for another couple of days, it should rally.”

“Weekend demand and renewables output is normal for this time of year, but given the limited flexibility of the system being unable to inject gas you have to back off imports. I would expect more volatility on the weekends with SoCal needing to call OFOs,” the analyst said.

Weekend and Monday deliveries to Malin fell 21 cents to $1.72, and gas bound for the PG&E Citygate shed 16 cents to $1.96. Gas at the SoCal Citygate changed hands a hefty 29 cents lower at $1.87, and deliveries priced at the SoCal Border Avg. Average were quoted 24 cents lower at $1.74.

Other market points into California eased as well. Gas on El Paso S. Mainline dropped 25 cents to $1.74, and Kern River receipts were quoted at $1.66, down 23 cents. Opal came in 22 cents lower at $1.68.

Along the REX Zone 3 Expansion, the differential between producing zones and market zones narrowed somewhat as gas at Marcellus/Utica points gained ground relative to downstream interconnects.

Deliveries to Dominion South shed 8 cents to $1.26, and gas on Tennessee Zn 4 Marcellus slipped 6 cents to $1.31. On Transco-Leidy Line, weekend and Monday gas eased 5 cents to $1.31.

At interconnects with several north-south pipelines carrying gas to the Midwest and Great Lakes prices retreated even more. Packages on REX Zone 3 at the interconnect with Midwestern Pipeline in Edgar County, IL, dropped 17 cents to $1.76 and gas at the Moultrie County, IL, junction with NGPL was seen 15 cents lower at $1.77. At the Panhandle Eastern interconnect in Putnam County, IN, weekend and Monday gas was quoted at $1.76, down 16 cents.

Futures traders suggested the firm June close might serve as a lift-off for higher prices in the coming week. “If we can hold $2.10, you may get an attempt to take out the $2.18 area,” a New York floor trader told NGI. “$2.045 is a good hold point, and $2.101 is a good settlement.”

Analysts are holding on to a bearish outlook. “This market is continuing to have difficulty following through in either direction as is often the case in the shoulder period when the weather factor subsides as a pricing influence,” said Jim Ritterbusch of Ritterbusch and Associates in a Friday morning report to clients.

“Although another cold spell is expected to move into the Midwest region later next week, this supportive force is currently being negated by expected mild trends along the eastern seaboard. As a result, some upward acceleration in supply injections is expected beyond next week’s EIA storage report that will likely offer a supply build similar in magnitude to yesterday’s 68 Bcf increase.

“But contraction in the surplus is likely given some cold patterns during the first half of this week that saw some low overnight temperatures lifting CDDs. And while the nearby gas futures are entitled to some weather premium given the possibility of a late May hot spell, the market now appears to be discounting normal trends that have narrowed the differentials between June futures and lower-priced next-day Henry Hub values.”

Across the MISO footprint forecasters were expecting only modest renewable generation through the weekend. “Fair and warm weather are expected [Friday],” said WSI Corp. in its Friday morning report. “High temps will range in the 70s and 80s, [and] a cold front will sag southward across the Midwest and Great Lakes as the weekend progresses with a round of showers and a few storms. This may lead to variable and changeable temperatures.

“A wave of low pressure will develop along the front and support a chance of showers and thunderstorms across the power pool early next week. Storms may be strong.

“A west-southwest to north wind associated with the cold front will likely support a pulse of wind generation today into Saturday. Output is forecast to peak 6-8 GW. Wind gen will subside during Sunday, but the next potential storm system will aid wind gen early next week.”

The Labor Department reported Friday that non-farm payrolls in April increased by 160,000, less than expectations of more than 200,000. The unemployment rate held steady at 5%, and the increase was the lowest since September.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |