Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Continental Charts Production Record, Boosts Guidance, But Posts 1Q Loss

For the second time this year Continental Resources Inc. executives raved about the performance of three wells targeting the Meramec formation within Oklahoma’s stacked reservoirs. But despite record production, the company also reported a net loss of more than $198 million for the first quarter.

On Wednesday, the Oklahoma City-based exploration and production (E&P) company reported net production of 21 million boe (230,802 boe/d) for 1Q2016, a 12% increase from the year-ago quarter (206,829 boe/d) and a 3% increase from 4Q2015 (224,936 boe/d). Crude oil accounted for 63% of total net production for the first quarter (146,469 b/d), while natural gas accounted for the remaining 37% (506 MMcf/d).

“A key factor driving our strong first quarter results is the exceptional performance of our over-pressured Meramec wells in STACK,” said COO Jack Stark. He said three wells targeting the Meramec, in the over-pressured oil window of the STACK — Foree 1-18-7XH, Bernhardt 1-13H and Quintle 1R-10-3XH — “are delivering some of the highest rates of return in the country.

“STACK has quickly become another premier growth platform for [us] and our shareholders, potentially adding as much as 25% to [our] net unrisked resource potential at current prices.”

The Meramec is part of the STACK (Sooner Trend of the Anadarko Basin in Canadian and Kingfisher counties). Continental said the Foree well had a 24-hour initial production (IP) rate of 2,061 boe/d with a 7,200-foot lateral. Meanwhile, the Bernhardt well had a 24-hour IP rate of 1,046 boe/d on a shorter, 4,550-foot lateral, and the Quintle well had a 24-hour IP rate of 2,150 boe/d on a 9,850-foot lateral.

A little more than two months ago, while discussing 4Q2015, Continental executives made similar raves about three different wells targeting the Meramec, as well as enhanced completion techniques (see Shale Daily, Feb. 26).

But the company also reported mounting losses. Continental posted a net loss of $198.3 million (minus 54 cents/share) for 1Q2016, compared to a net loss of $132 million (minus 36 cents/share) for the year-ago quarter and a net loss of $139.7 million (minus 38 cents/share) in 4Q2015. Total revenues also declined between 1Q2015 and 1Q2016, from $625.6 million to $453.2 million, respectively.

Continental reported an adjusted net loss of $150.5 million (minus 41 cents/share) in 1Q2016, compared to an adjusted net loss of $33.8 million (minus nine cents/share) in the year-ago period, and a net loss of $86.6 million (minus 23 cents/share) in 4Q2015.

Despite the losses, Continental said that as of April 29, it had $1.88 billion available under its credit facility, and had no borrowing base redetermination on the horizon. The company added that its long-term debt had only increased by about $20 million from 4Q2015 through April 29. Continental’s earliest debt maturity is $500 million due in November 2018.

Continental bumped up its production guidance for 2016. Originally set at 200,000 boe/d, the company increased it to a new range of 205,000-215,000 boe/d. The company kept its capital expenditures (capex) budget unchanged at $920 million for the full-year.

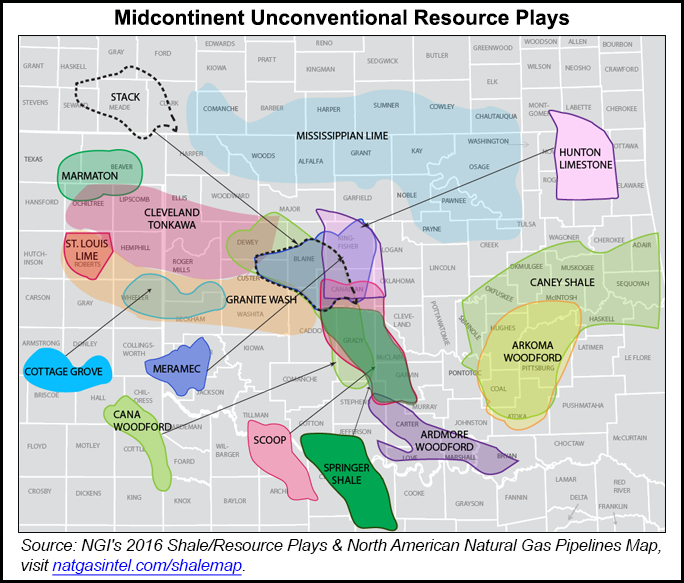

The company said it plans to deploy 19 rigs in 2016. It will run four rigs in the Bakken Shale; five to six rigs in the South Central Oklahoma Oil Province (SCOOP); four to five rigs in the STACK; and four to five rigs in the northwest Cana-Woodford Shale, where it has a joint development agreement (JDA) with SK E&S, a subsidiary of South Korea’s SK Group (see Shale Daily, Oct. 27, 2014).

“It’s going to be some time before we think about bringing on more rigs,” CEO Harold Hamm said during an earnings call to discuss 1Q2016 on Thursday. “I would say our primary emphasis is toward our balance sheet, followed by paying down our debt and DUCs [drilled but uncompleted wells]. We might ramp up completions of DUCs before we would ever consider bringing drilling rigs back –probably out in the $60/bbl range.

“That could happen prior to year end,” Hamm said. He added that it oil prices climb that high, the company would “certainly [drill in] the Bakken before anywhere else.”

Continental said it had also closed on the sale of approximately 132,000 net acres in the Washakie Basin in Wyoming for $110 million, and plans to use the proceeds from the sale to pay down its debt. The assets were considered non-core and had no production or proved reserves. After the transaction, the company now holds about 40,000 net acres in the basin.

Hamm said additional sales of non-core assets are a possibility.

“It’s easy when people have an interest in buying what you have,” Hamm said. “That was the situation with Wyoming. We see other interest and other non-core assets that the company owns. Obviously, we’re not out here trying to sell at fire sale prices — we’d like to have value for it.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |