Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Sempra Shedding More Assets, Looking to Expand Midstream, LNG, Mexico Reach

San Diego, CA-based Sempra Energy intends on shedding a few more assets while expanding its liquefied natural gas (LNG), midstream and Mexico holdings, according to senior executives who discussed first quarter results Wednesday.

Along with its U.S. interstate gas pipeline and Southeast natural gas utilities that have been sold, Sempra’s Mexican operating unit, Infraestructura Energetica Nova, SAB deCV (IEnova) is looking for buyers for the 625 MW gas-fired Termoelectrica de Mexicali (TdM) power plant along the international border in northern Baja California.

Sempra CEO Debra Reed said the TdM plant is one of three assets that no longer fit the company’s long-term growth prospects.

“We’re conducting a sales process right now that sells electricity exclusively across the border into the United States,” said Reed, noting the previously announced sales on the Rockies Express Pipeline (REX) interest and utilities will likely close later this quarter. “We believe our capital could be better used toward growth.”

While there will be proceeds to be applied to future growth, the REX sale would result in $60 million in lower future earnings, and releasing all the capacity the company held on the pipeline will lead to an after-tax loss of $100-120 million in the second quarter.

However, in terms of growth prospects from existing and future new assets, executives were bullish regarding future growth, which includes the addition of a fourth production train at the company’s Cameron, LA, LNG export facility, now under construction and about 43% complete.

Sempra is in active negotiations with shippers and buyers to support the fourth train at Cameron.

“We would anticipate having agreements in place by the end of the year,” Reed said. She indicated she wouldn’t be unhappy if it took a few months into next year to complete a deal, recognizing that in today’s global LNG market buyers and suppliers are hesitant to lock up deals.

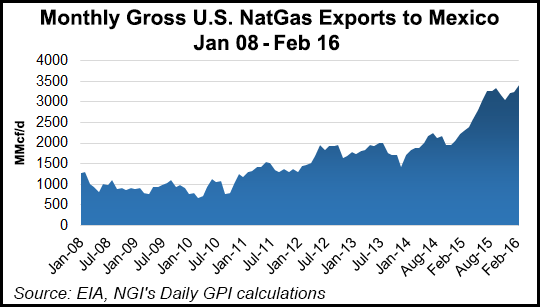

“Based on the conversations we’re having with counterparties right now, there are no new deals in place beyond 2020, so we think it is still a growth opportunity for us. And we also think when you have such a huge demand for gas, the opportunities to develop pipelines and storage around the facilities is also there.”

In Mexico the energy infrastructure development is in its infancy, Reed said, downplaying the fact the Sempra’s Mexico unit was disqualified from three recent gas pipeline project bidding competitions (see Daily GPI, April 14).

President Mark Snell added that Sempra disagrees with and has challenged the Mexican government’s disqualification of the three bids, but it has made some adjustments as a result and its next bids should be “quite competitive. It was unfortunate and was just the way all things came together, but it is behind us and we’re moving on; we’re still in a very good [competitive] position there.”

In addition to new projects, Mexico’ national oil company Petroleos Mexicanos (Pemex) has a number of proposed asset sales, including in liquids, in which Sempra is interested. In all, there a multi-billions of dollars of opportunity in building and buying south of the border, Reed said.

Selling the REX interest does not mean that midstream purchases are off the table, but those new acquisitions would need to be tied to existing major projects, such as LNG.

“What we tend to look at is that where we have a load, whether a utility or a contract for LNG, we would like to have assets that integrate with that load,” she said. “We’re not reluctant at all to get into more midstream assets; we’re very interested in getting into those type assets, but they need to provide us more growth, and that wasn’t the case with REX.”

For 1Q2016, Sempra reported earnings of $319 million ($1.27/share), compared with $437 million ($1.74) in the same period last year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |